After what was falsely portrayed as a “gangbusters” report for July retail sales this AM, the talking heads on CNBC were nearly hyperventilating.

We no longer need Secretary Robert Rubin and Fed Chairman Alan Greenspan— one of them gushed in reference to a famous 1990s Business Week cover. That’s because the US consumer is the New Committee to Save the World.

We beg to differ. As we elaborate below, the consumer is buried in $15.6 trillion of debt, has experienced punk real wage growth and, once again, is not remotely prepared for the loss of jobs and income which will happen when the next recession hits the ground.

More immediately, today’s headline gain of 0.7% amounts to a virtually meaningless one-month seasonally maladjusted factoid. For instance, Amazon pulled forward huge amounts of sales during July owing to its ballyhooed “Prime Day”, but these gains will likely be given back during the months ahead.

Yes, the good folks at the Census Bureau try to “seasonally adjust” for such things. But the growth of e-commerce sales has been so spectacular—going from less than 1% of retail sales at the turn of the century to more than 15% during the past month—that adjustments for something as massive as “Prime Day” are even a bigger stab in the dark than the ordinary monthly seasonal adjustments.

In any event, if you set aside the nonstore retailers piece of the July report, the month-over-month gain was only 0.4%.

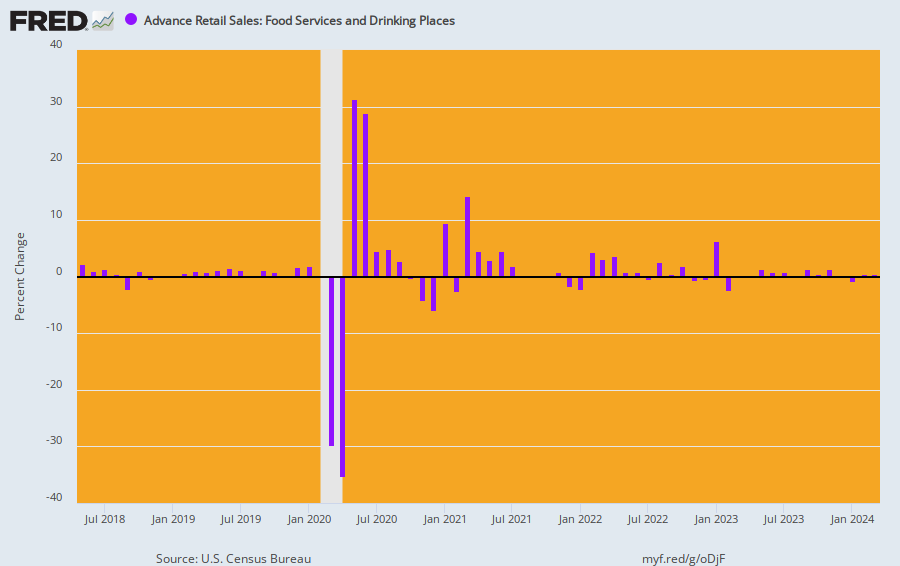

Likewise, the report included a highly suspicious seasonally adjusted gain of a whopping 1.1% during July versus June for restaurants and bars. That one smells more than a tad because during the previous June 2018 to June 2019 period, the non-seasonally adjusted average monthly gain was only 0.23%. That’s barely one-fifth of the purported monthly surge during July.

Of course, maybe the Dem presidential debates caused people to flock to the bars in unusual numbers or to dine out in air-conditioned restaurants to escape the evident global warming, whatever may have caused it.

More likely, however, it’s just noise that will be revised away or averaged out over the coming quarters and years.

In fact, the bouncing around of this so-called seasonally adjusted figure for the last 15 months pretty much tells you the July number was meaningless: In the real world, consumers just don’t go from spending +2.5% in May 2018 versus prior month to spending -1.7% in September and then back around the barn again.

Indeed, taking the monthly change numbers on face value is a fools errand owing to the huge imprecision of the Census Bureau’s data, sampling and adjustment methodologies.

In this case, what we do know is that consumers have not been binging at the restaurants: The core CPI was up 2.2% over the past year and June-to-June bar and restaurant sales were up 2.8%, meaning real spending had been advancing at only 0.6% per year.

In any event, excluding the suspect figures for restaurants and bars and e-commerce sales during the month of July, retail sales proper at brick and mortar stores were up by only 0.29%. And that’s not gangbusters by any stretch of the term.