It really doesn’t get more pathetic than this. We are referring to the crawler on bubblevision this morning which read, “Will the Fed cut rates?”

After all, it has barely begun normalizing what had allegedly been an emergency foray into extraordinary and exigent monetary policy—ZIRP and QE—in response to the great financial crisis. All along these radical and historically unprecedented measures were described as one-time expedients, and that they would be reversed upon the return of financial stability and economic growth.

Yet ten years after the event, the Fed funds rate is still barely positive in inflation adjusted terms, the Fed’s balance sheet is still humungous at $4 trillion and the U-3 unemployment rate is at a 50-year low of 3.8%. So under every traditional cannon of sound finance and even common sense, monetary “easing” wouldn’t even be thinkable at this moment in time.

Indeed, the only thing that can explain the Powell Pivot and the sudden “pause” in the Fed’s belated and tepid move toward normalization is an abject fear of another hissy fit among the truculent army of gamblers down on Wall Street. In effect, the Fed has become the handmaid of traders, speculators and the robo-machines.

Needless to say, today’s slowing economy is not an existential emergency, but virtually zero real interest rates bespeak of exactly that. What has happened, in fact, is that the Fed has become so progressively enslaved to propping-up the stock market averages that it has painted itself into a corner of economically absurd interest rate policy.

Moreover, its entrapment in ultra-low interest rate targeting can’t be explained by a secular trend toward steadily lower inflation or the putatively reduced level of an academic fiction called r-star or the neutral rate of interest. That’s because the former hasn’t happened and the latter is pure gobbledygook.

As shown in the chart below, the trend rate of CPI less food and energy—-a measure of inflation that smoothes out the commodity cycles—-has hugged the 2% line (+/-) for the last 19 years. By contrast, the Fed’s target rate for Fed funds (purple line) has been systematically compressed from a level well above this nearly constant inflation trend (brown line), and therefore positive by 2-3 percentage points in real terms, to a level that has been deeply negative in inflation-adjusted terms for more than a decade.

To be precise, the Fed’s target rate dipped below the smoothed CPI rate in April 2008 and remained in negative real rate territory until November 2018. That’s 127 consecutives months of a policy that essentially cannot be justified at any time—normal or emergency—because the idea of paying people to borrow and confiscating the real wealth of savers is flat-out ludicrous.

Likewise, with each cycle since 1998, the Fed’s peak level of normalization has slipped lower—-from 6.5% incepting in June 2000, to 5.25% in July 2006 and just 2.4% in December 2018.

Crucially, this rate compression can’t be explained by either Money or Economy. There was no shrinkage or even weakness of the money supply aggregates before or during the so-called Great Financial Crisis (GFC); and there is no part of the main street economy—consumer finance, business working capital or longer-term CapEx—that requires negative money market rates to thrive.

In short, 127 months of negative real money market rates served but one master. To wit, carry trade gamblers and options and futures market speculators whose cost of goods (i.e. carry or margin) is driven by overnight money costs.

Of course, when you deeply subsidize the cost of anything, you get more of it. Accordingly, the only function of ZIRP is to promote speculation in the money and capital markets at levels way beyond what would occur on the free market.

Worse still, the Fed’s recurring stock market Put in this context is doubly destructive. That because it adds to the rock bottom carry cost of speculators a sharp reduction in principal risk, thereby making speculation all the more lucrative—even as it eliminates almost entirely the corrective powers of two-way markets.

In this context, QE only added insult to injury. Whereas before the financial crisis the Fed’s balance sheet was money market focussed with a heavy representation of short-term Treasury bills, it currently owns no UST paper with maturities of one year or less; and the average maturity of its holdings is now 9 years, compared to less than 4 years before 2008.

What this means is that the entire, massive throw-weight of its peak QE portfolio of $4.5 trillion was dumped into the belly of the fixed income maturity curve, with ground zero just shy of the 10-year benchmark issue. It was meant to crush bond yields far below their natural free market levels, and that it surely did.

As is evident from the chart below, the normal 250-400 basis point spread between the 10-year yield and the smoothed inflation rate was virtually eliminated by QE.

For example, the 10-year UST yield averaged 5.0% during 1997-2007 compared to a smoothed CPI rate of 2.4%. Accordingly, the spread or real rate averaged 260 basis points.

By contrast, the 10-year UST yield averaged only 2.3% compared to a smoothed CPI average of 2.0% over the seven year period, 2012-2108. Therefore, not only did the spread or real rate shrink to just 30 basis points, but it was overwhelmingly the heavy thumb of the Fed and other central banks on the supply and demand scales that caused the massive compression of the real yield.

Stated differently, it wasn’t inflation that plunged, but the nominal yield on the 10-year, which was nearly cut in half owing to the massive bond-buying campaign of the central banks.

The obvious question is to what end did the Fed and its convoy of fellow traveling central banks crush the real yield on long-term debt to merely 30 basis points, which after taxes in most jurisdictions amounted to a rounding error?

The ostensible purpose, of course, was Economy. That is, the stimulation of borrowing to encourage greater spending and investment on main street than would otherwise have occurred at existing levels of household income and corporate cash flow.

Never once, however, have we heard the argument that the US economy was being choked or impaired for want of business working capital. So the central purpose was to encourage mortgage borrowings and home building or resales in the household sector and long-term borrowing and CapEx investment by the business sector.

Except neither kind of main street Economy stimulus really happened. That’s because most of the household sector’s balance sheet capacity–as measured by housing asset or collateral value—was used up in the 15-year housing boom before the 2008 crisis.

As shown below, new mortgage volume peaked between $600 billion to $1.1 trillion per year during 2002-2007, and that was all she wrote.

During the next six years, and despite massive monetary stimulus and the above-demonstrated compression of real borrowing spreads, home mortgage volume actually shrank; and during the last three years it has barely returned to the $200-300 billion per year level recorded in the mid-1990s.

To be sure, apologists for Keynesian central banking always and everywhere argue that without the Fed’s heavy thumb on the fixed income market, yields would have been far higher and mortgage borrowings and housing activity far weaker.

Then again, the apologists can never prove the contra-factual; they just assert it. They also assume that balance sheets don’t matter and that decisions by households to borrow less at market rates and lenders to advance fewer funds at higher borrower carry costs relative to income would be the wrong outcome.

That is to say, the Fed’s entire QE program and massive excersize in yield compression and debt price falsification was predicated on monetary central planning and the putative elixir of more debt.

Or to put it more baldly, it was predicated upon the claim that free market capitalism doesn’t work because benighted consumers don’t borrow enough and short-sighted bankers don’t lend enough.

Needless to say, that’s not economic enlightenment–just archaic Keynesian catechism. It has been proved for decades now that more debt relative to income (i.e. leverage) leads to less economic growth, not more.

That is, the ten-year trend rate of real US economic growth dropped from 3.5% in 1970 to 1.5% in 2018, even as the aggregate leverage ratio of the US economy soared from 1.5X to 3.5X. QED.

Stated differently, after the Fed-created housing boom and bust, the most massive monetary stimulus in history and the lowest real mortgage rates ever could not get humpty-dumpty back up on the high wall of speculative mania that had prevailed before 2008.

In fact, single family housing starts have already plateaued for this cycle and are now rolling-over at an 800,000 rate—a level far below the 1995 starting point of the epic housing boom which followed.

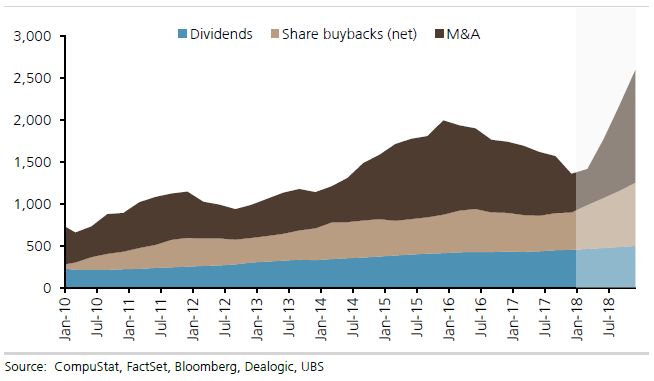

When it comes to stimulating Economy in the business sector, the consequence of the Fed’s radical spread compression was even worse. That’s because interest rate repression did induce the business sector—corporate and noncorporate—to borrow like hell as shown below.

Once the great recession was over, business debt levels surged from just under $10 trillion in 2007 to $15.0 trillion at present. During the last four years new debt has been issued at an $800 billion per year rate—a level exceeded only during the 2007 LBO binge right before the Wall Street meltdown.

Needless to say, however, virtually none of this borrowing went into elevated investment in productive plant, equipment, technology and intellectual property. In fact, net real business CapEx after depreciation is still below its turn of the century level—meaning that drastic compression of real debt costs did nothing at all for the efficiency and output capacity of the main street economy.

What it did do is fuel a massive burst of financial engineering on borrowed money. During 2018 alone, these financial engineering outlays totaled more than $2.5 trillion for the S&P 500—a figure more than 3X CapEx last year.

In other words, whatever QE might have accomplished by stimulating borrowing in the business sector was perverted and re-routed back into the stock market owing to the speculative mania on Wall Street fueled by ZIRP and the Fed’s endless price-keeping operations in the risk asset markets.

The truth is, both the fiscal and monetary branches of the Federal government are now being deployed for a single purpose: Namely, to systematically inflate the price of financial assets—knowingly and wittingly or otherwise—in behalf of the top 1% and top 10% of households which hold 40% and 85% of risk assets, respectively.

Even when the Trumpite/GOP corporate rate cut—financed with Uncle Sam’s credit card—was piled on top of the Fed’s radical rate compression, there was no surge in production of business equipment by US suppliers. As of the February 2019 release, production was still below the level reached in November 2014 and barely above the pre-crisis peak way back in December 2007.

In short, the Fed is not ending its normalization campaign for fear of a negative impact on Economy because there hasn’t been any detectable positive impact on main street for the past decade.

This is all about appeasing the traders, speculators and robo-machines.

As we said, it’s pathetic. And it’s laying the groundwork for the populist Left to come riding in on a platform of unadulterated redistributionism.