As we indicated in Part 2, the Reagan business cuts were based on the principle of “no ticky, no washy”. That is, if you didn’t add to your productive capacity or process efficiency by purchasing new plant and equipment, there was no tax benefit.

None of Reagan’s giant business cut, therefore, went back into the canyons of Wall Street as stock buybacks (which weren’t even legal until 1983) or dividends: The benefits flowed to suppliers of capital goods and their workers, instead.

In that context, the plant and equipment linked cuts in the current bill are small potatoes by comparison. They disappear entirely after 2022, and amount to only $37 billion in the peak year of FY 2019.

In round terms, therefore, the Reagan bill’s incentive for CapEx was about 8X larger relative to the size of the economy. Beyond that, since the current bill’s deprecation incentives disappear abruptly, their primary impact will be to pull forward in time existing business CapEx plans, not stimulate higher long-term investment.

At the end of the day, the Christmas Eve Tax Cut is no supply-side policy measure at all. There is virtually no potential for stimulus or enhanced, sustainable economic growth in the overwhelming bulk of the GOP’s 500 pages of gifts to K-Street and Wall Street.

To be sure, the far larger Reagan tax cuts for both individuals and business ended up being an excersize in unprecedented fiscal irresponsibility, as well. That’s because the off-setting spending cuts in the original Reagan fiscal blueprint of 1981, which were intended to pay for a goodly part of the revenue loss from the tax cuts, did not happen.

Once the giant tax cut was enacted in August 1981, however, the GOP promptly forgot about the “payfors” it still owed. But at least the large marginal rates cuts and sharply accelerated depreciation features, which accounted for two-thirds of the so-called “static revenue loss” as shown in the chart above, did have a strong pro-growth impact.

Needless to say, even the pro-growth part of the Reagan cuts is not even remotely replicated in the Christmas Eve Tax Cut, and that makes the current resort to credit card based “stimulus” all the more condemnable.

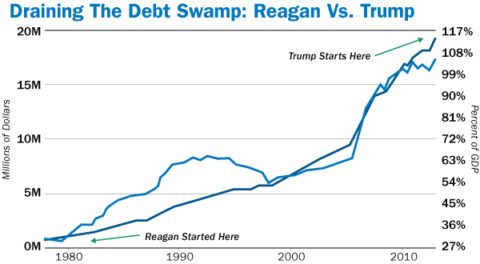

That’s because there’s a crucial fiscal difference between today and 1981. Back in the early 1980s, Uncle Sam could afford to borrow (not wisely) to fund the kind of supply-side oriented tax cuts which dominated the 1981 act—since the public debt only amounted to only $930 billion and 30% of GDP.

By contrast, today the Treasury balance sheet reflects 35 years of reckless fiscal policy and labors at 106% of GDP. And that’s before adding on the roughly $20 trillion of new deficits over the next decade which are built into current law and the Trump/GOP tax and spending programs.

Even then, as shown below, the huge Reagan supply-side tax cuts did not appreciably move the needle of GDP growth relative to the then embedded trend of 3.5% per year trend that had prevailed since the end of the Korean War.

You might wonder, therefore, what the GOP pols had been smoking when they essentially voted to borrow $1.7 trillion to finance stock buybacks and M&A deals under the far more challenging fiscal and monetary conditions of the present time, and the worsening trends that are already baked into the cake for the coming decade.