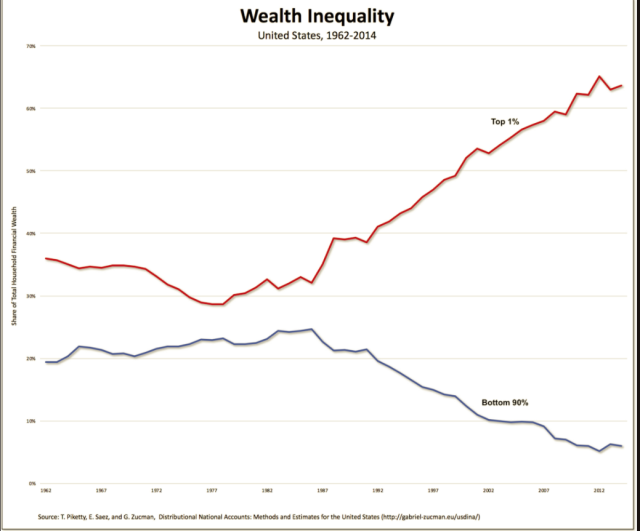

You can’t find a more red hot smoking gun than the chart below. It tells you precisely what happened to the stupendous $74 trillion gain in household financial wealth between Q2 1987 and Q1 2020 that we charted in Part 3.

To wit, 65% of that massive gain—-from $12.8 trillion to $87.0 trillion—went to the top 1% of U.S. households; and 96% went to the top 10%.

Indeed, the phrase “you can’t make this stuff up” has never been more apt than in the instance below. That’s because the lines on the chart for the top 1% (red line) and the bottom 90% (gray line) began to dramatically diverge precisely after 1987 when Alan Greenspan inaugurated what he was pleased to call “wealth effects” policy, or what was just a gussied up name for Keynesian monetary central planning.

The chart extends through 2014 only, but it is absolutely certain that the wealth divergence shown below has widened even further during the final blow-off phase of the stock market which incepted in late 2016. But even the numbers for 2014 are dispositive: The top 1% of households’ share soared from 32% in 1987 to 63%, while the share of the bottom 90% plunged from 24% to 7%.

Accordingly, and conservatively assuming no further change in financial wealth shares since 2014, here is what we get after 33 years of increasingly more aggressive and unhinged monetary stimulus by the Federal Reserve. Comparing 1987 to 2020:

Change in Shares of Financial Wealth:

- Top 1%…………….32% to 63%;

- Next 2-10%……..44% to 30%;

- Bottom 90%….. 24% to 7%;

Change in Wealth Level and 33-year Gain:

- Top 1%…………… $4.1 trillion to $52.2 trillion=+$48.1 trillion;

- Next 2-10%………$5.6 trillion to $28.7 trillion=+$23.1 trillion;

- Bottom 90%…… $3.1 trillion to $6.1 trillion= +$3.0 trillion;

2020 Financial Wealth as a Multiple of 1987:

- Top 1%………………12.7X;

- Next 2-10%……….5.1X;

- Bottom 90%……...2.0X;

Share of $74 Trillion Household Financial Wealth Gain, 1987-2020:

- Top 1%……………….65%;

- Next 2-10%……….31%;

- Bottom 90%………4%

It doesn’t get any more definitive than that. Keynesian central bankers have been the rich man’s fairy godmother.

Never in American history has an arm of the state conferred so much ill-gotten wealth on so few; and never have the natural effort and talent based reward differentials of the free market been so capriciously and unjustly re-arranged by deliberate acts of the state—in this case, the utterly flawed and arbitrary judgements of 12 un-elected PhDs, bankers and career apparatchiks who comprise an all-powerful monetary politburo, otherwise known as the FOMC.

Of course, it is to exactly the flawed and arbitrary judgements of what truly amounts to a monetary politburo that Judy Shelton so vehemently objects:

How can a dozen, slightly less than a dozen, people meeting eight times a year, decide what the cost of capital should be versus some kind of organically, market supply determined rate? The Fed is not omniscient. They don’t know what the right rate should be. How could anyone?” Ms Shelton said.

“If the success of capitalism depends on someone being smart enough to know what the rate should be on everything . . . we’re doomed. We might as well resurrect Gosplan,” she said, referring to the state committee that ran the Soviet Union’s planned economy.

You can’t find a more concise and splendid summary of all that is wrong with modern central banking than these well-chosen words.

But here’s the thing. The obvious truth which would debunk the entire enterprise is contained in the wealth mal-distribution figures and chart above, yet the thundering scandal of the present era is that to a man and woman, the Fed heads and their Wall Street shills deny that they have had anything to do with it.

Back in the day, Nixon’s folks called it the “stonewall” defense, mainly because their case was indefensible on the facts and merits. And the same is true here.

The wealth distribution “splits” incepting in 1988 and so dramatically depicted in the chart above were not owing to Ronald Reagan’s 1981 “trickle down” rate cuts, nor even his 1986 tax reform act, which actually raised the capital gains rate and closed a whole suite of loopholes used almost exclusively by the top 1% and 10%; and even if you believe shareholders indirectly pay the corporate tax, as do we, the split was fully formed long before the Trumpite/GOP corporate rate cut of 2018.

So on the currently raging income inequality issue, GOP tax policy is not the guilty party, even if it has been a fiscal abomination owing to the lack of off-setting spending reductions.

To the contrary, and as we demonstrated in Part 3, household financial wealth has grown by roughly 7X since 1987 while nominal GDP has risen by just 4.2X.

This means that the top 1% and 10%, who own 53% and 90% of the financial assets, respectively, have gotten a huge ride on the Fed’s financial asset inflation cloud.

At the same time, the wage and salary incomes of the bottom 90% have been essentially stagnant in real terms, and they have been punished—nay savaged—for attempting to save from current income, and essentially haven’t.

Not surprisingly, therefore, if you started with meager financial assets ($3.1 trillion) in 1987 and haven’t added much new savings since, it is no wonder that the bottom 90% finds itself still in possession of meager financial assets ($6.1 trillion) in 2020.

So the question recurs: Why has the progressive-left gone bonkers over Judy Shelton’s nomination, when, in fact, she is the closest thing to a real Fed governor who has dared to say out loud and in public that the Eccles Building is the great infernal machine of wealth mal-distribution in contemporary America?

For the answer to that we really need to look no further than the blistering op ed in the New York Times entitled,

“God help us if Judy Shelton Joins the Fed”.

As it happens, it was written by our old friend Steve Rattner, who we first knew as a cub reporter for the New York Times covering the White House in the early 1980s, and then as a notable partner at Morgan Stanley and Lazzard, a private equity investor of stature, the czar of Obama’s auto industry bailout and then the manager of Michael Bloomberg’s vast fortune.

Back in his Washington days, Steve didn’t know from central banking, gave your editor a lot of guff about supply-side tax cuts, but as we recall did share our admiration for Paul Volcker.

The latter is relevant to the matter at hand because 40 years later we are reasonably sure of this: Tall Paul Volcker would likely not have been overly keen about Judy Shelton’s nomination because he wasn’t much of a gold bug during his finest hours as the inflation-slaying head of the Fed in the early 1980s.

He had fought the good fight to preserve the gold-anchored Bretton Woods system at the US Treasury in the 1960s; and as a top official in the department under Nixon, he had struggled to patch together a successor arrangement once Nixon pulled the plug at Camp David in August 1971, believing thereafter that gold’s time had passed.

But he never wavered in his belief that financial discipline was essential, monetizing the public debt was a no-no and that the Fed’s modest remit involved keeping inflation low and Wall Street at risk for its own errors and excesses.

Moreover, after he was fired by the Gipper’s political hatchet men in 1987, he never did sign on to Greenspan’s new style-wealth effects activism at the Eccles Building; thought Bernanke’s 2.00% inflation target was nuts; and now, surely, is rolling in his grave in the face of a $7 trillion Fed balance sheet (it was $240 billion when he handed it off to Greenspan) and it’s insane $3 trillion monetization of the public debt during the last 90 days.

That is to say, to denounce Judy Shelton, you have to denounce Paul Volcker, too.

At the end of his life, he was deeply disturbed about where the post-1987 Fed had gone, and would be literally horrified by today’s reality: Namely, the fact that the Fed has essentially destroyed honest price discovery on Wall Street, lobotomized Washington on the fiscal front and fueled the greatest burst of debt and speculation in American history.

So 40 years later, why is our friend, pedigreed liberal and major Dem contributor, Steve Rattner, so vociferously anti-Volcker? At least, that is, in the metaphorical sense that Tall Paul at the helm of the Fed was the next best thing to gold-anchored money itself—the very thing that today’s central bankers, Wall Street speculators and Washington politicians alike hate with a vengeance?.

We wouldn’t profess to say, exactly, but we do know that back in 1981 Steve Rattner had only a few dimes to rub together and presently has billions of them. That is, he deftly rode the Brobdingnagian financial bubble that Alan Greenspan and his heirs and assigns have fostered over the last 33 years.

Indeed, it is the one and same bubble that real estate speculator Donald J Trump rode upon—along with the hedge fund and private equity moguls, the silicon Valley billionaires and Mayor Bloomberg and Jeff Bezos, too.

Many of the latter—the Silicon Valley entrepreneurs especially—created much new innovation, technology and value. But the Fed’s misbegotten monetary policies have artificially magnified it many, many times over—along with the fortunes of the Wall Street money shufflers, who have been more in the business of harvesting economic rents than the creation of new economic value.

But either way, they all believe the narrative: Namely, that the Fed is in the necessary business of guiding, stabilizing and enhancing the performance of American capitalism and lifting main street America ever closer to the nirvana of recession-free full employment, world without end; and that the financial anomalies and malignancies that literally scream out of the common publicly available data are either not notable or are the price that must be paid for the economic goodness which purportedly flows from the Eccles Building.

That is to say, the narrative holds that there is nothing wrong or unsustainable about the 1987 to 2020 era of Keynesian central banking, which has produced a—

- 13X increase in the wealth of the top 1%;

- 6.7X increase in public and private debt;

- 4.2X increase in nominal GDP;

- 2.1X increase in real GDP;

- 1.1X increase in real median family income.

We beg to differ, profoundly, and not only on the matter of wealth maldistribution in its own right. The fact is, the greater good argument doesn’t work, either: The post-1987 Fed has brought no extra economic goodness at all.

What fading levels of main street growth and tepid gains in median household incomes we have had during the last 33 years were the product of private capitalism at work, not the machinations of the Eccles Building; and the crises allegedly averted—the 1991 recession, the dotcom crash, the 2008 financial meltdown and now the Lockdown Nation disaster—were the products of Washington and its central banking branch, not the tens of millions of entrepreneurs, workers, investors, inventors and disrupters operating on the free market.

That is, for the main street masses there is no there, there—even as the top 1% and 10% have been gifted with hideous excesses of financial wealth owing to the monetary apostasies which reign at the Fed.

But for want of doubt, just consider the gravamen of friend Steve Rattner’s diatribe against Judy Shelton’s dim view of the post-1987 Fed:

The Federal Reserve is an indispensable player in managing our economy. Period…..Then there’s the gold standard, a significant culprit in deepening the Great Depression and abandoned decades ago by every country in the world (including the United States in 1973). By rigidly fixing prices to a single commodity, a gold standard exaggerates economic swings, on balance for the worse.

Between 1880 and 1933, the United States experienced at least five full-fledged banking crises; in the past 87 years, we’ve had two. Though promoted as smoothing price movements, a gold standard in fact magnifies them, as a comparison of the pre-Depression period to the post-World War II era makes clear.

We will delve deeper into the gold standard matter in our final installment (Part 5) of this series, but start with the heart of the matter: The claim that prior to modern central banking, the US economy was a hopelessly unstable, under-performing whirling dervish, but especially since 1987 the central bank has become an “indispensable player in managing our economy. Period.”

That’s the comforting, received narrative of the Wall Street bubble-riders and the Washington borrow-and-spend generation, of course. The problem is, it is not remotely true and you can find the damning facts on page 224 of the Historical Statistics of the United States (Volume 1).

In 1873, after the excesses of civil war finance had been purged and digested, the GDP of the United States stood at $23 billion (1958 dollars). By 1913 and on the eve of the destructive financial era triggered by the Great War, the GDP was nearly six times larger at $131 billion.

That encompasses 39 years and the various banking panics which are said by the Keynesian to have marred that era before the Fed opened its doors in 1914. But the figures compute to a 4.6% compound annual real GDP growth rate for the entire period, the four banking panics and short-lived recessions of the era notwithstanding.

By contrast, the real GDP growth rate between Q2 1987 and Q2 2020 computes to just 2.2% per annum or well less than half the gain during the pre-central banking era; and the real GDP gain of 0.84% per annum recorded since the pre-crisis peak in Q4 2007 amounts to only one-fifth.

Moreover, the nit-picking complaint that the pre-Fed period was blessed with rapid population and work force growth owing to the waves of late 19th century immigration doesn’t wash, either. The per capita real GDP growth rates per annum are as follows:

- 1873-1913: 2.42%;

- 1987-2020: 1.18%;

- 2007-2020: 0.17%

As we recall, our friend Steve Rattner was a big booster of Walter Mondale’s presidential campaign in 1984, but surely the latter’s famous campaign slogan applies to the alleged economic growth miracles of modern central banking—the very kind of intrusive central banking that Judy Shelton, notwithstanding all of her backsliding and double-talk, stands firmly against.

Namely: Where’s the Beef?