…….Although it was peddled as some kind of latter day incarnation of Reaganomics, the Christmas Eve Tax Cut was nothing of the kind. It actually makes a mockery of the still valid supply-side ideas and theory from the 1980s; and there is no better way to demonstrate that than to compare it with the original 1981 Reagan tax cut—-as imperfect as even it was in the final execution .

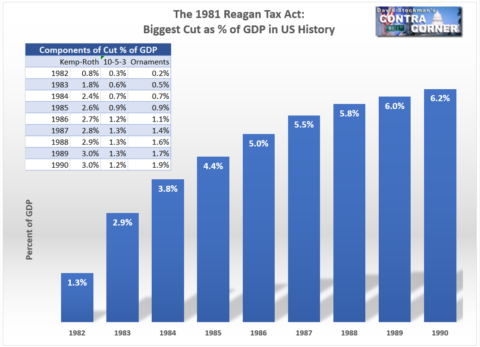

The key points about “supply-side” with respect to the Reagan tax cut of 1981 are depicted in the indented box contained in the chart below.

It shows the split between

- marginal rate cuts for individuals, which was the high-powered pro-growth element;

- the business cut in the form of sharply accelerated (10-5-3) depreciation schedules, which unlike today’s corporate rate cut at least had the virtue of being tied to purchase of plant, equipment and technology; and

- a medley of loopholes and special interest tax breaks (“ornaments”), such as tax credits for oil royalty owners and wood-burning stoves, that emerged from the bidding war between the Reagan White House and Congressional Republicans, on the one hand, and Speaker O’Neill’s’ Democrat majority in the House. The latter was determined to maintain its rule of the roost—-even by trashing the nation’s revenue basis if necessary for legislative victory.

Taken altogether, however, the actual 1981 tax act provides a benchmark for exposing the phony supply-side stimulus claims made for the Christmas Eve Tax Cut of 2017.

In the first instance, when the “bidding war” with the Dems ended in July 1981, the US Congress had cut the Federal revenue base by 6.2% of GDP in the outyears. At today’s economic scale that would amount to a tax cut of $1.2 trillion per year!