Larry Kudlow cut loose with a doozy yesterday, suggesting there would never be another interest rate increase in his lifetime. Yet according to the actuarial tables, the 71-year old Kudlow should last another 14 years–unless he’s had some bad news from his heart doctor that he’s not sharing.

Hopefully, he hasn’t—so what we really have is the chief economic advisor to the President saying he’s OK with essentially zero cost money after accounting for inflation through 2033.

‘As I say, we wish they hadn’t raised, I notice from the various reports and so forth that they’ve changed their view, I don’t think rates will rise in the foreseeable future, maybe never again in my lifetime,’

Then again, money market funds have been negative in real terms since April 2008, which implies Kudlow is endorsing deep subsidies to the Wall Street gamblers for 25-year running (2008-2033).

That would guarantee, of course, a thunderous financial collapse long before 2033, but, still, the question recurs: What are these people thinking because on this matter Kudlow is not a madman shrieking in the wilderness. He’s actually got a lot of allegedly respectable company.

For instance, Goldman pronounced in somewhat more professional terms the same theme this AM, averring that there would be no more Fed rate hikes through the end of 2020.

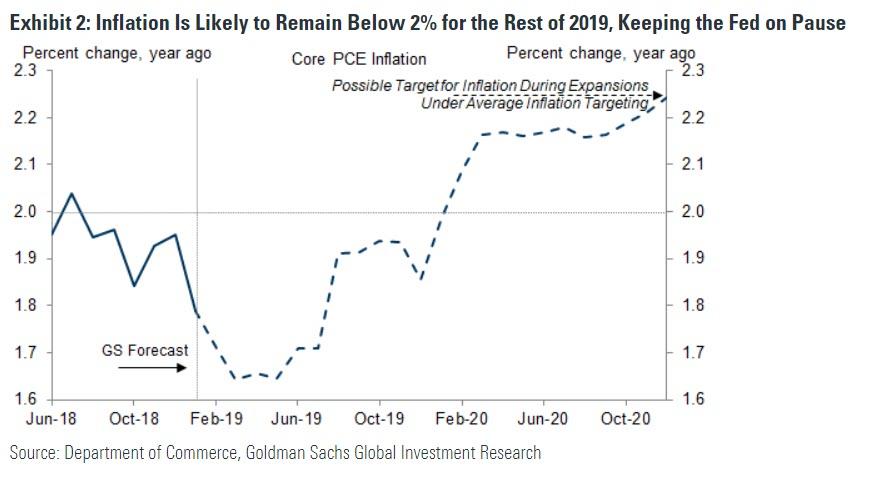

While the growth news has been encouraging, the inflation numbers have surprised to the downside. Following this morning’s PPI report, we now expect year-on-year core PCE inflation to slow to 1.64% in the March print and to end 2019 at 1.9%, vs. the 2.1% we had expected just a few weeks ago

At the same time, the goalposts for the next rate hike have shifted and could move even further back as the Fed undertakes a review of its policy framework. The FOMC’s emphasis on “muted inflation pressures” as a reason for patience suggests that above-2% inflation is now almost a necessary criterion for further tightening, making a rate hike later this year quite unlikely.

Needless to say, Goldman makes profits when Wall Street is energetically speculating on carry—so the cheaper the overnight funding costs in the money markets, the better.

Still, for marketing purposes, if nothing else, it needs to have an “analysis” based cover story for pressuring the central bank to keep subsidizing its business, and the excuse de jour is “no inflation”.

As the great Paul Volcker keeps pointing out, however, the “no inflation” story is patently false. At the Fed’s sacred 2.00% target, a dollar saved by a worker at ago 20 will be worth just 38 cents when he retires at age 68.

While it’s not our purpose in this post to assay the long-term war on savers, this computation does raise a question as to what statutory authority—to say nothing of standard of fairness— empowers the central bank to massively expropriate the wealth of savers over the decades?

The question never gets asked or answered on either end of the Acela Corridor—and for reasons that are not too hard to discern. That is, on the Washington end of the Acela they spend and borrow; on the Wall Street end they speculate and scalp; and on neither end do time horizons extend more than a few months, meaning that the longer-run destruction of savers by the “no inflation” meme is not even remotely recognized.

Unfortunately, however, there is something more than obliviousness to the time dimension of economics at work here. What’s really going on is a descent into obscurantism that is breathtaking in its complete detachment from all discernible principles of sound money, and even common sense itself.

What we are saying is that these cats think 2.00% inflation is a sacred duty of the central bank and that shortfalls to the second decimal point are meaningful and matter—greatly. This chart from the above referenced Goldman missive is thus scaled to make the actual and forecasted track of the Fed’s favorite inflation measure—the core PCE deflator—-look like it is undergoing significant change.

It is not. From the point of view of sustainable capitalist prosperity there is absolutely no difference between a 1.8% y/y change and a 2.2% y/y change. Both are too high from the point of view of equity and neutrality as between savers and borrowers, and neither comport with the traditional notion of sound money.

Between 1877 and 1914, for instance, the producer price index did not change at all—even as the American economy grew at an average of nearly 4.0% per annum. And from 1953-1965 the CPI rose by only a tad more than 1% per annum, but that did not block a robust expansion of the main street economy, which grew by an average of 3.5% during that 12-year period.

So the Fed’s worry that there is not enough inflation, the Trumpian claim that there is “no inflation” and Goldman’s precision calculations which suggest there is plenty of time and room for “patience” on the rate front is just an exercise in mis-direction—and not a very subtle one at that.

For their own reasons, all parties want the stock averages to rise and rise and rise some more, world without end.

So in order to justify a regime of grotesque financial asset inflation and interest rate repression, they all pretend–like the medieval theologians—to be counting the number of inflationary angels that can sit on the head of a pin.

If you need any evidence that this entire “no inflation” meme is bogus, just consider the last two years of the producer price index for finished goods—-shorn of the volatile components for food and energy. Note that this index is for the so-called “low-flation” items in the market basket—-goods rather than the more inflationary services components—and it’s up at a 2.3% per annum rate since March 2017.

Moreover, the rate of gain is again accelerating as indicated by the fact that during six of the last seven months the year-over-year gain has exceeded 2.5%. Given that we are in month #117 of the second oldest business cycle in history—and therefore long past the time that rates should have been normalized—-the actual inflation numbers are signaling that all time for “patience” has expired.

After all, this is not some obscure measure of inflation. It the foundation level of pricing in the wholesale market for goods which will sooner or later pass through into consumer prices; or in the best case, be absorbed by retailers in reduced profit margins, which are not exactly stock market friendly, either.

Then we have the matter of services prices. As we have frequently indicated, they are no longer immune to the competitive pressures of the global market and are especially vulnerable to the India Price for any services that can be conducted remotely over the worldwide internet.

Still, this index makes a mockery of the no inflation case. We are speaking here of the soaring cost of medical care, rents, educational services, transportation and many personal services, and an aggregated index of these items that has not risen at less than a 2.0% y/y rate since September 2011.

That’s right. During the past 90 months, the inflation rate for services has averaged 2.6% per annum, and has been above 2.8% most of the time since late 2015.

Finally, if you combine goods and services in the CPI, but trim out the 16% most volatile outliers each month to eliminate short-run fluctuations due to big swings in a few components, the result speaks for itself: The so-called 16% trimmed mean CPI has hugged as close as you please to the 2.00% line since mid-2016, and has averaged exactly 2.01%.

As we said, there is no magic to 2.00% inflation, but the alleged policy “patience” based on its absence speaks of an altogether different matter.

What we really have is the monetary policy equivalent of the fabled Maytag repairman syndrome from the famous ad campaign of the 1950s.

That is, there is utterly no need for monetary policy action by the FOMC because owing to the Bernanke panic in the fall of 2008 and the subsequent flood of new bank reserves injected into the banking system under the various phases of QE, the system is chock-a-block with excess reserves in a manner never before seen.

Accordingly, there is not a snowball’s chance in the hot place that the commercial banking system could become parched for reserves for years to come, which is the only Money based reason for the Fed’s existence in the first place; and there is every reason to believe that the millions of traders and investors in today’s money markets could find the correct market rate of interest in that environment without any help from the FOMC whatsoever.

So what the whole “no inflation” scam is about is simply a giant cover story for the Fed’s attempt to keep the massive bubbles it has fostered on Wall Street aloft by any device and excuse necessary.

But, as we will see in Part 4, that can only lead to an ever greater financial catastrophe than is already baked into the cake.