The money markets are now pricing-in a 70 basis point Fed easing by year end. That would take the funds rate to 160 basis points and back below the inflation rate where it has dwelled most of the time since April 2008.

Whatever kind of madness you call that, MAGA is not what comes to mind first, last or at all. In fact, as Bill Blain noted this AM:

This is crazy. Some analysts are predicting 3 Fed eases by year end. Australia and New Zealand have cut rates. German yields are now negative 0.21%. Nothing screams recession more loudly!

He got that right. The Keynesian mainstream has suddenly awakened to the parlous state of the domestic and global economy, and is now yapping loudly for another round of rate cuts.

That’s the very cure, of course, which has not worked for the last 10 years; and which has actually intensified the secular decay of the US economy because it fuels destructive financial engineering in the C-suites, rampant speculation on Wall Street, uncompetitive cost inflation on main street, and the perpetuation of corporate zombies supported by yield chasing portfolio managers.

Further evidence that the 10th anniversary of this Easy Money hobbled business cycle is signaling that recession lies around the corner came in today’s report on factory orders for April. They posted a 3% decline from last September’s sugar high—- and the lowest year-over-year gain since the Donald was sworn to the oath.

More crucially, the seasonally adjusted monthly number for April 2019 was $499.3 billion, and that’s as close as you please to nowheresville when compared to the $499.4 billion posted way back in November 2013.

That’s right. We are nearly six years out from the post-recession bounce-back of late 2013, but factory orders even in nominal dollars have not even recovered the ground lost during the Red Ponzi induced mini-recession in global trade and production of 2015-2016; and now factory production is clearly rolling over still again.

To be sure, the Donald has never said exactly what elements of the debt-burdened US economy are leading to the greatest ever boom and prosperity. But we’d surmise from all of his Trade War maneuvers and boasting about the salutary effects therefrom that manufacturing should be at the head of the parade.

Actually, even if you ignore the reporting aberration for July 2014 (purple line peak) and deflate the data below by the GDP deflator, factory orders in April was down 10% from November 2013 levels.

So call it what you may—but just not MAGA.

The point should be clear by now that the Donald and his inner circle of economic cheerleaders are as adept at cheery-picking the incoming monthly data as the sell-side stock peddlers on Wall Street.

As we have frequently documented, however, there has been no trend-acceleration in the US economy; and the Donald has delivered no cyclical old-age defying economic Viagra equivalent capable of rejuvenating the cycle and sending the US economy back into off-the-charts orbit.

As shown below, real final sales—which remove the short-run inventory distortions resulting from the Donald’s Trade Wars—have averaged just 2.59% per annum during the first nine quarters of Trump’s tenure. That’s an actual deceleration from the 2.89% rate posted during Obama’s final nine quarters.

But if anything Trumpian avers to have those magical qualities it is the 21% corporate rate and the related business tax reductions. Those are peaking this year with more than $200 billion of cash flow relief —paid for by Uncle Sam’s credit card, of course.

Yet, where do business CapEx orders now stand after all of that credit-card stimulus—-stimulus, we might add, which will fade considerably in the years ahead as bonus depreciation, which is tied dollar-for-dollar to CapEx spending, phases out?

Why CapEx orders are not just down 1.9% from last July’s post-tax cut sugar high; at $68.7 billion for the month of April 2019 they are actually below the $70.0 billion level registered way back in February 2012.

Folks, you do not have the greatest economy ever when core CapEx orders (excluding defense and aircraft) are still below there 7-years ago levels in nominal dollars!

What you have is a broken economy and a tepid investment cycle that oscillates with the Red Ponzi’s credit impulses, and the resulting ebb and flow of global trade and production. But on a trend basis, there has actually been no growth at all in net business investment after depreciation and inflation since the turn of the century.

The fact is, the deep bowl-shaped decline in 2015-2017 shown below had virtually nothing to do with Obama leaving the Oval Office or Trump arriving there.

With a slight lag, it was driven by the Red Suzerains of Beijing as they first attempted to cool-off the massive debt-driven speculative bubbles enveloping the Chinese economy after 2013, and then re-applied the credit juice in preparation for the coronation of Emperor Xi Jinping in October 2017—–which stimulus has once again been largely throttled back

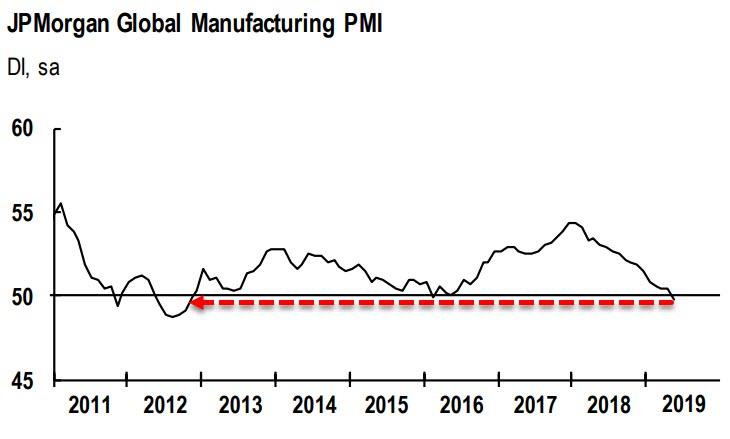

The same China-driven cycle is evident in the JPMorgan composite global manufacturing index below. After the initial post-recession surge, it peaked in 2014, swooned to virtually stall speed in early 2016, peaked right after the Red Coronation in late 2017, and has now dropped back into negative territory for the first time in seven years.

Needless to say, in his mercantilist wisdom, the Donald has launched what is increasingly an all-out economic and technology war on that which—for better or worse—has been the driver of the global economy’s stop and go expansion since the financial crisis. We are referring to the $250 trillion of worldwide debt that resulted from the borrowing spree in the Red Ponzi and among its supplies, supplicants and customers around the world—-an epic exercise in borrow and spend that never had a prayer of being sustained.

But now the die has been cast because there will be no China trade deal or evens “stick save” meeting between Xi and the Donald at the G-20 meeting in Japan a few weeks from now.

Trump’s absolute treachery via his swell new idea to tariff Mexico into compliance with his notion of border control—after they had agreed to a content-free NAFTA replacement in order to save the Donald’s face—was simply a whim too far. It has now convinced the Chinese to wait out the American election cycle rather than find themselves humiliated by another tweeted early morning whim that would amount to a double-cross courtesy of the Donald’s unique art of the deal.

That is to say, the Red Ponzi is already the most unstable house of cards ever created by statist madmen—-the Beijing rulers having been introduced to the false economy of the monetary printing press and credit-fueled boom times by the Greenspan Fed back in the 1990s.

But even a state printing press backed by monopoly control of economic resources cannot stand a sudden $140 billion (the Trump tariff at 25% on all $563 billion of Chinese exports to the US) hammer blow to the fragile supply chains anchored in China and flowing to all points in the global economy.

The Donald’s Trade War actually means that the failing economy he inherited will actually stumble soon into the greatest crisis ever.

Do we think that the casino is ready for the next–crash—phase of the central bank-created financial fantasy that now afflicts the global economy?

We do not—-and there is no better evidence for that than today’s irrational rebound in the casino on the strength of rate cut hopium and some Chinese agit prop designed not to restart the negotiations, but to position Beijing as the “reasonable” party to the earth-shaking Trade War that lies directly ahead.

Indeed, even if the Donald finds some way to temporarily kick the can like at last December’s Buenos Aires meeting, it’s all over except the shouting for MAGA.

That because the Donald never had a snowball’s chance in hell of Draining the Swamp—let alone making MAGA. So Flyover America is fast on its way to being betrayed yet again.

This should have been evident all along because from day one Trump lacked even a simulacrum of a program to rectify America’s failing economy. And Trump-O-Nomics isn’t a policy—it’s a dog’s breakfast of Trade War and Border War populism and about the worst combination of fiscal debauchery and monetary profligacy ever proposed.

The stock market boom since November 2016, therefore, wasn’t even remotely the kind of well considered endorsement of Trump-O-Nomics that you can take to the bank.

To the contrary, it was just one last rip of Wall Street’s army of gullible speculators and momentum chasing robo-machines. The latter have been rewarded by central bank liquidity injections, financial repression and price-keeping operations for so long that they could probably get bulled-up on a plan to harvest green cheese from the far side of the moon.

In fact, what we have been dealing with on both main street and Wall Street is not responses to the Donald’s policies and palaver at all, but simply residual momentum. Both the in-coming macro-data and the stock indices are essentially tracking the “last mile”, so to speak, of the trends—-business cycle expansion and rising bull market— which have been in motion for nearly a decade.

Needless to say, these post-crisis debt and bubble driven trends are anything but healthy and are clearly not sustainable. They inhabit a financial fantasyland confected during a decade of the most reckless fiscal and monetary policies ever conceived.

So the very idea of boasting about the data prints of a badly impaired 119 month-old business expansion and a speculation driven 122 month-old bull market smacks of rank amateurism and stunning political naiveté. It’s as if the Donald is joyfully carrying around a platter and inquiring about where exactly to place his head.

What we mean is that when you are at the top of what is now the longest business cycle in history, it is far past the time to be bragging about the current economy and the allegedly good data flashing in the rearview mirror; and imperative, instead, to assess the headwinds coming at the windshield and their implications for steering the vehicle.

That’s especially because the headwinds facing the current aging cycle are ferocious compared to what prevailed when the record 119 month run of the 1990s finally rolled over into recession in March 2001.

Back then, there were virtually no macroeconomic headwinds visible. The Federal budget was in surplus; the Fed had finished its tightening cycle at a 6.5% funds rate nine months earlier; Europe was busting out of the single-currency starting gates; and the Red Ponzi was just finding its export sea legs and had only $2 trillion of debt.

It goes without saying, of course, that today’s circumstances are the opposite—-with massive headwinds accumulating like never before.

The US Treasury will be borrowing $1.2 trillion this year; the Fed is still at a 2.40% funds rate and way behind the curve with no new dry powder; the European economies are again rolling over and global trade is slowing sharply; and the Red Ponzi sits precariously atop $40 trillion of debt and an economy drowning in wasteful malinvestment, hideously inflated real estate markets and inexorably slowing GDP growth.

With the cycle at 119 months of age, therefore, any of those headwinds could trigger a downturn. But in combination they make the odds of a US recession during the next 12-24 months overwhelming.

The Cyclical Clock Is Ticking Into Record Old Age

So there is nothing strategic or even tactical about the Donald’s foolish embrace of an aging stock market bubble and wizened economic cycle. It’s just a glandular lurch—the impulsive action of an incorrigible megalomaniac grasping for anything which can be portrayed as a personal “win”, including even dodgy successes (like the U-3 unemployment rate) that are sure to implode at any moment in time.

In fact, the Trump Bubble—which the Donald has embraced with all fours—will prove to be the most lunatic stock market mania of modern times. As its implosion now gathers force, even the casino revilers will soon be shaking their heads in a grand consternated chorus of “what were we thinking?”