During the last 24 hours Barry and the Donald have gotten into a “mine is bigger than yours” squabble with respect to US economic growth.

While neither had much to do with the subpar expansion that accompanied their respective tenures in the Oval Office, their dueling tweets on the matter tells you exactly why the American economy is in such terminal trouble.

To wit, what modest growth we have had is the product of capitalism as carried out by the tens of millions of workers, managers, entrepreneurs, investors, inventors and savers who drive its wheels forward day-in and day-out. If anything, the power-seekers and special interest bagmen who briefly domicile at 1600 Pennsylvania Avenue are a fount of policy headwinds which badly thwart capitalism’s natural tendency to grow.

Barry apparently started the tiff by claiming that he laid the groundwork for the alleged Trumpian Boom that the Dems fear in this election season:

Eleven years ago today, near the bottom of the worst recession in generations, I signed the Recovery Act, paving the way for more than a decade of economic growth and the longest streak of job creation in American history.

To be sure, we get why the above pen and parchment ploy got the Donald’s dander up. After all, the very idea that the Democrats’ $800 billion shovel-unready boondoggle had anything to do with the U.S. economic recovery is downright offensive, to say nothing of groundless.

At the same time, the Donald’s rejoinder that he single-handedly reversed the course of the Failing Obama Economy is equally ludicrous.

Did you hear the latest con job? President Obama is now trying to take credit for the Economic Boom taking place under the Trump Administration. He had the WEAKEST recovery since the Great Depression, despite Zero Fed Rate & MASSIVE quantitative easing. NOW, best jobs numbers……..ever.

If Dems won in 2016, the USA would be in big economic (Depression?)

Far be it from us to defend Obama’s tax, spend, borrow and print policies. They were destructive Keynesianism at its worst. Except that Donald has only advocated more of the same—and to the same dismal end for main street America.

Indeed, historians will surely label Trump’s incessant boasting about the Greatest Economy Ever as a starkly delusional fantasy. Promising MAGA, he actually will have delivered an economic debacle of epic proportion.

But not by his lonesome. He’s actually just the loudest braggart on either end of the Acela Corridor and has plenty of only slightly less delusional company at the Fed and on Wall Street.

The truth is, Trump inherited a debt and speculation addled malignancy that was already living on borrowed time in January 2017 when he stumbled into the Oval Office against all odds. He just doubled-down on the fiscal incontinence, monetary profligacy and statist assaults on capitalist prosperity that had been festering for decades.

That this toxic brew co-existed for more than three years with the simulacrum of a Trumpian Boom was the handiwork of Wall Street and its obeisant subalterns at the Fed. The latter conspired to wildly inflate the already bubble-ridden stock market the Donald roundly (and accurately) denounced during the campaign, thereby conflating speculative madness on Wall Street with an alleged rejuvenation of the main street economy that never happened.

We will address the pre-existing rot on another occassion, but first we needs clear the decks of the GOP’s increasingly noisy and mendacious claims to having effected a sharp turn-around since January 2017.

Absolutely nothing of the kind has happened. That’s as in nichts, nada, nugatory and no way. The American economy is still drifting toward the shoals—only even faster.

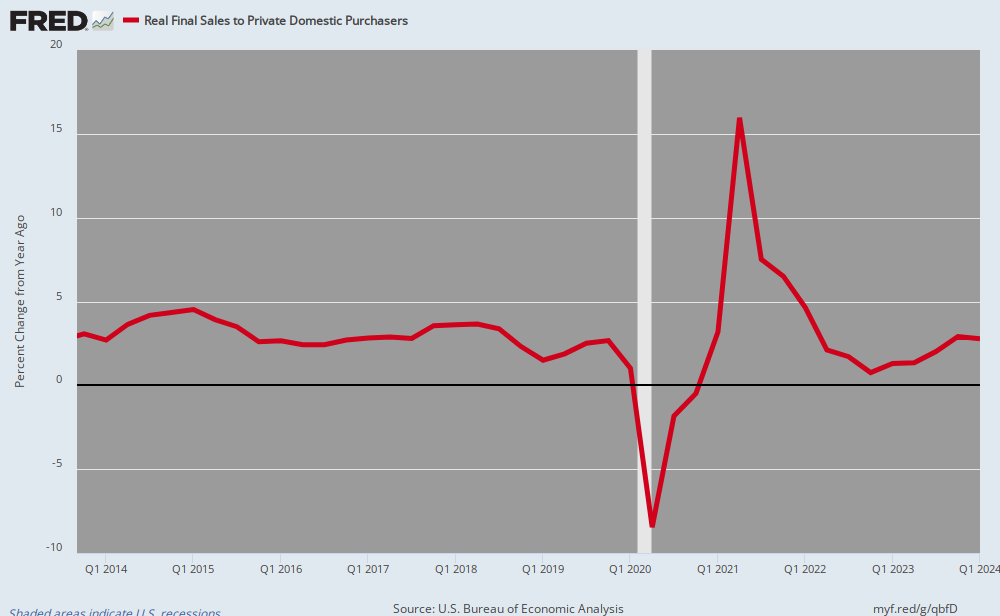

On that score, the bedrock metric for short-term change in the economic aggregates is real final sales to private domestic purchasers. That’s essentially GDP but it eliminates extremely volatile inventory swings from quarter-to-quarter (which tend to wash out over any reasonable time span) as well as government spending, where Republicans, presumably, have not yet overtly become Keynesian pump-primers.

As we amplify further below, the only valid way to assess the incoming economic data is in the context of the business cycle, not by the election calendar or the occupant of the Oval Office.

It so happens that the post-June 2009 recovery cycle matriculated to middle age (months #54-90) during the final three years of Obama’s watch (2014-2016), and then flowed into its relative golden years (months #90 to #126) during the Donald’s first three years (2017-2019).

But as is evident in the chart below, there has been no Trumpian boom or even minor economic acceleration.

In fact, the growth rate of the US economy has actually slowed materially on the Donald’s watch. Real final sales to private domestic purchasers grew by 3.24% per annum during Obama’s last three years and weakened to just 2.78% per annum during 2017-2019.

Moreover, during the 12 months ending in December 2019, the growth rate slowed further to just 2.15%, representing the weakest year-over-year growth rate since mid-2013.

When it comes to long term prosperity, there is no more salient measure than shown in the graph below; and what it shows is that the Trumpite/GOP tax cut induced sugar high of 2018 was modest and short-lived, and is now heading for a dismal zone that is the very opposite of MAGA.

All things being equal, of course, you would expect the economic expansion to slow during its late cycle phase, but that’s what makes the Donald’s incessant boasting all the more misplaced. Rather than taking credit for the deeds of main street capitalism, he should be getting Uncle Sam’s fiscal house in order while the cyclical sun is still shinning and encouraging the Fed to normalize interest rates and its balance sheet with all deliberate speed.

He has done the opposite, of course, thereby leaving the main street economy vulnerable to a steadily weakening spell of cyclical old age—even as the headwinds of rising debt and speculative excess weigh ever more heavily on capitalism’s struggle to advance.

However, the Donald’s penchant for capital letters did, inadvertently, underscore the true condition of the US economy. When he highlighted “the WEAKEST recovery since the Great Depression” he was accurately depicting a business cycle that since the Q4 2007 peak has been freighted down by the double whammy of the money printers in the Eccles Building and the bipartisan borrow and spend crowd on both ends of Pennsylvania Avenue.

Here is the same graph as above, but stretching back to the June 1981 cyclical peak prior to the so-called Reagan recovery. What it shows is that neither Barry, the Donald nor the bipartisan windbags on Capitol Hill should be boasting in any way, shape or form about economic growth on their respective watches.

Again, we insist on measuring growth as real final sales to private domestic purchasers, thereby omitting the government sector, which does not create wealth but only accounting statement GDP. And we also measure it on a cycle peak-to-peak basis to capture the fact that by all traditional notions, the deeper the recession, the stronger the recovery’s spring-back ought to be—all other things equal.

On that basis, the data leave no doubt that Barry and the Donald occupied the Oval Office during the absolute WEAKEST recovery of modern times:

- Between Q2 1981 and Q2 1990, real final sales to private domestic purchasers rose by 3.68% per annum;

- Between Q2 1990 and Q4 2000, they rose by 4.40% per annum;

- Between Q4 2000 and the pre-crisis peak in Q4 2007, real private sales increased by 2.63% per annum;

- During the 12 years between Q4 2007 and Q4 2019, they rose by just 1.92% per annum.

Needless to say, the latter figure bespeaks the WEAKEST economy ever—a baleful condition that hasn’t changed owing to the Boaster-in-Chief’s tenure in the Oval Office.

Of course, the Donald likes to talk about the BLS jobs data and unemployment rates, but even there he has nothing to write home about when you look at the cyclical context.

As we have often demonstrated, the U-3 unemployment rates are not worth the paper they are printed on because more than 100 million unemployed adult American are not included in the labor force, thereby flattering the ratio owing to a short-changed denominator.

The fact is, the BLS green eyeshades have no more insight on who should be in the labor force and who should be exempted from hauling their own weight in the great economic scheme of things than the man in the moon.

So if you need an employment rate, the only thing that is even remotely valid over time is the ratio of job holders—even 10 hours per week—to the total adult population. But as the chart below shows, those ratios have been falling decidedly since the turn of the century, and even the long Obama/Trump recovery— if you want to call it that—has not restored the status quo ante.

To wit, the total employment to adult population ratio (red line) stood at just 61.2% in January 2020 compared to 64.7% on January 2000. Likewise, even the ratio for the prime working age population (age 25-54 years) in the latest month (purple line) was also well below its turn of the century level.

As it happens, during the Donald’s first 37 monthly employment reports, the new jobs count has averaged 193,000, but that’s well shy of the 226,000 average during Obama’s last 37 monthly reports.

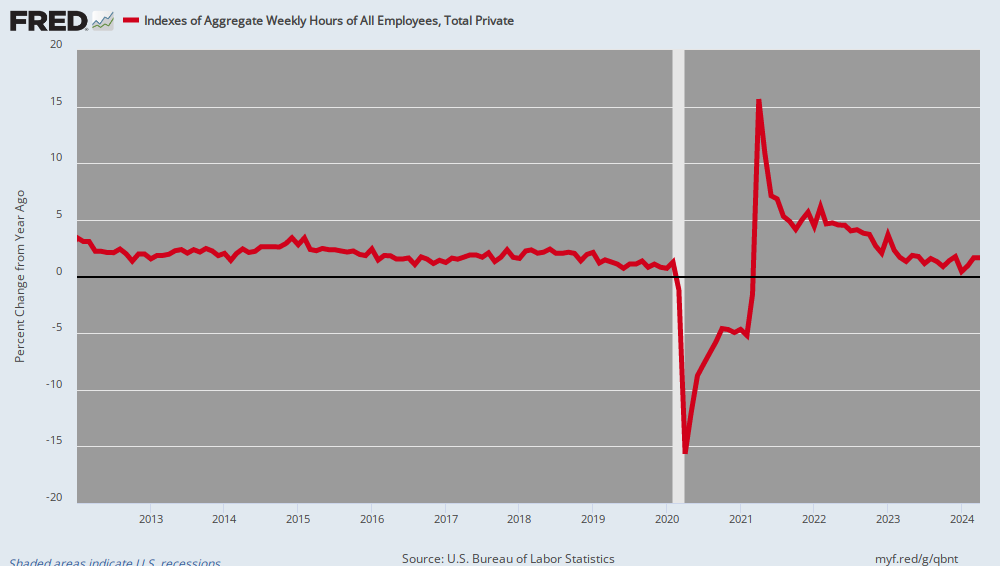

In fact, what counts into today’s gig-based and scheduled-by-the-hour labor economy when it comes to the fundamentals of income, spending and prosperity is hours worked, not headcounts. And on that basis, the same story of a steadily weakening, aging cycle also holds true.

During Obama’s final 37 reports, the index of private hours worked rose by 1.91% per annum. On the Donald’s watch, the average has fallen to 1.65% and during recent months it has been below 1.00%.

No matter how you slice it, therefore, the chart below does not evince a Trumpian Boom; it actually suggests that the end days of the MAGA fantasy lie dead ahead.

This debunking of the Donald’s latest boasts and his tiff with Obama is actually a cogent reminder that prosperity is a gift of capitalism, not the handiwork of vainglorious politicians.

So we must say it once again: The main street economy operates on the Fed-driven business cycle, not the presidential election calendar.

By a quirk of fate, the Donald was sworn-in during month #90 of the current expansion–a longevity point attained only twice before when Richard Nixon was elected in month #94 and George Bush the Younger in month #117.

The reason this is fundamentally important is that very late in the cycle, levels of economic activity (such as the unemployment rate or total jobs) always look impressive because they are cumulative, whereas rates of change are far more problematic because octogenarian business expansions tend to peter out in their waning days.

Needless to say, early in the cycle the political hacks on the Washington-end of the Acela Corridor and the stock peddlers on the Wall Street-end gravitate to the high rates of change that come with the rebound from recession, such as is reflected in the number of jobs gained or the annualized growth rate of GDP.

By contrast, near the end of the cycle they switch to level based indicators, such as the total number of Americans employed, the average weekly wage or real median family income. All of these latter measures, of course, capture the accumulation of all historic gains; they stand on the shoulders of all that came before.

So, yes, with 158.7 million employed in January 2020, there were more Americans working than ever before in history.

But so what!

The same thing could be said by every president of modern times. Thus, there were 61.6 million employed when Eisenhower was sworn in during January 1953, but by the end of his years in office and those of his successors, the level was higher each and every time:

- Eisenhower, January 1961……………65.8 million;

- Kennedy-Johnson, January 1969….76.8 million;

- Nixon-Ford, January 1977…………….89.9 million;

- Carter, January 1981…………………….100.0 million;

- Reagan, January 1989…………………..116.7 million;

- Bush the Elder, January 1993………..119.3 million;

- Clinton, January 2001…………………..137.8 million;

- Bush the Younger, January 2009……142.2 million;

- Obama, January 2017……………………152.2 million;

- Trump, January 2020……………………158.7 million

Total Number Of American Employed, 1953-2019

The same thing is true of most other level type indicators, most notably that for median real family income—albeit the rate of rise has slowed sharply. As shown in the chart, between 1953 and 2000, real median family income more than doubled from $35,000 to $74,000. That amounted to a 1.61% rate per annum over that 47 year period, and posted higher during every presidential tenure.

During the last 18 years, the rate of improvement has slowed to just 0.33% per annum, but the $78,646 posted in 2018 on the Donald’s watch is still yet another all-time high.

That is, a further ratchet higher of the real income level because capitalism keeps growing no matter who is in the Oval Office and no matter what kind of obstacles and impediments Washington throws in its path.

Real Median Family Income, 1953-2018

So the issue at hand with respect to the Donald’s MAGA boasts is whether his policies have accelerated the rate of change, not the economic levels he inherited with his late cycle arrival at the Oval Office; and whether they have diminished or added to the Washington policy rot that inherently threatens each business cycle expansion as it ages.

On that score, the Donald gets a D-, and that’s being charitable.

Metaphorically speaking, he is just riding the wizened mule which is the American economy until it finally drops from the accumulating infirmities of cyclical old age—even as he is injecting it with so much fiscal, monetary and Trade War rot that it is destined to dwell in recessionary purgatory for years to come.

In a word, the upcoming Trump Recession will be the longest in post-war history.

The truth is, the Donald is leaving America in the throes of a fiscal nightmare; has forced the cowards on the Federal Reserve to capitulate before they had barely begun to normalize interest rates and their balance sheet, thereby leaving the Fed bereft of dry powder; and has started a Trade War with China which will fester indefinitely and pull the lynch-pin of global growth—the Red Ponzi’s successive, massive credit impulses—out from under the global GDP.

And that doesn’t even considered the unguided economic ballistic missile now known as Covid-19.