Well, the Low Interest Man left nothing to the imagination with this morning’s tweet. He’s now all-in for a currency race to the bottom, practically calling out to the central bankers of the world: Gentleman, start your engines!

China and Europe playing big currency manipulation game and pumping money into their system in order to compete with USA. We should MATCH, or continue being the dummies who sit back and politely watch as other countries continue to play their games – as they have for many years!

It’s hard to think of anything dumber than the proposition that if they trash their currency, we should do the same. And there is also nothing more certain to kill genuine capitalist prosperity than to embark on a currency race to the bottom: It would lead to economic mayhem, not MAGA.

Then again, why should the Donald be held to traditional standards of rationality and at least minimum regard for the requisites of sound money? Certainly Wall Street isn’t.

Indeed, since the end of May the day traders and algos have gone just plain berserk—drastically aggravated by the Fed’s abject capitulation to Wall Street at its June meeting. That is, when the equity markets are allegedly forecasting a boom and the bond pits a bust, something is going to go bump in the night.

And it won’t be a garden variety “dip”. Not when in a matter of weeks, trillions have moved in cross-wise trades—all turbo-charged by margin, repo and options leverage.

Needless to say, if you boast it and you break it, you own it.

Yet with respect to that truism, the Donald doesn’t have a clue. He actually thinks the central bank fueled madness now at loose in the financial markets is a ringing endorsement of his policies and his preening persona.

In that sense, our self-aggrandizing central bankers may be sowing the whirlwind they deserve and which will ultimately discredit their baleful reign. That is, the Donald is so full of himself on the economic and stock market file—that when the current mega-bubble collapse finally comes he is sure to go on a thundering take no prisoners rampage against the Fed.

Until now, no mere hard money critic or even level-headed financial analyst has been able to lay a glove on the Fed’s bogus economic theories–so long as the bubble has kept inflating and buy-the-dip got rewarded over and over.

But signs of the much-delayed third recession of this century are accumulating everywhere per below. And it is happening at a time when the Fed and other central banks are both out of dry powder and institutionally on the defensive like never before.

Accordingly, when what they called a “stock market break” in the old days actually arrives, the reaction from the Oval Office will give “ugly” an altogether new definition. To wit, the Donald will mobilize his entire 40% election-year “base” against the Fed in a vicious political crusade that until now has been completely unthinkable.

The good if it will be that the vast usurpation of financial power by the unelected monetary politburo domiciled in the Eccles Building will be put to referendum during the 2020 election campaign. A taste of things to come is that even Supply Side Guru Art Laffer, a once-upon-a-time goldbug and current day Trump-o-phile, is now calling for subordination of the Fed to the dictates of Congress and the White House.

Likewise, Trump has nominated Judy Shelton to one of the seemingly un-fillable open Fed seats. But Shelton has more monetary curveballs than the legendary Sandy Koufax. These include a long-standing support for gold-backed hard-money and a recent call for lowering the Fed’s target rate to zero by eliminating the infamous IOER payments to US banks.

Whether cancelling IOER would cause the money market rate to drop to zero or not remains to be seen. But it would call dramatic attention to the Fed’s outrageous $40 billion per year payment to banks to not loan money to the private sector by keeping their still massive excess reserves ($1.4 trillion)parked in the figurative vaults down on Liberty Street.

In this regard, it should be noted that the green space between 1987 and September 2008 is not intentionally left blank in the chart below. It is just that the purple line (excess reserves) never exceeded $1-2 billion until the Lehman bankruptcy filing in September 2008, and therefore is essentially invisible in the chart.

Thereafter, of course, Bernanke and his heirs and assigns cranked up the Fed’s printing presses to a fare-the-well, flooding the banking system with a tidal wave of excess reserves that peaked at $2.7 trillion in mid-2014.

Among other things, this tidal wave of fiat credit to the banking system completely eviscerated the Federal funds market (overnight interbank loans between institutions where those with excess reserves loaned funds at the Fed’s target rate to those with shortfalls) in the sense of taking Coals-to-Newcastle. Who needed to pay a competitor for overnight funds when the system was drowning in excess cash?

So to prove that the Fed could still command the money market, Bernanke invented IOER (interest on excess reserve payments) and snuck it past the shell-shocked politicians in the fall of 2008. But that may well prove to have been too clever by half.

We believe the case against IOER will become front-and-center in the Judy Shelton confirmation hearings (assuming she doesn’t get Moore’d & Cain’d), and that it will not take the Donald long to test out slamming the Fed for a $40 billion give-away to the bankers at his stadium rallies.

If he does, it will light-up the crowds even more powerfully that his beloved Mexican Wall; and when that happens it will be curtain time for the independent Fed and lights out on Wall Street.

That is to say, the Judy Shelton nomination may be the catalyst which results in the Donald launching a 21st century William Jennings Bryan style crusade against Wall Street’s dutiful monetary concierges in the Eccles Building.

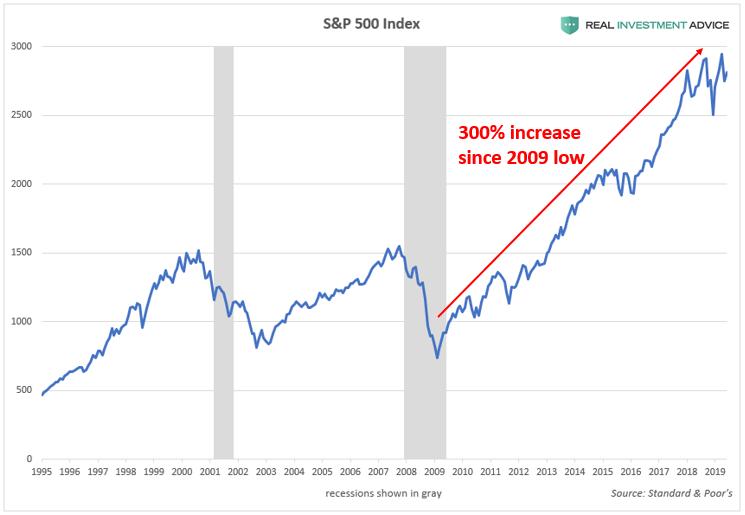

In any event, the Shelton IOER caper will also leave the Donald high and dry—even as the stadiums resound with applause. That’s because he insisted upon bragging about a big fat ugly bubble that has not gone away since the Donald nailed it during the campaign, and has only gotten more dangerously explosive in the 30 months since.

We have the greatest economy anywhere in the world…..S&P 500 hits new record high. Up 19% for the year. Congratulations!

Not so fast!

The current Atlanta Fed’s GDP Now forecast for Q2 economic growth has slumped to just 1.3% based on this morning’s punk factory orders report and the soaring trade deficit for May.

And that’s not the half of it. As Patrick Watson cogently observed in a post today:

Just as an army moves on its stomach, an economy moves on ships, trucks, and planes. They carry the goods whose purchase adds up to growth. Nowadays many goods are digital, delivered electronically. But we still need lots of physical stuff which must travel to the customer. Fewer goods in motion mean lower growth… and that’s exactly what is happening.

The widely regarded Cass Freight Index shows declining year-over-year volume for the last six consecutive months and was down 6.0% Y/Y in May after the 2018 sugar high boom simply vanished.

Of course, what happened is that the Donald’s Trade War fostered an import boom that temporarily created more activity and jobs. As Watson further noted,

This was perfectly predictable. The 2018 transport boom didn’t represent higher demand for imported goods. It was future demand, pulled forward in time. President Trump’s tariff threats gave importers incentive to rush, and they did. That extended the growth a little more. But those effects were temporary, and now they’re running out.

Some investors think the Fed will pull a rabbit out of the hat by cutting rates again. But access to credit isn’t the problem. Businesses that want to borrow can do so on good terms. The problem is they don’t need to borrow unless they are growing, and they’re not. The Fed can’t fix that.

Moreover, the hits do not stop coming.

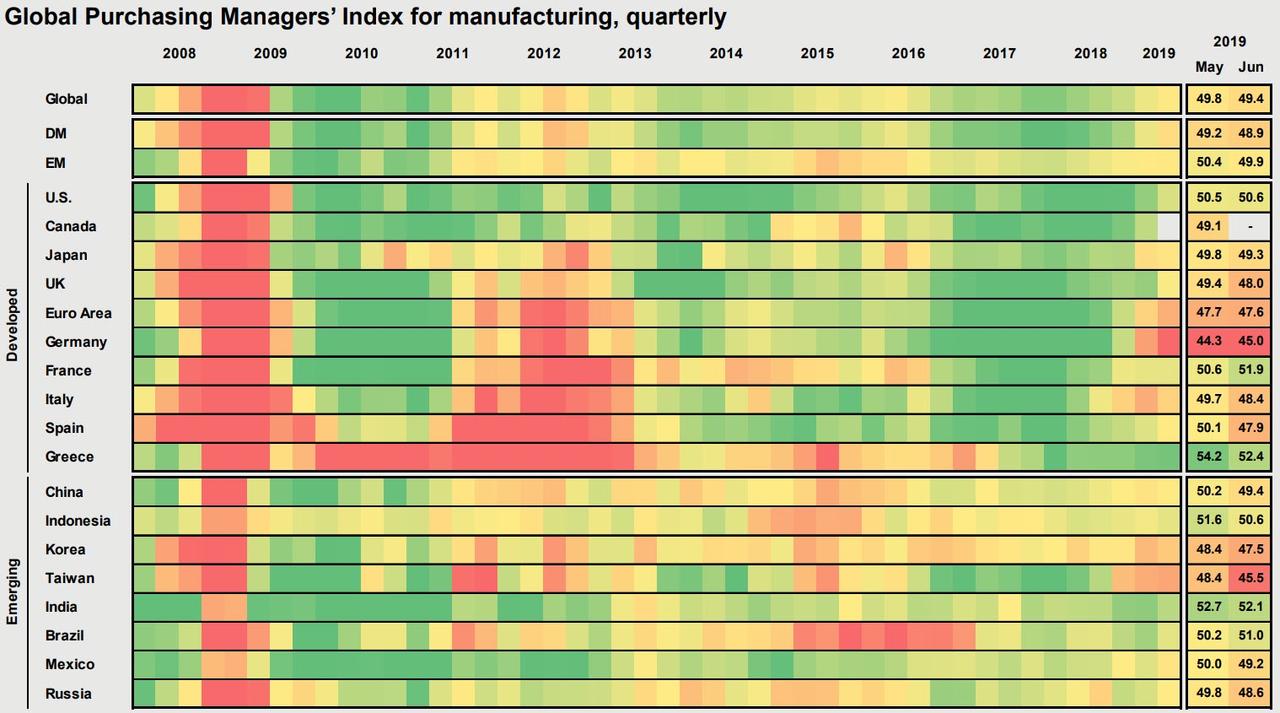

As is now evident, a huge share of the global manufacturing economy is already entering recession territory:

Likewise, small business sector is visibly faltering, and it usually leads the pack down. As David Rosenberg noted, the recent job shrinkage rate is the worst since February 2008:

The small business sector leads the cycle and employment here has plunged 61k in the past two months. Haven’t seen this in over 9 years; same decline we saw in Feb-March of 2008 when the consensus was busy calling for a soft landing. This isn’t a repeat of 2016 by any stretch.

So just how far does the Donald think the market can rise—when everywhere there are signs that the central bank engineered simulacrum of main street recovery is reaching it sell by date?

We’d say when you are in the nosebleed section of history that crowing about you position is tantamount to taking a suicide dive.

As Sven Henrich observed:

Things are so terrible investors panic buy stocks to all time highs betting on the Fed to cut rates with unemployment at 50 year lows and financial conditions at their loosest in 25 years.

Well, it might accommodate the punters a few weeks from now, but so doing it will only guarantee a harder landing in the end.

The Fed’s egregious money-pumping has already led to a massive diversion of resources into speculation–the building of bubbles throughout the warp and woof of he US economy. Just consider how the e-commerce upstart of the residential real estate world, Zillow, has decided to turn itself into a speculative house-flipper.

As Forbes described it, the signs of speculative excess are clear as a bell:

Zillow has actually had more success buying homes than reselling them. In the program’s first nine months in 2018, Zillow purchased 686 homes and sold just 177 of them, at an average price of $295,800—bringing in $52.4 million, with a pretax loss of $62.4 million. (Overall Zillow lost $151 million pretax last year.) In the first quarter of 2019, Zillow purchased 898 homes and sold 414. Home revenue for the quarter was $128.5 million, with a pretax loss of $45.2 million. Zillow ended the quarter with 993 homes in inventory, worth approximately $325 million.

Despite that sluggish start, Zillow boldly predicts that in three to five years it will be buying 5,000 homes a month—1% of all real estate transactions—and booking home sale revenue of $20 billion a year, compared with $2 billion or so from selling real estate ads on line.

Needless to say, this is not going to end well. As Steve Eisman of Big Short fame noted,

“Genius is not always transferable. The people who have created Zillow are very well known for creating internet platform companies, but flipping homes is not an internet platform company,” says Neuberger Berman portfolio manager Steve Eisman, who famously shorted the housing market ahead of the crash and who is now short Zillow. “A house is not a book. It is expensive to hold a house,’’ he says, adding that holding an empty house involves everything from getting the lawn mowed to making sure neighborhood kids aren’t sneaking in to smoke pot. Then, of course, you’ve got to sell it.

Moreover, its financing its own inventory, too, by means of the ancient scam of financing its own customers, thereby turning is accumulating inventory into customer receivables of dubious collectability.

Moreover, Zillow is now financing a large portion of its inventory and receivables with floating rate credit lines worth $1.1 billion. Yet interest payments will eat into already razor-thin margins—even as the company is exposed to additional cost should rates rise and loss costs should borrowers default.

Finally, consider the action on the other side of the pond where already rock bottom Euro bond yields today plummeted into the financial netherworld. The Italian 2-year was yielding negative 5 basis points and the ten-year touched just 1.59%.

That’s about as absurd as it gets when you recall that Italy’s economy has been shrinking in real terms for nearly a decade, while its debt-to-GDP ratio remains stuck at nearly 135% of GDP.

Italian Government Debt-To-GDP %

Italy Constant Price GDP

Italian Government 2-Year Yield

So does the Donald really want a race to the bottom?

Yes, he does. And it’s going to unleash mayhem in very short order.