The fatal turn in the road toward Keynesian central banking occurred during the early 1990s when Greenspan returned the Fed to strict interest rate pegging and a focus on Economy rather than Money.

The interest rate pegging part of it was understandable–even if wrong-headed and futile. As we indicated in Part 1, due to banking innovations you couldn’t measure the money supply (i.e. M1-z) accurately any more; and, anyway, what was the basis for metering out new reserves to the banking system (what the Fed actually does when it creates so-called high-powered money) after money supply management had been abandoned?

More importantly, the nerdy new Fed Chairman had an abiding crush on the economic data from the government statistical mills—-the more obscure the better. For instance, he once instructed your editor on the illuminating window on the macroeconomy that he had found buried in the price movements of pork bellies.

So whether it made any sense or not or whether the Fed had a mandate or not, Greenspan led the FOMC down the rabbit hole of plenary surveillance of all the components of the GDP and the nooks and crannies by which they were interconnected.

Moreover, this abandonment of Money in favor of Economy was easy enough to justify under its rubbery authorities (mainly the Federal Reserve Reform Act of 1977), wherein the Congress had instructed the Fed please to bring about the blessings of full-employment, stable prices and friendly interest rates.

To be sure, none of these wondrous objectives were defined in quantitative or even qualitative terms, and they actually constituted the dependent clause in the 1977 Act. That is, the Fed’s job was to “maintain long term growth of the monetary and credit aggregates” (i.e. Money) in a manner that was “commensurate” with:

- “the economy’s long-run potential to increase production”; and

- “so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates”.

To be sure, those benign conditions are the gifts of capitalism on the free market and the work of the millions of workers, businessmen, investors, savers and speculators who operate there. They can’t be willed by the central banking branch of the state, and most especially they are not deliverable via the blunt instruments of interest rate pegging and public debt monetization.

But no agency of the state every looks a gift horse in the mouth, and most especially not a delegation of power so opened-ended and immense as the right to manipulate at will the entire financial nervous system of American capitalism in the name of what amounts to economic motherhood.

That is to say, whether out of inadvertence or just plain stupidity, the 1977 Act turned what had been a typical Money-oriented 20th century central bank into a latent Monetary Politburo.

It was only a matter of time, therefore, before the denizens of the Eccles Building sussed-out how much room that had to run; and that, at length, to discover that they could direct the flows, levels and valuations of the entirety of the capital, money and credit coursing through the American economy.

And with the Maestro of numbers directing the evolution of policy, it was only a short backslide from there to the revival of the Phillips Curve, inflation targeting and the lame-brained notion that the $20 trillion US GDP resembles a kind of contained economic bathtub that is somehow sequestered from the rest of the $80 trillion global economy.

The irony, actually, is that the Economy-oriented Greenspan Fed turned the statutory sequence upside-down. After all, as quoted above, it is obvious that Congress wished the Fed to focus on its traditional job of regulating the “growth of the monetary and credit aggregates”, and that in doing so to be mindful of the economy’s potential GDP and the undefined trio of optimum employment, inflation and interest rates.

What happened, however, is that the Money part of the equation got deep-sixed by the Economy obsessed Greenspan. Accordingly, after the early 1990’s, money and its off-spring grew like wildfire—starting with the Fed’s own balance sheet, the well-spring of what used to be called the monetary aggregates.

To wit, the balance sheet of Fed grew from $200 billion at the time of Greenspan’s arrival in the Eccles Building in 1987 to $4.5 trillion at the QE peak in October 2014. That’s a 22.5X expansion, and it contrasts dramatically with the 3.8X rise in nominal GDP during the same 27 year period.

That’s right. The Fed’s balance sheet simply became unhinged after Greenspan abandoned Money in favor of Economy.

Thus, the pre-Greenspan balance sheet amounted to 4.1% of GDP and that was consistent with the ratio that had prevailed for decades. For example, in 1955 the Fed’s balance sheet was about 5% of GDP and in 1971 it was still 5.5%. Yet by 2014 it had reached 25% of GDP.

Stated differently, during the heyday of American prosperity between 1953 and 1973, the Fed’s balance sheet grew from $24 billion to $80 billion or by 3.3X. At the same time, the US nominal GDP rose from $385 billion to $1.48 trillion or by 3.8X.

Accordingly, the Fed’s balance sheet was essentially anch0red to the GDP and actually grew slightly more slowly than national income over these two decades. But prosperity was no worse for the wear.

Real GDP grew at a 3.5% annual rate between 1953 and 1973. But even more importantly, the real standard of living of US families rose dramatically.

Real median family income of $59,600 in 1973 was 73% higher than the $34,200 level in place in 1953 (2017$). In annual terms, the growth rate was a robust 2.8% per annum—-meaning that there was a reason they called it the American Dream.

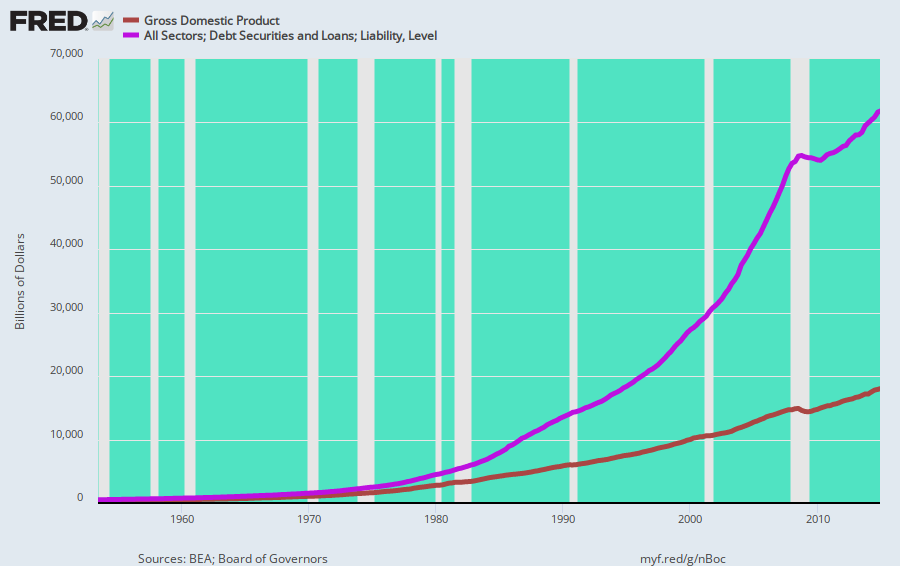

Needless to say, when the Fed’s historic focus on Money was abandoned in favor of Economy by the rail carload-counting Maestro, the economic offspring of the monetary aggregates—credit—was unleashed like never before. Between 1987 and 2014, total credit market debt outstanding—household, business, finance and government—soared from $10 trillion to $62 trillion or by 6.2X.

By contrast, GDP only grew by 3.7X during that 27-year period. As depicted in the chart below, however, that marked a true pivot point in US economic history. During the heyday of prosperity, the expansion of credit (brown line) hugged the growth of GDP (purple line); and the national leverage ratio of 1.35X debt-to-GDP in 1953 remained close to that at 1.5X by the peak of middle class prosperity in 1973.

Thereafter, of course, the gap rapidly widened. When Greenspan’s tenure began in 1987 the debt to GDP ratio was already about to 2.2X, but then it was off to the races under the new regime of Keynesian central banking. By the peak of QE in late 2014, the ratio was 3.5X–meaning that the US economy now had two full turns of extra debt relative to the pre-1973 trends.

In dollars and cents that amounted to an incremental debt burden of $35 trillion—a figure that has grown to approximately $40 trillion since then.

Stated differently, when the historic FOMC morphed into a Monetary Politburo, and when central banking became focused on Economy rather than Money, the US economy was rapidly transformed. It became water-logged with debt.

But that is not surprising. After all, once the Fed defined its job in terms of inflation, employment and driving GDP to it so called Full-Employment or “potential output” level, the explosion of credit took on a whole new assessment.

Prior to 1971, soaring credit was a warning sign that sound Money was being threatened. After 1990, it became the silent (and completely ignored) help-mate of the new Monetary Politburo in the pursuit of its Economy objectives.

At length, in fact, the Greenspan Economy-focussed policy regime morphed into an outright Keynesian GDP model, and its job became to pump “stimulus” (credit) into the US economy until the water level of demand reached the exact Full-Employment brim.

Moreover, getting the PCE-deflator reliably and persistently at the 2.00% marker soon was held to be a crucial tool in the pursuit of that objective.

The flaws in this Keynesian central banking model, of course, are virtually plenary and will be further addressed in Part 3. But consider the simple matter that the US conducts $4.3 trillion of annual bilateral trade with the rest of the world, and that within that total turnover, imports exceeded exports by the staggering sum of $950 billion during 2018.

Setting aside the modest surplus in services (tourism, transportation etc) and recognizing that last year’s merchandise trade imbalance was not a one-time aberration but the 44th consecutive year 0f ever deeper deficits, the obvious point recurs: Namely, that the purported bathtub of US GDP leaks like a sieve—meaning that if the Fed pumps in incremental demand it may well end up in the accounts of foreign suppliers rather than levitating domestic production to the magical level of Full Employment.

Indeed, since the year 2000, the leakage has turned into a flood. During that 18 year period domestic consumption of durable goods (brown line) increased by 61% whereas domestic production of durables (purple line) rose by only 32%. The difference, of course, went into the coffers of foreign producers.

To be sure, the Fed’s defenders say no matter. That’s just a partial view of the international flows and that everything comes out in the wash. That is, foreigners off-set the gargantuan US trade deficit with capital inflows into the US economy in the form of loans and investments.

Over a long enough period that amounts to going hopelessly into hock, and 44 years surely qualifies as a long time because each and every year foreign lenders extract a return on their investments.

Still, our point here is more limited. To wit, under the Keynesian central banking regime, the Fed claims to macro-manage and fine tune the bathtub of US GDP by the year, quarter and sometimes even the month.

Yet even if it could generate honest incremental demand, which it can’t, a lot of it would flow right out of the bathtub through the mechanism of America’s massive global trade.

Moreover, when it comes to the vaunted 2.00% inflation target the leakage is all the more massive—-especially since the Fed can no longer even hit is inflation targets, even as it inflates serial bubbles in the canyons of Wall Street.