Covid-19 and Oil-30 tell you all you need to know about today’s dangerous financial regime of central bank fueled Bubble Finance.

The former is the kind of mega-disruptive act of god which always hangs over the planet and the human population, while the previous $60-$70 oil price was an act of state (Russia and Riyadh) that prevailed at the whim and convenience of two dictators, at least one of whom would not necessarily be considered a stable genius.

Background factors such as these are why free markets were invented to price-in the kind of deep risks which are always with us and to balance the powerful vectors of fear and greed which animate human economic actors. But when Keynesian central bankers take over the job of financial price discovery they tend to asphyxiate the sense of risk and supercharge the impulses of greed.

Their reason for doing so, of course, is more blind than malign. That’s because these PhDs and apparatchiks of state policy do not respect the delicate and uber-important price discovery function of free financial markets.

To the contrary, their territory is the macro-economic domain of labor markets, household spending, aggregate business investment and the rate of change in the general price level. The prices of money and financial assets are presumed to be strictly secondary, derivative and infinitely malleable—that is, macroeconomic control dials which exist first and foremost as channels of “policy transmission” for the convenience of Keynesian central bankers.

The ills, injustices and dysfunction which result from central banker appropriation of the price discovery function in financial markets are legion and egregious. For instance, the savaging of savers and the downright obscene subsidization of speculators.

But the ultimate sign of today’s style of omnipresent central bank intrusion in financial markets is that it causes speculators to price for perfection. They do so out of abundance of liquidity and cheap leverage and an institutionalized belief that central bankers will not allow markets to crater or permit the main street economy to fail.

Consider today’s case of poor Harold Hamm, the Donald’s MAGA buddy and reigning king of shale oil. He reportedly dropped a cool $2 billion of net worth on Monday when the oil price dropped over 20% in a single day after the Saudi Crown Prince took an economic bone saw to the shale patch.

But here’s the thing. The global oil industry got fair warning back in 2014-2016 when an abundance of supply showed that the real market clearing price of oil was in the $20-$30 per barrel zone. It only recovered back to the $60-70 range when Vlad Putin made a temporary deal in 2017 with the Saudi/OPEC forces to restrain production on the margin just enough to clear the market at double the price (in the short-run).

But as the good folks at Gavekal noted this morning, the $60-70 band was artificial, fragile and subject to reversion to much lower market based levels at any time the two dictators had a falling out or change in their respective long-run strategies for maximizing the present value of their hydrocarbon resources in the ground:

Whatever its reasons, Moscow has upended the monopolistic pricing regime that has supported the price of oil over the last three years, and returned the market to the competitive pricing regime that existed from 2014 to 2016. A competitive pricing regime means cheaper energy, which is positive for consumers.

In effect, the big hump to north of $70/bbl. in the middle of the chart was an aberration, not something that could be discounted as indicative of the permanent state of the world; and certainly not a reliable index of the level of free cash flow which might be generated by the ultra-high cost producers (i.e. $50 per barrel and above) of the US shale patch.

Needless to say, that is exactly what got priced-in to the market cap of Harold Hamm’s shale company, Continental Resources Inc (CLR).

If you go back to late 2008 when the Bernanke Fed was in the first phase of its massive balance sheet expansion, the market cap stood at $3.0 billion on about $1 billion of revenue or 3X sales.

But by the time that the world oil price peaked in September 2014, CLR’s market cap had exploded to $30 billion compared to revenue of $3.5 billion, meaning that its price-to-sales multiple had exploded to 8.4X.

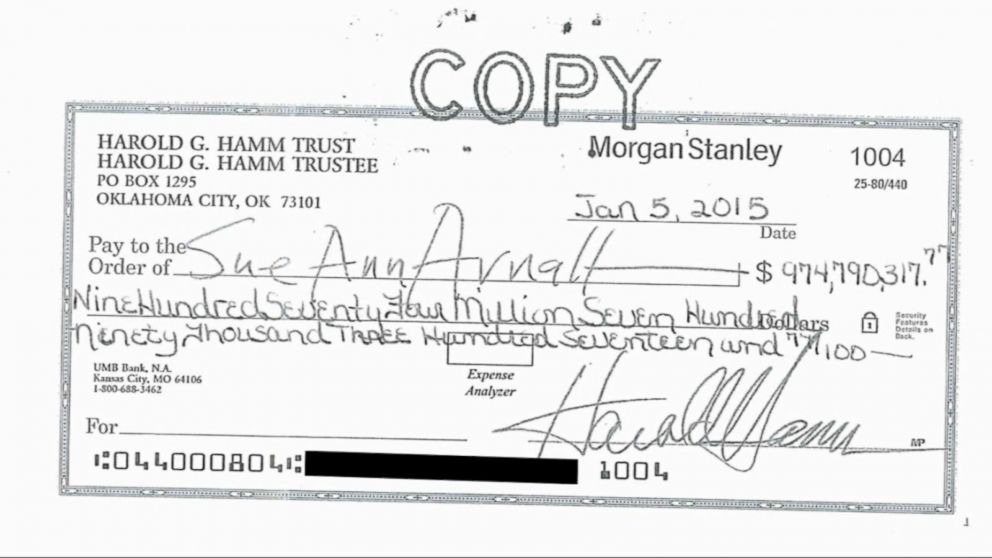

Thereupon occurred a clanging warning bell to the punters who had jumped on the 10X ride of Continental’s stock and had made Harold Ham so rich that he wrote out in long-hand a $1 billion check to his estranged wife in a divorce settlement. No sweat!

That is, if he wasn’t, they should have been. Within months, the Saudi’s concluded they were giving too many competitors around the world a free-ride by over-curtailment of their own production—-not the least of these being Harold Hamm and the other shale patch promoters, as well as every breed of non-conventional renewable energy.

So the Saudis opened up the spigots and by early 2016, what had been the cartel’s $100 oil price had morphed into a market-clearing $30 per barrel. Presently, CLR and the rest of the shale pitch were bleeding red ink profusely, causing the momo-machines and day traders to head for the hills with all deliberate haste.

On January 26, 2016, Continental’s market cap collapsed to just $7 billion, down 77% from its value just 17 months earlier.

Needless to say, nothing had really changed about the fundamentals of the world’s 100 million barrel per day oil market—except that the fragile and artificial price of still another wanna be cartel had fallen to the law of markets and the conceits of rulers who overestimate their powers to control the forces of the global economy.

But the fact that notwithstanding the 2015-2016 bloodbath in the shale stocks and credits, the punters were back in hand-over-fist within months tells you all you need to know about how busted the casino really is. By December 2016, CLR’s market cap was back up to $20 billion and it tipped $26 billion and 5.7X revenues a year later.

Alas, at today’s close, Harold Hamm’s stock market flying machine had landed back were it started 12 years ago—-at a $2.957 billion market cap.

While we doubt that Mr. Hamm is any worse for the wear, we are pretty sure that American capitalism is.

That is, Continental would have never drilled enough shale wells to produce $4.6 billion of oil revenue in the LTM just ended had not the financial markets been rife with speculation, thereby misallocating billions of capital to the uneconomic production of high cost shale oil in a $20-$30 per barrel world.

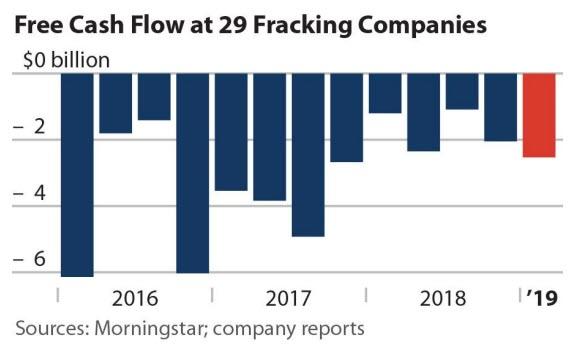

And that’s not the half of it. Continental Resources is actually one of the most efficient operators in the shale patch and has been modestly cash flow positive most of the time. But as shown in the chart below for the top 29 shale patch producers, it has always been a matter of the size of the net cash burn as world oil prices have oscillated up and down.

Even during the Saudi/Putin reprieve in 2018, the shale industry has been dependent on diagonal drilling in Wall Street, where the industry has raised in excess of $300 billion of debt and production credits over the last decade–none of which had produced a return.

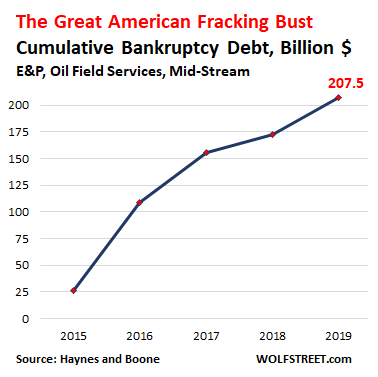

In fact, more than $207 billion of this giant capital misallocation has already been winnowed through the bankruptcy courts, and in some case more than once. Yet in a world of free financial markets and honest price discovery on Wall Street, the overwhelming bulk of this capital would have never made its way to an early death down the well-bore.

Now that the oil price is back in the $30 per barrel zone, the next round of oil patch credit carnage is only a matter of weeks away. Their only hope is a bailout from the Donald and his band of fake GOP conservatives (at least the Dems this time are unified against the outrage of a bailout) or a hall pass from the Crown Prince of bone saws.

We think the prospects of either are negligible, but that is a very big deal when comes to the rot underneath the Donald’s ballyhooed Best Economy Ever.

The only real booming part was in the energy patch, and most of that was Fake as we will amplify in Part 2.

Meanwhile, the Covid-19 is proving itself to be an economic neutron bomb of frightful potency. Nearly 99.99999% of the US population is still standing, but the economy is shutting down all around them.

Accordingly, the Donald could not be more wrong about the nature of the crisis. It is secondarily a public health problem of grave import, but its primary impact will be to expose the rot and fragility on which the entire $21 trillion US economy is based.

“This is not a financial crisis,” Mr. Trump said. “This is just a temporary moment in time that we will overcome as a nation, and as a world.”

Not that Washington won’t try with every kind of bailout known to man. In Part 2 we will address the utter insanity of today’s $1.5 trillion print-a-thon by the Fed, but that’s only the opening ploy in the madness.

The attempt at “fiscal policy” will be even more egregious because Uncle Sam is already broke.

More importantly, the reason small businesses, the travel and leisure industry and laid-off/quarantined workers, among countless others, need help is that the entire thrust of Washington policy has been to strip the economic and financial system of shock absorbers, just-in-case inventories and other reserves and rainy day funds to counter the inherent dislocations of economic life.

What we are talking about here is Moral Hazard like never before.. That was perhaps conveyed this afternoon by the Donald’s double-talking empty-suit who occupies the fifth floor of the U.S. Treasury Department.

In pitching the impending bailout package for hotel, airline, and cruise ship companies, he let loose this gem:

“This package isn’t going to include everything,” Treasury Secretary Steve Mnuchin said Wednesday. “This is round one. We’ll be back for more.”

“I want to be clear: This is not bailouts. We are not looking for bailouts,” he said.

Yes, of course, he isn’t!

Without his own bailout bounty during the last crisis, in fact, when the Fed’s handed him a $3 billion payday for baby-sitting on Uncle Sam’s dime an insolvent and utterly dispensable S&L, Mnuchin would still be bumping around Hollywood trying to get the girl.

Needless to say, the Republic would be far better off if he were and did.