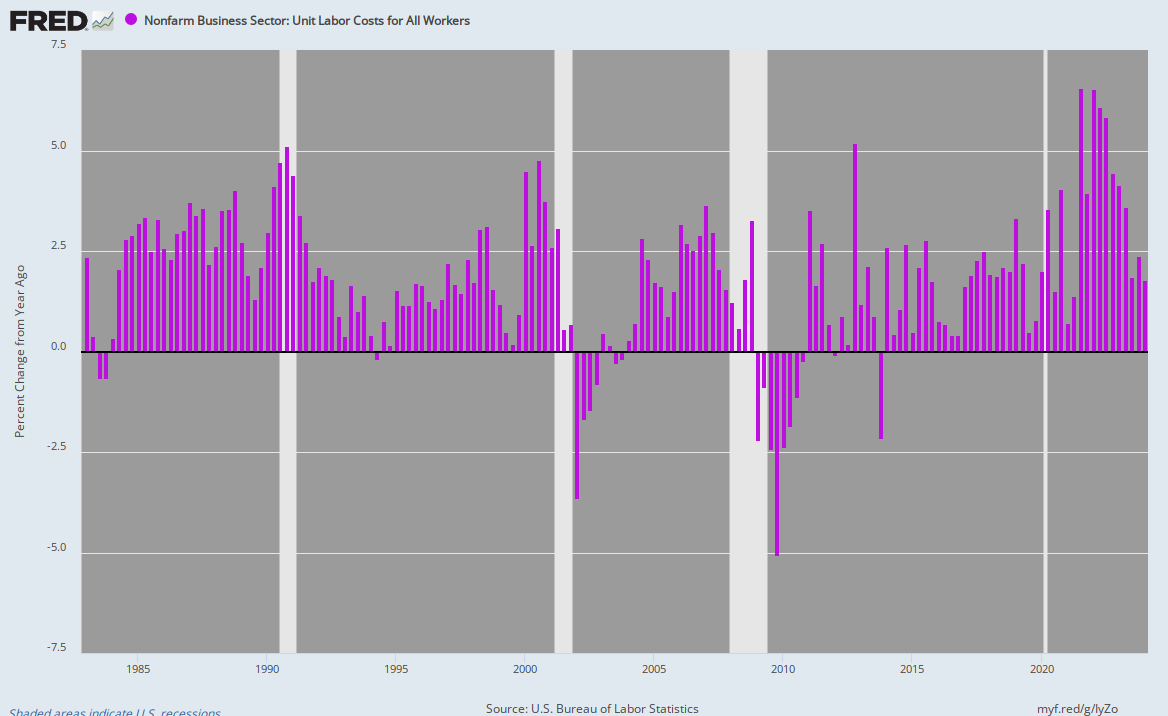

Nonfarm unit labor costs for the September quarter came in yesterday at 4.8% above prior year—and was among the largest gains in the last four decades. But never mind—it’s all transitory: The pumping of $4.9 trillion of new Fed credit into the US economy since August 2019 had nothing to do with it at all!

Y/Y Change In Nonfarm Unit Labor Costs

Yet with numerous inflation measures running at 5% Y/Y and many indicators in double-digits it’s apparently still way too early to allow interest rates to get up off the zero bound, at least accordingly to the geniuses in the Eccles building. In fact, here’s the Fed-dictated price of money in today’s so-called markets:

- 1-month Treasury Bills: 0.036%;

- Effective Federal Funds Rate: 0.08%;

- 6-month Treasury Bills: 0.068%;

- Money Market Yield: 0.07%;

- Six-months LIBOR: 0.21%;

- One-year Treasury Bills: 0.147%;

- 2-Year Treasury Notes: 0.391%;

- Five-Year CDs: 0.41%

It doesn’t get crazier than that. The money markets are literally buried under inflation, meaning that trillions of dollars worth of deposits and savings are being confiscated by these utterly insane interest rate repression policies.