Just because the frogs bask silently and (perhaps) happily in the steadily warming waters, it doesn’t mean that all is copacetic and that the kettle temperature is not relentlessly rising. The foolish amphibians are just adjusting to it without measuring it.

So it goes for the lunacy of the Fed’s relentless money printing. It has been raising the speculative temperature in the Wall Street casino dramatically—especially since the eve of the financial crisis in Q4 2007. But the apparently amphibian Keynesian economists bivouacked there are not even warm-blooded enough to note the rise.

Then again, that’s why they never see a bubble expanding and are shocked when it bursts, preferring to believe instead that it was a one-off freak of history. This time, however, that might actually be true, but not in a good way.

At the pre-crisis peak in Q4 2007, the Fed’s balance sheet stood at $890 billion, while today it rounds to $7.4 trillion. The implied 13 year growth rate is thus a staggering 17.6% per annum.

Since that latter compares to a nominal GDP growth rate of just 2.9% per annum during the same period, the question recurs: Where did all that putative “stimulus” go?

Indeed, the contrast between the expansion of the Fed’s balance sheet and the change in both nominal and real GDP is so staggering that you would think it might even arouse the frogs from their fatal slumber.

Change per Annum, Q4-2007-Q4 2020:

- Fed balance sheet: 17.6%;

- Nominal GDP: 2.9%;

- Real GDP: 1.3%

The justification, of course, is that American capitalism has been suffering from some kind of ornery preference for recession, deflation and low-flation. So its been up to the central bank to lean hard into the wind and force the main street economy to man-up and robustly inflate itself.

Alas, when the main street target (nominal GDP) of all this monetary muscling grows at only 16.5% of the rate of stimulus applied, something is slipping big time between the monetary cup and the economic lip.

And that’s especially the case when the ultimate target of all this central bank stimulus—real GDP—has grown at only 1.3% per annum, thereby marking the worst trend growth rate in US history, and by a country mile at that.

Growth of Fed Balance Sheet Versus Nominal GDP, 2007-2020

With respect to Wall Street’s boiling frogs, it needs be said that the above chart is not as it has always been. For instance, during the 17-year peak-to-peak period between Q2 1990 and Q4 2007 (with the mild 2001-02 recession tucked in between), the Fed’s balance sheet grew at only one-third the rate of the past 13 years, while both nominal and real GDP expanded at rates 2-3 times higher.

Change Per Annum, Q2 1990-Q2 2007:

- Fed balance sheet: 6.3%;

- Nominal GDP: 5.3%;

- Real GDP: 3.0%.

In short, this time is different as dramatically evidenced by the fact that Fed credit injections into Wall Street, which were 3X larger than during 1990-2007, generated barely one-third of that period’s real GDP growth on main street. Money-pumping is self-evidently losing its macroeconomic efficacy.

Indeed, when these same data are viewed relative to those for the real golden age of the post-war American economy (1953-1990), the last 13 years have been a veritable farce. What none of the Wall Street stimulus hounds or Keynesian economists–as the case may be—can explain, is why the allegedly recession/deflation/low-flation addled US economy did not roll-over and die during the golden era when the Fed’s balance sheet grew by only 5.0% per annum over the entire 37-year stretch.

In fact, both real and nominal GDP grew 2.6X faster during that period than during 2007-2020, and nominal GDP actually grew faster than the Fed’s balance sheet for nearly four decades running.

Change Per Annum, Q2 1953-Q2 1990:

- Fed balance sheet: 5.0%;

- Nominal GDP: 7.6%;

- Real GDP: 3.4%.

Then again, all that stupendous Fed balance sheet expansion after Q4 2007 did not disappear down an economic black hole. It simply never left the canyons of Wall Street, where it shrunk the supply of Treasury and GSE paper by the trillions, thereby forcing benchmark yields lower and equity cap rates (PE multiples) higher.

The result, of course, is a hideously unbalanced and unsustainable outcome which should be obvious to all except the most obtuse of boiling frogs—the population of which on Wall Street and the precincts of the homegamers has become staggeringly large. To wit, since the pre-crisis peak in Q4 2007, the annualized rate of gain has been:

- Nominal GDP: 2.9%;

- NASDAQ 100: 15.0%

Stated differently, rampant money-printing by the central bank has not lost its power to inflate after it, but what has gotten inflated has been the stock indices, not the main street economy.

NASDAQ 100 Versus Nominal GDP, Q4 2007-Q4 2020

Needless to say, an inflating stock market is not quite the equivalent of a rising tide which lifts all boats equally. What happens, instead, is that central bank generated excess liquidity gravitates toward “story stocks”, and as the bubble progressively expands, fewer and fewer story stocks attract more and more momentum chasing capital, resulting in absurd over-valuations for a handful of the ultimate winners.

In the present bubble cycle, the story is “growth” and the poster child is Tesla, which closed today at a staggering $805 billion market cap. What that means is that relative to June 2019—

- Tesla’s LTM revenue stands at 1.13X (up from $24.9 billion to $28.2 billion);

- Tesla’s market cap stands at 19.8X (up from $40.7 billion to $805.1 billion).

Forget about the fact that the global auto market is crawling with uber-competitive, volume car-makers blessed with superior engineering, marketing, mass manufacturing and supply chain management skills and all of which are plunging into the EV (electric vehicle) business big time. Regardless of the business context, not even God Almighty could earn out the 1700X PE multiple and 441X free cash flow multiple implied by today’s closing price of $849 per share.

This simply represents the final madness of the momo crowds which have been carried into a handful of red hot stocks by the Fed’s endless flood of liquidity injections, and which stocks have now become completely severed from any semblance of valuation fundamentals.

To be sure, Tesla is the lunatic exemplar that defines the case, but it nonetheless merely amplifies the unhinged “growth” story that also accounts for the stampede of speculators into the Big Tech Five (Apple, Amazon, Twitter, Google and Facebook), which have now become a clear and present danger to free expression, democratic governance and competitive enterprise in America,

The clay feet of these growth stories is amplified further below, but it first needs be noted that the dangerous concentration of power in these companies is happening, again, not because of current monopoly profits.

Instead, they have become marauding monsters of the political midway because their stock market valuations have become so absurdly excessive that they are being badly mismanaged by people drowning in windfall riches. That is, the cost to top executives, whose compensation is overwhelmingly concentrated in stock options and grants, of indulging in business-harming political virtue-signalling has become almost non-existent.

Consequently, they are turning private companies, which are not and should not be governed by the First Amendment, into unrestrained 800-pound guerrillas in the nation’s political arena. The long-standing and powerful profit-maximizing discipline that otherwise keeps companies on the political sidelines, pitching what amounts to nickels and dimes into their PACs and lobby operations, has now been busted.

As Glenn Greenwald noted, over the weekend, three tech titans—-Jeff Bezos, Sundar Pichai and Tim Cook—put their heads together briefly and asphyxiated Parler in what amounted to a nanosecond, but not even for the usual (and illicit) reason of unwanted competition; they simply didn’t like its implicit libertarian politics and the fact that it had become a refuge for deplatformed Trumpites:

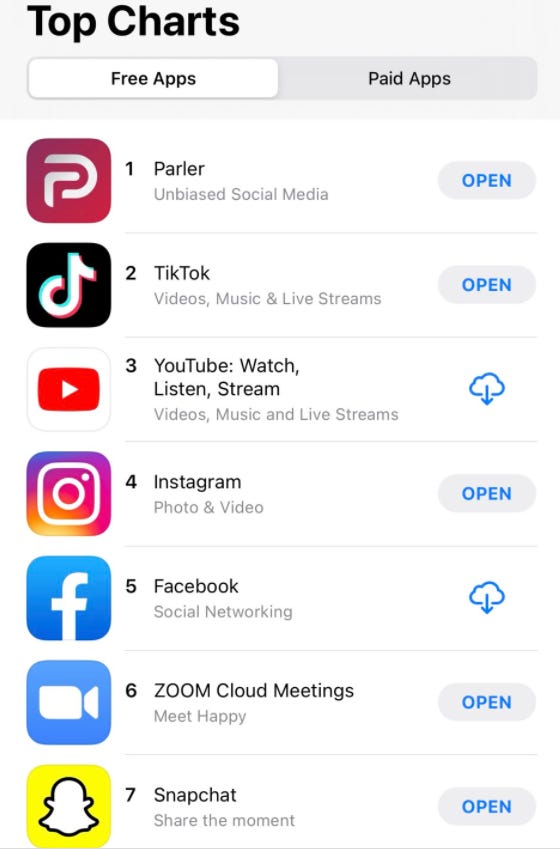

On Thursday, Parler was the most popular app in the United States. By Monday, three of the four Silicon Valley monopolies united to destroy it.

Indeed, the non-business based destruction of Parler was so egregious as to crystalize exactly why the Big Tech Five are the spawn of the Fed’s madcap money printing.

As it happened, Parler had a huge head of steam as a competitive business enterprise. Owing to the increasing arbitrary, left-wing highhandedness of Twitter, there had been a stampede to Parler (launched in 2018) during the past year. Overall, the app was the 10th most downloaded social media app in 2020 with 8.1 million new installs, according to TechCrunch.

And then after the ostentatious Twitter and Facebook deplatforming of the Donald himself last weekend, the migration to Parler became a tsunami. Parler was actually catapulted to the number one spot on the list of most-downloaded apps on the Apple Play Store during the most recent period.

Glenn Greenwald, who is a strikingly honest and consistent left-wing pundit, further observed:

But today, if you want to download, sign up for, or use Parler, you will be unable to do so. That is because three Silicon Valley monopolies — Amazon, Google and Apple — abruptly united to remove Parler from the internet, exactly at the moment when it became the most-downloaded app in the country.

It is hard to overstate the harm to a platform from being removed from the App Store. Users of iPhones are barred from downloading apps onto their devices from the internet. If an app is not on the App Store, it cannot be used on the iPhone. Even iPhone users who have already downloaded Parler will lose the ability to receive updates, which will shortly render the platform both unmanageable and unsafe.

Amazon delivered the fatal blow. The company founded and run by the world’s richest man, Jeff Bezos, used virtually identical language as Apple to inform Parler that its web hosting service (AWS) was terminating Parler’s ability to have AWS host its site: “Because Parler cannot comply with our terms of service and poses a very real risk to public safety, we plan to suspend Parler’s account effective Sunday, January 10th, at 11:59PM PST.”

To be sure, the stock prices of Twitter and Facebook have experienced minor hiccups in the last two days. As a result of Twitter’s ban on the Donald & friends, its stock fell 12 percent on Monday, with the share-price decline snatching $5 billion from the company’s $41 billion market capitalization.

The executives at Twitter may not have liked it, but President Trump was their number one draw by a very wide margin. And while it is ordinarily very bad business to kill off your number one source of income, that’s exactly what Jack Dorsey did because he is rolling in so much Fed enabled bottled air that had doesn’t give a rip about losing customers when it comes to venting his politics.

Likewise, some Facebook investors appeared to be exiting, as well. At one point on Monday Facebook’s market cap was down by a cool $33.6 billion, but that didn’t phase Mark Zuckerberg and his thousands of stock-option engorged minions.

They even celebrated their blatant political attack on the Trumpite right under the guise of stopping “incitement” of off-line violence by temporarily blocking Ron Paul from making new posts on his FB account for “violating community standards”

Really?

For crying out loud, Ron Paul is surely America’s leading peace advocate of the last half-century, and before that he delivered more than 3,000 babies in his private practice as a beloved community gynecologist and obstetrician. Yet this snot-nosed Harvard drop-out blocked Dr. Paul for no business reason whatsoever, but merely because at Facebook’s absurdly excessive market cap of $735 billion, he can.

In fact, however, on a honest free market, Facebook would be lucky to be worth half that amount, as we will demonstrate in this case, as well as the other Big Tech malefactors, in Part 3