Just when you think the Donald’s usefulness in undermining the Wall Street/Washington ruling class has disappeared—often into the maws of Deep Staters like his insidious foreign policy team of Pompeo and Bolton—he takes things into his own hands and lets the brickbats fly.

So he has with his duet of Fed nominees—Stephen Moore and Herman Cain. Yet the ferocity at which the talking heads and pedigreed economic commentariat have gone after them is all you need to know.

Besides whatever dirt about their private lives can be slung across the bubblevision screens—the broadside against them amounts to the charge that they are not professional economists, their views are way outside the consensus and they admit to having a political philosophy.

So we say, hurrah!

The single greatest threat to capitalist prosperity in America today is the insidious, in-grown Keynesian groupthink of the self-appointed central banking guild that runs the Fed and dictates its policy narratives to the financial media echo chamber.

So doing, this unelected guild has transformed the central banking branch of the state into the handmaid of Wall Street and the financing arm for Imperial Washington’s egregious fiscal excesses. It has also become the fount of a self-serving fantasy that holds everything is fixed and that the American economy has come bounding back to new heights of prosperity after the dark days of the Great Recession.

In truth, however, the financial crisis never ended; the scourges of debt and money printing which caused it have been doubled-down upon; and the ballyhooed gains have largely gone to speculators in financial assets, not providers of labor and enterprise.

So in economic terms it boils down to an unsustainable and unstable regime of staggering debts, recurrent bubbles, speculative excesses and sweeping malinvestments in financial engineering rather than productive assets. These metastatic deformations have caused the economic growth rate on main street to slow to a crawl—even as the resulting massive inflation of financial assets has fostered the worst, artificial maldistribution of wealth to the top 1% and 10% in modern times.

But here’s the thing. The guild’s Keynesian model for the conduct of central banking is completely, irrevocably and abysmally wrong.

In the modern world of global trade and finance and technologically enabled money dealing, a national central bank in one country—even the mighty Fed and the $20 trillion US economy—-can not effectively manage inflation, unemployment, GDP growth, housing starts, business investment or anything else, including the cure for hangnails. And most especially, these macro-management and targeting functions cannot be done in the real time, monthly meeting cycles by which the central banking guild pretends to be busily and earnestly in charge.

It is not. Our modern day central bankers merely spend their days tilting at windmills while cherry-picking and spinning the in-coming data to conform to their running self-serving narratives.

One of the latter, for instance, holds that fractional decimal points in an arbitrarily chosen inflation index (PCE deflator) are meaningful, matter and are manageable toward an arbitrary 2.00% target via the FOMC’s machinations in the money and capital markets.

They are not. In a world flooded with central bank intermediated cheap money and capital, the reported inflation rate for commodity and industrial products is inherently low owing to chronic, price-crushing excess investment (think Red Ponzi, Turkey, India, etc plus DM zombie companies); and also due to a giant reservoir of essentially peasant labor that can be quickly mobilized into the world supply system in response to rising demand via the global networks of transport and technology.

Likewise, unemployment targets and the BLS’ hideously worthless monthly jobs reports do not remotely attach to the Fed’s so-called “policy tools”. That is, the fiat credit and word clouds which it injects into the canyons of Wall Street.

Yet owing to the Welfare State’s subsidized sequestration of labor hours in the DM world and the aforementioned surplus peasantry in the EM world, there is no practical limit on available labor hours—-the true coin of production capacity in the contemporary world. Therefore, attempting to drive America’s 212 million strong working age population (ages 20-68) toward a U-3 unemployment target is an exercise in driving a jalopy with a busted steering gear.

In other words, the Fed’s so-called dual mandate is pointless. Inflation and employment would take care of themselves if the central banks just stepped aside and permitted the pricing system and global commerce to do their thing. The only effect of the Fed’s vaunted policy tools is the inflation of financial asset prices in the canyons of Wall Street and falsification of the true cost of debt to speculators and producers alike.

But there is more. Tying these unmanageable variables to a macro-economic model that boils down to the economic equivalent of a national bathtub is just plain ludicrous.

That is, the U-3 unemployment rate and the core PCE deflator are treated reverently by the guild and its acolytes in the financial press and on the Wall Street sell-side as telemetric read-outs on conditions in the USA economic bathtub; and as direct inputs to appropriate adjustments of the policy dials.

But they are no such thing. There is no contained national economic aggregate that has some kind of pressure level measured by the Phillips Curve. Indeed, there could be no trade-off between inflation and unemployment unless the supply of potential labor hours were fixed, which it absolutely is not—owing to the nearly bottomless latent global labor pool indicated above.

At the same time, there is no accurate measure of aggregate inflation, anyway. Embedded in popular indices such as the CPI or PCE deflator is an endless mish-mash of subjective judgments with respect to hedonic adjustments (reduction of reported prices for quality improvements) and weightings by product and category that are purely subjective and which are continuously revamped by the data bureaucrats over time.

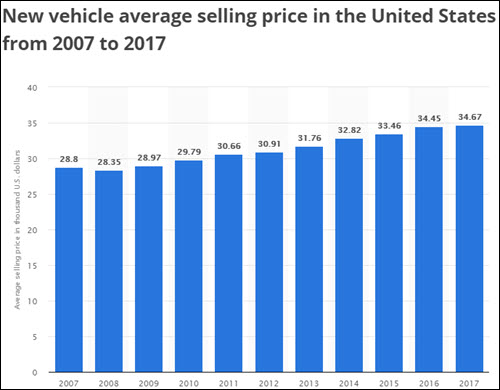

For instance, the BLS says there has been zero rise in the price of new autos for the last 20-years, but in the last decade alone, the average transaction price on dealer lots has risen by 20%!

There surely has been improvements in the functionality of automobiles over the last decade or two. Still, the average main street household needs to drive 28 miles to work and back each day and hundreds of miles per week to the malls, super markets, schools and places of entertainment and recreation, among others.

So if it costs 20% more to accomplish those functions, it comes out of their paychecks, which have not been adjusted upwards for airbags, voice-activated navigation systems and self-parking, among other frills and follies.

In short, the idea that there is a statistically robust relationship—or even a rubbery one—between the BLS’ primitive measures of employment and its even more arbitrary yardsticks for inflation is complete gibberish.

Indeed, the Humphrey-Hawkins inflation and unemployment targets are just a cover story: They are the public excuse used by the central banking guild to justify its meddling in the financial markets as being for the benefit of the main street economy, and the tens of millions of workers, businesses and households of which it is comprised.

But tampering with and falsifying interest rates, yield curves, cap rates and stock prices does only one thing: It falsifies prices in the casino, thereby undermining the true function of money and capital markets in a healthy capitalist economy.

We dwell on this topic because their is no way back to free market prosperity until the U-3 unemployment and 2.00% PCE inflation targets are shit-canned, and the FOMC’s excuses for massive intrusion in the canyons of Wall Street are eliminated.

After all, if the truth were known—-that the central banking guild can do virtually nothing for inflation and employment that main street cannot do for itself—the emperor would be revealed as buck naked, so to speak.

That is, the Fed would be revealed to be little more than a handmaid of Wall Street in the business of rigging and inflating financial prices to the benefit of speculators, assets gatherers and the 1% and 10% of households, which own 45% and 85% of the financial assets, respectively.

Needless to say, the unwashed public of Flyover America would not cotton for a New York minute to this cozy arrangement—once it understood that the price was the massive off-shoring of production and jobs, the strip-mining of corporate balance sheets and cash flows to fund Wall Street based financial engineering gambits and the savaging of savers and retirees, who have no choice except to keep their meager savings liquid and available.

And that’s where the Donald’s two Fed nominee brickbats come in. While it is not clear what their monetary theories actually are—since both of them have made statements all over the lot during the last several decades—they are most definitely anti-Keynesian and will fight the guild’s hoary Phillips Curve policy predicate tooth-and-nail; and do so with the compelling rhetorical point that might even get through to the euthanized Republicans on Capitol Hill.

To wit, more people working can’t possibly cause inflation!

That proposition exposes the Achilles Heel of the entire Keynesian regime. If in today’s global economy there is no validity to the Phillips Curve, well pray tell then, where did the specious 2.00% inflation target come from?

In fact, it was the invention of Ben Bernanke and his small posse of academic neo-Keynesians, and it was specified in a finger-in-the-air manner as the flashing orange warning light that signaled full-employment was at hand, and that the bathtub of GDP was nearly filled to the brim.

Stated differently, full-employment as measured by the primitive metrics of the BLS was postulated to be a wonderful thing and the be-all and end-all of monetary policy. So when 2.00% inflation was reliably delivered, the putative Nirvana of Keynesian Full Employment was nearly at hand.

Yet get rid of inflation targeting, and you are on the way to getting rid of Keynesian monetary central planning. After all, we have been under 4.0% unemployment for 25 continuous months now–since February 2017. So with no inflation target, the case for “monetary accommodation” would have been exposed as threadbare long ago.

To be sure, the Donald gets more clueless about the content of monetary policy by the day—as revealed by his call for rate cuts and a resumption of QE today.

But no matter. His job is to attack, discredit and set-up the Fed to take the fall when the present super-bubble finally bursts and the main street economy is driven into the brink for the third time this century.

Indeed, no one is more proficient at the blame-game than the Donald or incorrigible about the use of red hot rhetoric to make the point.

Now, the Donald has found his target, and the Senate willing, he has two new helpers to prosecute the campaign.

“I personally think the Fed should drop rates, I think they really slowed us down, there’s no inflation, in terms of quantitative tightening, it should really be quantitative easing…you would see a rocket ship. Despite that, we’re doing very well.”

In the meanwhile, today’s “strong” monthly jobs report provides just one more powerful illustration of why Keynesian monetary central planning is pointless and impossible.

To wit, over and against the 196,000 gain for March on the establishment survey, the household survey showed a nearly identical 190,000 loss of full time jobs; and this stark contrast is made all the more striking when it is noted that fully 60% of the establishment survey gains (or about 120,000 jobs) were in low pay, low value-added and often part-time jobs in the government, leisure and hospitality and health and education sectors.

Nor was this a one-month aberration in the household survey. During Q1 the gain in full-time employment was only 19,000 per month, and that is about as close to stall speed as it gets.

By contrast, the Q1 seasonally adjusted gain in full time jobs last year (2018) averaged 250,000 per month; and the monthly average for Q1 in 2017, 2016, 2015 and 2014, respectively, were 428,000,260,000, 280,000 and 188,000.

So do we think the US economy is experiencing a sharp slowdown and likely beginning its descent into recession?

Yes, we do, and so does the authoritative Challenger, Gray and Christmas survey of employee layoff announcements.

That number soared to 190,000 in Q1, and as is evident in the chart below, we have not been at that level since the dark days of 2009.

So when it comes to “strong” or “weak” take your cherry-pick.

But when it comes to the healthy functioning of capitalist prosperity in American and honest price discovery in the money and capital markets, it’s time for the central bankers guild to get their cherry-picking hands off the American economy, and, in fact, to be run out of the Imperial City on a rail.

On that project, at least, the Great Disrupter is getting up a pretty good head of steam.