Oops! The Fed’s ultra-dove and government lifer, Lael Brainard, pulled a switcheroo for the ages yesterday. As the Fed’s favorite fanboy at the WSJ noted,

“It is of paramount importance to get inflation down,” Ms. Brainard said Tuesday at a virtual conference hosted by the Federal Reserve Bank of Minneapolis. “Accordingly, the committee will continue tightening monetary policy methodically through a series of interest-rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.”

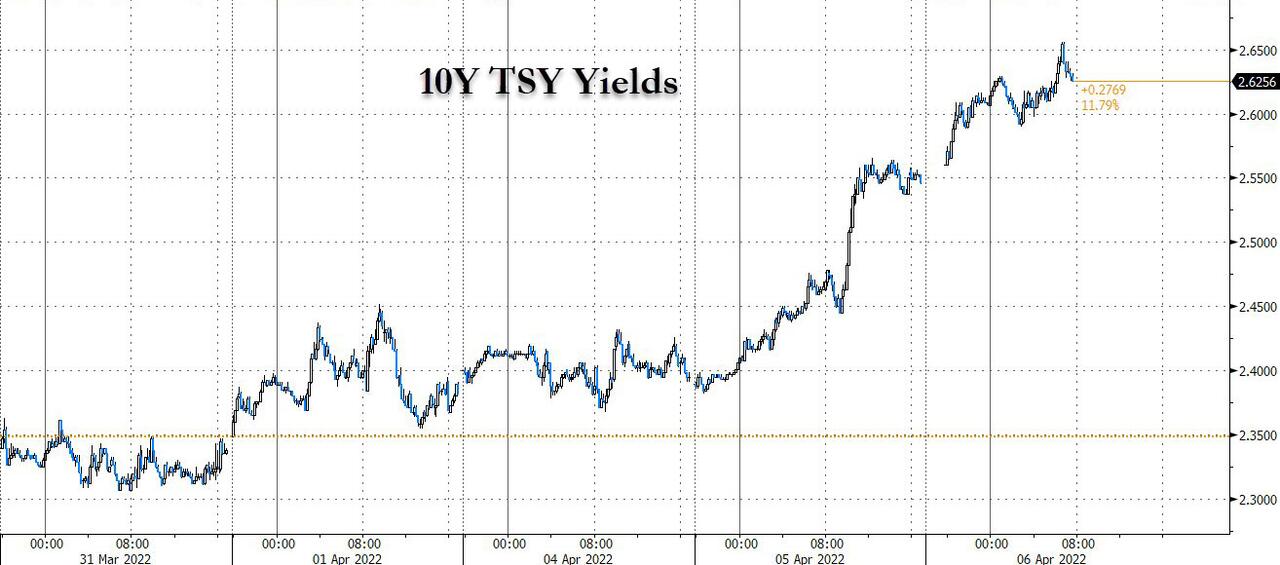

Longer-dated Treasury securities sold off sharply after Ms. Brainard’s remarks, which emphasized how the portfolio runoff would be larger and faster than the last time the Fed shrank its holdings. The yield on the benchmark 10-year Treasury note, which rises when bond prices fall, jumped to 2.554% Tuesday, from 2.465% just before she spoke and 2.409% on Monday.

Ms. Brainard’s remarks were notable not only because she is one of Fed Chairman Jerome Powell’s top lieutenants in shaping the central bank’s monetary-policy agenda but also because she had been one of the most vocal advocates last year warning against prematurely pulling back its stimulus. Ms. Brainard focused her remarks on the potential for higher inflation to hit low-income Americans hardest, and her shift underscores the Fed’s alarm at high inflation and its urgency to withdraw stimulus quickly.

In short, while the Fed’s hardcore statists fear Wall Street hissy fits to an embarrassing degree, their devotion to the greater good of society’s underdogs ultimately trumps.

What was especially crucial about Brainard’s flip-flop was her extended and explicit discussion of a much more aggressive approach to balance sheet reduction than the short-lived effort in 2017-2019, and certainly well beyond expectations currently baked into the market.

When the Fed last attempted to shrink its asset portfolio, it phased in the process gradually over more than one year, and it ultimately never allowed more than $50 billion in securities to mature in any month.

Based on the expectations of Wall Street firms surveyed by the New York Fed in January, the expectation this time was for about $80 billion per month of run-off. But the tone of Brainard’s comments yesterday suggest that a triple digit monthly run-off is more likely to be in the cards, and that the phase-in will also be much more rapid than during 2017-2019.

Not surprisingly, therefore, the resulting selloff was broad based and also hammered rates, with the 10-year Treasury yield rising as high as 2.65%, taking it back into the ranges traded in 2018 and 2019.

Following Brainard’s comments, money-market traders are now also betting on the steepest Fed tightening in almost three decades, betting the Federal Reserve will implement 225 basis points of interest-rate hikes by the end of the year. As the WSJ further noted,

Factoring in the hike already delivered in March, that would mean an increase of 2.5 percentage points for the whole year. The Fed hasn’t done that much tightening in one year since 1994, a famously brutal year for bond investors that even included a 75 basis-point hike

What this means is that the Fed is so far behind the inflation curve that its inner council is regressing to a panic mode, contemplating money-destruction at rates never before experienced or even contemplated. The Brainard implied $100 billion or more per month of QT (quantitative tightening), in fact, would shock the bond pits to their very core.

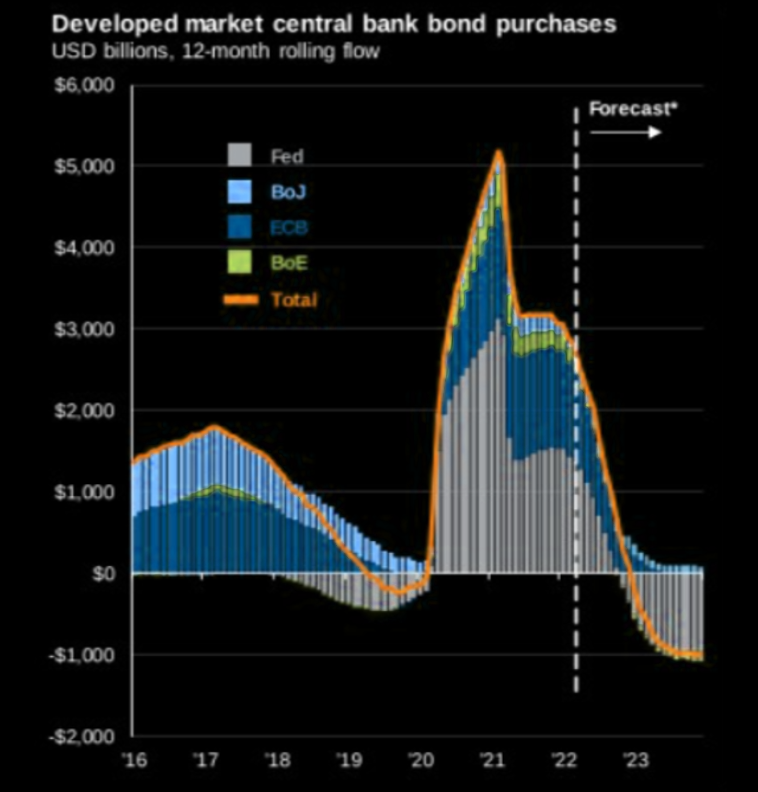

The chart below gives a hint of the financial shock waves to come. At the peak in early 2021, the Fed was printing money at a $3 trillion annualized rate, and the major central banks of the world taken together were pumping out nearly $5.1 trillion per annum of digit credits snatched from thin air.

But with the other central banks moving toward neutral and the Fed pivoting to toward a money-shrinkage rate of more than $1 trillion per annum, the whip-lash in the bond pits is certain to be one for the ages.

Meanwhile, the Bloomberg Global Aggregate Index is now below a measure of so-called par value, with its price falling to 99.9 or a tad under the level at which bonds are ordinarily sold to investors. It’s the first time since 2008 that the gauge has traded at a discount to face value.

Moreover, to add insult to injury, Brainard’s Bombshell was accompanied by a Bronx Cheer from one of the leading culprits of the Fed’s money printing craze, which eventually led to the current pickle.

We are referring to a cat we called B-Dud, a former Goldman heavy-hitter and then president of the NY Fed. Yesterday Bill Dudley saw fit to issue another of his post-service op-eds, warning that “If Stocks Don’t Fall, the Fed Needs to Force Them”…

Wow! Dudley, who is one of the most unabashed Keynesian money-printers to come down the pike during the last two decades, is now calling for a stock market crash!

You can’t make this up. Here are Dudley’s own words:

It’s hard to know how much the U.S. Federal Reserve will need to do to get inflation under control. But one thing is certain: To be effective, it’ll have to inflict more losses on stock and bond investors than it has so far.

…Investors should pay closer attention to what Powell has said: Financial conditions need to tighten. If this doesn’t happen on its own (which seems unlikely), the Fed will have to shock markets to achieve the desired response. This would mean hiking the federal funds rate considerably higher than currently anticipated. One way or another, to get inflation under control, the Fed will need to push bond yields higher and stock prices lower.

Needless to say, if this were just an ordinary anti-inflation tightening cycle, the Fed’s day late and dollar short posture would be bad enough. But what will add insult to injury is the fact that the Fed is being forced into an abrupt, market-jarring braking action at the very time that official Washington is busy wrecking the dollar-based global financial system in the name of Spanking Vlad Putin good and hard.

Thus, in response to the confected Bucha Massacre story, it was off to the races yesterday with new sanctions. That is, Washington elected to whack the American economy right in the foot one more time per the Wall Street Journal:

This week, the US Treasury blocked JPMorgan from processing Russia’s attempt to make debt payments of more than $600 million, ramping up pressure on Moscow.

Russia is no longer allowed to make sovereign bond payments using American banks after the Treasury’s Monday policy change. A Russian debt default would likely be a major worry for the government, which could be locked out of capital markets for years.

Really?

After having confiscated $300 billion of Russia’s $650 billion of central bank reserves and hijacked tens of billions more of private Russian assets with reckless abandon, why would anyone think Russian authorities care a whit about being excluded from the western financial system?

For crying out loud, that’s Washington’s actual policy!

Then again, the war-mongers still don’t understand that systematically wrecking the dollar-based global trade and payments system will hurt the world’s reserve currency issuer and massive debtor far more than Russia.

Indeed, the latter is actually running a massive trade surplus. As Robin Brooks, chief economist for the authoritative Institute for International Finance, noted:

Russia is making money hand over fist from its sales of oil and gas, helping it generate a massive current account surplus. Last year, Russia’s surplus was roughly 6 percent of gross domestic product — It could be roughly double that this year, given how much energy prices have risen, Brooks said.

Still, the dudes at the Atlantic Council are apparently ecstatic about the Treasury Department’s latest dumb-ass move:

But it could create a decades-long overhang for Russia, said Josh Lipsky, director of the Atlantic Council’s GeoEconomics Center. Restructuring its debt could prove extremely difficult as long as sanctions are in place, and it won’t be able to turn to the International Monetary Fund for help.

“It will affect their credit rating, it will affect their ability to access debt for years. When they do borrow, it will be at a much higher rate,” Lipsky said.

Well, here’s a news flash for Mr. Lipsky. For better or worse, Russia will be going toward a non-dollar future in league with China, India and other non-aligned economies, along with pursuing autarky (self-sufficiency) with a vengeance.

What that means, of course, is that the only incremental harm from this latest madness will be to the US, (and European and Japanese) lenders who will suffer big losses from the Washington-forced default.

So talk about upholding the rule of law, to saying nothing of the fifth amendment to the constitution.

Yesterday’s move is a flat-out “taking” of private property. And yet the GOP—the supposed champion of property rights—is not only cheerleading this outrage, but demanding more where that came from.

Worse still, the unhinged Sanctions War is hitting the global trading system right in the solar plexus owing to Russia’s huge position as a commodity supplier.

Since in practice the sanctions leak like a sieve—given that China, India, Indonesia, Brazil, South Africa and countless other developing nations are not participating in the NATO Putin Spanking Operation— Russia will one way or another sell its commodities, even if at a considerable discount to today’s sky high prices.

But the resulting dislocations in the global commodities trade will cause untold inflationary pressures. For want of doubt, the following excerpt from International Man summarizes as well as possible Russia’s huge role in the commodity trades and the inflationary implications of today’s sanctions madness:

In essence, we would like to point out how Russia is way more important to the world economy than it was some 20 years ago. To embargo or limit Russia’s exports will only lead to an inflationary super storm.

Russia is a major supplier of the most wanted raw materials including: palladium, 46% of global production, platinum 15% of global protection as well as gold, oil, natural gas, coal, nickel, aluminum, copper and silver, as well as wheat.

Some 20 years ago Europe (and the “West”) had the North Sea, which produced as much as Russia and the US. Now it is a shadow of its former self. And if US shale continues to disappoint, it won’t be long before Russia becomes the world’s biggest oil producer “beyond reasonable doubt”.

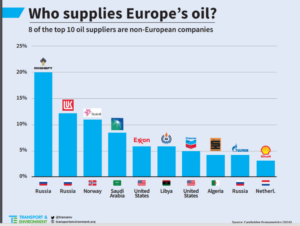

Do you really think that Rosneft, Lukoil, or Gazprom are in trouble of being sanctioned when they supply some 36% of Europe’s oil needs?

Have a look at the below chart to see who supplies Europe’s oil?

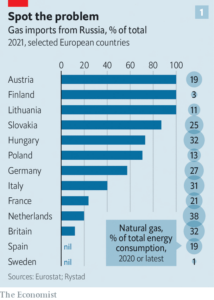

And natural gas (not that this is unappreciated).

But there are probably a couple of commodities that few have given any thought to, coal in particular. Russia exports almost as much thermal coal as Australia (granted the chart below is a few years old but volumes wouldn’t have changed materially in that time). Russia also exports about as much coking coal as the US and about 40% of Australia.

If the gale forces of global inflation were not enough, now comes a new study showing another Washington-instigated inflation-accelerator. To wit, the Donald Trump inspired crackdown on immigration is creating serious labor shortages in those sectors of the economy that are heavily dependent upon foreign-born workers.

As is happened, for several years after the 2007-09 recession, roughly a million people moved to the U.S. annually, thereby providing a major portion of the modest growth in America’s working-age population. But as the Wall Street Journal noted,

In all, this one-two punch left the U.S. with 2.4 million fewer immigrants of working age—about 1% of the working-age population—than if pre-2017 immigration trends had continued, according to Giovanni Peri, a labor economist at the University of California, Davis.

Thus, in the accommodations and food service sector, where foreign born workers account for 28% of employees, the jobs vacancy rate is now 11%. Likewise, in the health care and social assistance sector 17% of workers are foreign born and the vacancy rate is now 9%.

There are also high vacancy rates among truckers, where foreign born account for 28% of employees, with the ratio similar for the construction trades.

Overall, therefore, during the 12 months ended last June 30, about 247,000 people moved to the U.S. That was less than a quarter of the 2016 level and half that of 2019. Accordingly, the new worker flow from the top five green card countries—Mexico, the Dominican Republic, Vietnam, the Philippines and China—saw declines of half to two-thirds in green-card issuance from two years prior, according to Department of Homeland Security figures.

The result, of course, is that the steadily rising supply of foreign-born workers—which had gone from 32.5 million in 2010 to a peak of nearly 38 million in 2018 has now shrunk modestly for the first time in decades, meaning that the US labor market is now experiencing a commensurate increase in labor cost pressures.

Finally, the estimable Joseph Carson has noted yet another quandary now confronting our erstwhile gung-ho money-printers. Namely, that at the ultra-low interest rates they imposed on the financial system, a modest percentage rise in interest rates will not have the demand-killing and therefore anti-inflation punch that would be the case when commencing the tightening cycle from a more rational and normalized starting point:

For want of doubt, here is the nominal GDP versus Fed funds rate gap referred to by Mr. Carson. At 1000 to 1500 basis points in recent quarters, it’s literally off the charts.

So, as we said, buckle-up. Those clueless cats domiciled in the Eccles Building have screwed-up royally.