Sven Henrich hit the nail on the head this AM in surveying the Sunday night’s blitz by the People’s Bank of China (PBOC) which included rate cuts on overnight reserves, a record 150 billion yuan liquidity injection and an indefinite ban on short-selling.

Exactly how does that differ, he wondered, from the $400 billion print-a-thon by the Fed since October or the infamous “whatever it takes” money printing tsunami launched awhile back by Madman Mario Draghi?

Have you noticed that in the central banking world there is no difference in action between supposed communist or supposed capitalism regimes? Constant bail outs, constant intervention, the only variable being the degree of intervention at any given time, for whatever reason.

How is the PBOC doing anything different than the US Fed? Cut rates, repo, liquidity injections, it’s all the same script. The BOJ buys ETFs, the SNB buys US FAAMNG stocks, all is centered and focused and organized to prevent any market damage.In the past 11 years we’ve morphed from occasional intervention mode to permanent interventions. We’re in 2020 and there is no one anywhere on the planet that has a single clue as to when central banks will ever raise rates again and the notion of normalization has been safely tossed into the garbage bin of history.

And it won’t stop. Uncertainty. Climate change. Slow down, virus, whatever the occasion, there’s a central bank ready to make all the trouble go away:

Central bank intervention for every occasion:

Uncertainty? Hit print

Market Selloff? Hit print

Earnings recession? Hit print

Climate change? Hit print

Virus? Hit print

Someone sneezes? Hit print

Showers in the forecast? Hit print

A butterfly flaps its wings? Hit print

There is a lot to unpack here, but it absolutely encapsulates the over-riding danger of the hour, month, year and decade. Namely, Wall Street’s absurdly inordinate confidence that central banks are the ultimate source of growth, profits and prosperity and that there is not any conceivable headwind that more money pumping cannot ameliorate and reverse.

Needless to say, the market’s daredevil response to the Wuhan coronavirus is a stunning case in point.

Today even the talking heads were expressing uncustomary caution about how big this might get and the magnitude of the potential shock to the global economy it might bring.

But never mind: They were also still buying the dip with gusto because the mushrooming coronavirus scare has sent the odds of rates cuts during 2020—which had been viewed as being on hold—surging higher. The futures market is now indicating a 98% certainty of an initial cut no later than June.

But so frickin’ what?

SUBSCRIBE TO CONTINUE READING

Already a subscriber?

Login below!Goodness gracious me. Why would anyone in their right mind think a money market rate of 1.30% a few months hence versus today’s already ridiculously low 1.55% rate would make any difference whatsoever in an $85 trillion global economy that is in danger of having its central supply chain and motor force of expansion gutted?

And we don’t mean just on account of some kind of worst case pandemic, either. Or the fact that one statistical study—apparently an outlier but from highly credentialed Chinese academics— estimates the virus has an RO (R-naught) factor of slightly over 4.0. That means that this virus— which can remain asymptomatic for up to a week–would infect four other people on average for each carrier; and thereby compound exponentially from there.

We will leave the epidemiological analysis to the scientific experts. But we are more than a little confident that China is the source of an economic virus called runaway debt and malinvestment that has fundamentally distorted and inflated the entire global economy, and left it vulnerable to an inexorable China shock that will rock the entire planet when the Red Ponzi finally unwinds.

So even if 2019-nCoV turns out to be a dud, a voracious bear still prowls the China woods red in tooth and claw. How could it be otherwise when you examine the virtually parabolic rise of its now staggering $44 trillion of debt?

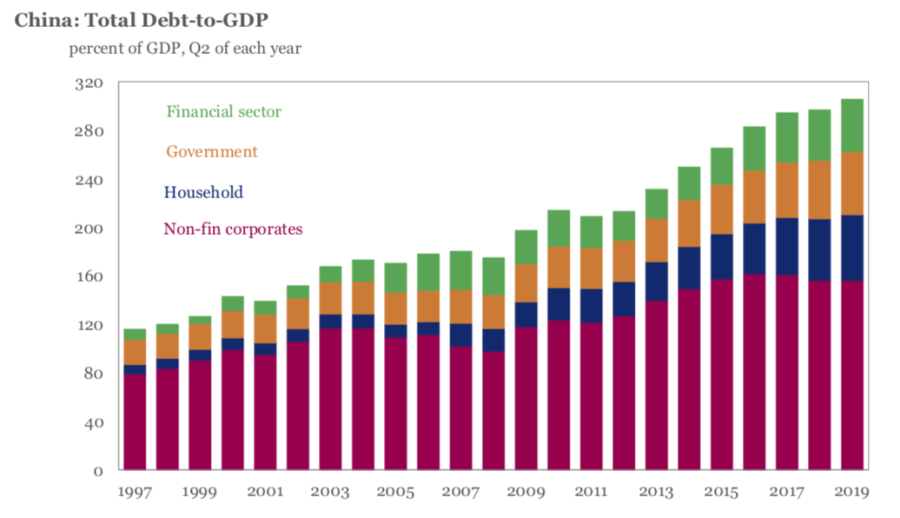

To wit, in 1997, China’s GDP stood at $950 billion and its total public and private debt at $1.15 trillion, meaning that its implied national leverage ratio was a manageable 1.20X.

By the eve of the global financial crisis in 2007, its GDP had surged to $3.5 trillion and its debt to $6.5 trillion. The implied national leverage ratio, therefore, had swollen to a much more problematic 1.80X GDP; and it had taken $5.4 trillion of incremental debt to generate an additional $2.5 trillion of GDP.

But then the entire Red Ponzi went bonkers, as the communist party rulers in Beijing subjected its economy to round after round of centrally dispatched credit stimulus in order to keep the ponzi going and the people pacified with the accoutrements of rising incomes, jobs and living standards.

Thus, by 2019 China’s national income had risen to $14.4 trillion, at least under the loosely applied conventions of Keynesian GDP accounting. But debt had simply gone off the charts at $44 trillion, and that’s just the best estimate of the visible total—with likely trillions more buried in China’s opaque and byzantine financial system.

Not only does this mean that the national debt ratio stands at 306% of GDP, but that in just 12 years of furious credit pumping, China’s debt outstanding rose by nearly $38 trillion, yet generated incremental GDP of only $11 trillion.

These numbers are their own flashing red warning signs. You couldn’t grow GDP by a factor of 4.0X and debt by 6.7X in a mere 12 years without tremendous instability and unsustainability risk—even in a legally mature system with transparent, competitive free market checks and balances .

But as the apparent 6-weeks cover-up of the spreading coronavirus in Wuhan reminds once again, the Red Ponzi is just the opposite: It is a top down system of plans, allocations, controls, quotas and enforcement orders that gives rise to a bottoms-up cantilevering of misinformation, deception, mendacity and lies.

Stated differently, China is not a marvel or miracle of economic achievement that may temporarily suffer a setback owing to a public health emergency in the form of the coronavirus or any other.

To the contrary, it is a vast economic malignancy of debt, malinvestment, speculation and lies that sooner or latter will implode, and so doing shake the very foundations of the world’s $85 trillion GDP and the multi-ten trillion dollar China-based supply chains which now criss-cross the planet.

Needless to say, up against the brobdingnagian risk posed by the Red Ponzi, the feeble remaining firepower of the Fed and other central banks is a bad joke. In fact, central bank impotence has been the case for years now, but has simply gone unnoticed and unremarked upon owing to a mainstream financial narrative which confuses financial asset inflation with economic efficacy.

That is, the Fed, ECB, BOJ and other developed world central banks have gone through repeated phases of easing, accommodation and stimulus since the financial crisis, but those money-pumping episodes did not move GDP, jobs or incomes much, if at all; they merely fueled another leg up in the stock market averages.

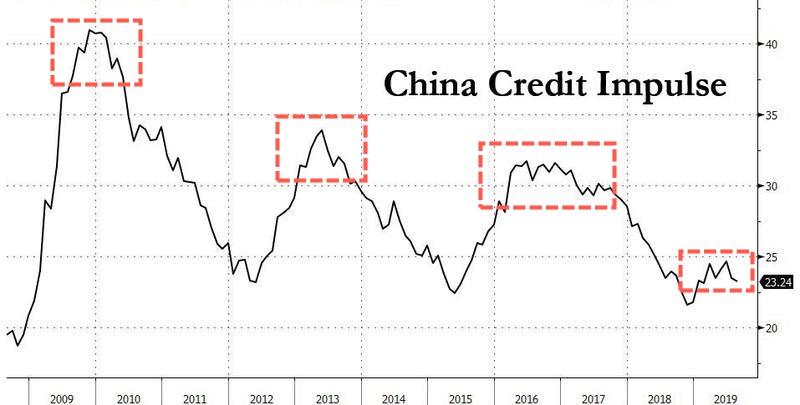

For example, here is the year-over-year growth in real GDP since the recovery took hold in mid-2010. The undulations shown in the chart have absolutely nothing to do with Fed policy, and everything to do with the ebb and flow of global trade, inventories, production and commodity prices driven by the madcap credit impulses of the Red Ponzi.

And while we are at it, we should also mention that the gesticulations emanating from the Oval Office, whether occupied by Barry or the Donald, had even less to do with it.

For example, the huge China credit surge in 2012-2013 (second dotted red box) led to the global mini-boom that peaked in 2014-2015, and was manifest in the 4.0% year-over-year real GDP growth posted in Q1 2015 per the chart above.

Contrary, to the Donald’s boasting about the upsurge early in his term, however, the pre-election low at 1.3% year-over-year in Q2 2016 wasn’t Obama benighted policies taken a short-term toll; it was the Red Ponzi taking a rest per the chart below, as depicted in the 2014-2015 waning of the credit impulse because even Beijing’s rulers are worried stiff about their insanely mounting levels of debt.

At the same time, the rebound to 3.2% year-on-year real US GDP growth peaking in Q2 2018 didn’t have much to do with Fed policy because it was allegedly either on hold or tightening during most of that period; and nothing at all to do with the Donald’s tweetstorms from the Oval Office and even the Christmas Eve tax cut of December 2017.

What explains the secondary GDP growth blip of Q2 2018 is the third dotted red box in the China Credit Impulse Chart below. After its hothouse economy almost went into free fall in 2015 and early 2016, Beijing cranked up the credit machine once again, not only to brake the fall, but, more importantly, to insure that the planned coronation of Mr. Xi as ruler for life at the 19th Party Congress in October 2017 would go off without a hitch and with nary an economic cloud on the horizon.

That was followed, of course, by another sharp cooling of China’s credit expansion and therefore its call on the global commodity complex and its worldwide industrial supply chain. And with it, of course, came the end of still another false Wall Street narrative about “synchronized global growth” and an alleged MAGA boom in the US that is deflating very rapidly as per the incoming data and the punk internals of the Q4 GDP report.

Finally, during 2019, Beijing once again turned on the credit machine in at least modest aspect (fourth dotted red box), but that’s now all by the boards. Even if the coronavirus is miraculously contained from here, China’s economy and therefore the global trade and production trends are heading sharply south during the months and quarters ahead.

That much is already evident in the trend of JPM’s composite global PMI shown in shorter-term detail below. As is plain as day, it peaked in Q4 2017 right in conjunction with Xi’s coronation in October of that year and was heading sharply southwards during 2018 and the first half of 2019.

Then came another head-fake. China modestly reignited its credit machine per the fourth box above, and the global PMI’s made a modest upturn late last year. That was ballyhooed on Wall Street as occasion for another reflation trade, but, alas, the 2019-nCoV has already cut that party short, as well.

So we’d argue, mind the dip, don’t buy it.

Here is the year-over-year trend for even the Almighty Consumer. As is evident in the first chart, it too follows the path of the China Credit Impulse, and as shown in greater relief in the second chart, is now rolling over sharply.

This is obviously not known to the Donald and thoroughly ignored by the dip-buying boys and girls of Wall Street and their adjuncts and robo-machines.

But that doesn’t gainsay its truth that there is a virus stalking the planet alright—but it’s much greater than even the 2019-nCoV.

Year-Over-Year Growth In Real Personal Consumption Spending, 2014-2019

Year-Over-Year Growth in Real Consumption Spending, Q1 2018-Q42019