Quest Post By Wolf Richter

Stocks are down ferociously at midday today (Friday Jan. 21), with the S&P 500 Index down 3.8%, the Dow Industrial Average down 2.7% and the Nasdaq Composite down 4.5%. This follows a large-scale and widespread and relentless selloff that for the Dow and the S&P 500 started on the second trading day in January; and for the Nasdaq in November. By this morning, the Nasdaq was down nearly 20% from its intraday high in November.

By Friday at the close, the S&P 500 Index had dropped through the 200-day moving average, and combined with a huge mega-boom of the type stocks had experienced after March 2020, is not a common occurrence, and in the past has been followed by serious selloffs and crashes. By this morning, after the steep losses, the S&P 500 Index was down 12% from its high. This all came in the span of three weeks, with each week having been a loser.

The Nasdaq and the Russell 2000 fell into the negative for the 12-month period, having surrendered all of their gains plus some that they’d obtained over the prior 11 months (gray line). The Dow is still up 10.7% (brown) and the S&P 500 is up 12.8% (purple) for the 12-month period, having surrendered in three weeks about half of their huge gains of the prior 11 months (index data via YCharts):

These kinds of sudden widespread losses day after day, week after week, are screaming for a bounce.

Any bounce would do. Whether this would be what traders call a “dead-cat bounce” that then leads to more losses, or the beginning of something new, well, we’ll see. But there needs to be a bounce (on Monday). There always is.

Traders are always eager to pick the bottom of the drop if for nothing else but a brief and violent ride up because the craziest rallies occur during the pauses in broad sustained sell-offs, and so they dive in, and they’re buying what others are selling. And for days and weeks, these dip buyers got carried out on stretchers. But some day, there must be a bounce.

This selloff has been particularly brutal for holders of many most-hyped meme stocks, SPACs, and IPO stocks that have collapsed by 60%, 70%, 80% and some by 90% from their highs. And dip buyers were relentlessly beaten up.

And there better be a bounce soon or else I will have to revise the WOLF STREET dictum, immortalized on our beer mugs: “Nothing Goes to Heck in a Straight Line”:

Some of the biggest stocks are down massively. Midday Microsoft was down over 5%, and by nearly 20% from its high in November. Netflix was down over 8% midday, and down 48% from its high in October. These kinds of sustained drops are screaming at least for a dead-cat bounce of sizeable nature.

Here are the 10 biggest losers at midday in the S&P 500 Index and their declines from their 52-week highs:

| S&P 500 Biggest Losers Today | Price | Today % | From 52-Wk High % | |

| 1 | Moderna | $144.36 | -9.8% | -71.0% |

| 2 | Netflix | $365.57 | -8.0% | -47.8% |

| 3 | Signature Bank | $302.14 | -7.4% | -19.2% |

| 4 | Xilinx | $173.99 | -7.4% | -27.2% |

| 5 | DISH Network | $29.57 | -6.9% | -37.1% |

| 6 | Lincoln National Corp. | $63.36 | -6.6% | -18.3% |

| 7 | NVIDIA | $218.76 | -6.4% | -36.8% |

| 8 | Expedia Group | $163.32 | -6.4% | -14.9% |

| 9 | Freeport-McMoRan | $38.46 | -6.2% | -16.4% |

| 10 | Enphase Energy | $118.25 | -6.2% | -58.1% |

No matter what happens to the market over the next few weeks or months or years, one thing we know for sure for sure, Nothing Goes to Heck in a Straight Line, so to speak. That’s my story and I’m sticking to it. And we’re due for a bounce that could make your ears ring.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Monday Dead Cat Bounce Update From Zero Hedge:

This was the biggest intraday rebound for Small Caps since 6/15/20. The S&P was unable to get back to its 200DMA however…

Behold The Dow’s 1400 point rebound…

But do not forget, The Fed has “never tried to manipulate the stock market…”

The S&P and Dow were rescued from official ‘correction’ today while Small Caps rebound lifted them out of a bear market…

Source: Bloomberg

But things are a little different this time. As Goldman’s Chris Hussey notes, stock markets have not had to deal with a Fed raising rates out of inflation concerns for almost 30 years.

As a result, the confidence that markets built up that they could act as a bully pulpit to the Fed and sell off to change Fed policy may be eroding in the current environment.

While in the past, tighter financial conditions caused by a market sell-off may have been enough for the Fed to curb its hiking cycle, such an environment may not have the same effect when the Fed is looking to curb inflation, not runaway growth.

But for now, just as we wrote earlier, the stock market’s accelerating slide has prompted traders to adjust (dovishly) their rate-hike trajectory expectations…

Source: Bloomberg

And compared to Dec 2018’s drop in financial conditions – which prompted Powell’s rapid reversal – markets this time have a lot further to go…

Source: Bloomberg

VIX surged to its highest since Oct 2020 (before reversing rapidly – but still holding above 30 and around the same levels that it reached before Powell pivoted in 2018)…

Source: Bloomberg

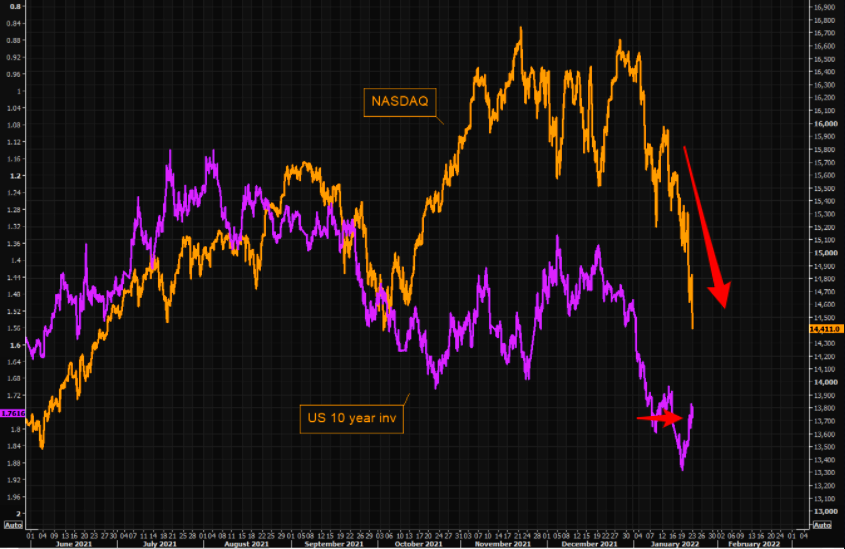

This is the biggest inversion since the COVID crisis crash in March/April 2020…

Source: Bloomberg

Before we shift away from stock-land, these charts are worth some mockery…

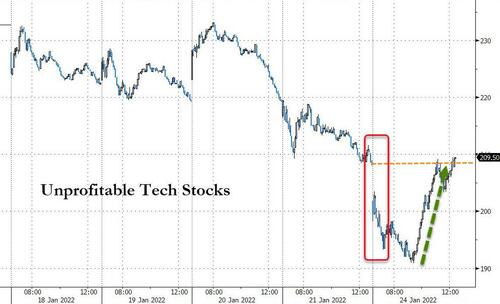

Unprofitable tech was panic-bid back into the green today…

Source: Bloomberg

As was Cathie Wood’s ARKK…

Source: Bloomberg

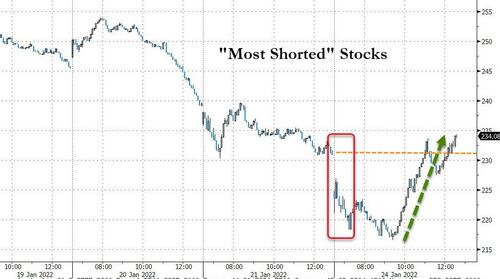

“Most Shorted” stocks ramped over 8% off the intraday lows to get back into the green…

Source: Bloomberg

Treasuries were strongly bid overnight, led by the belly of the curve, but around 1330ET bond-sellers rushed in, pushing the long-end yield higher on the day (short-end outperformed)…

Source: Bloomberg

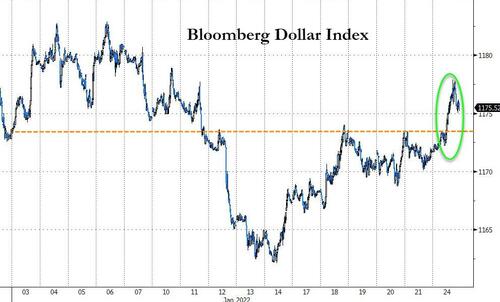

The dollar extended its rebound today, closing back in the green for 2022…

Source: Bloomberg

Bitcoin followed a similar pattern, dumped overnight to a $32lk handle at its lows then as rate-hike odds dropped, crypto ripped higher, back above $36,500…

Source: Bloomberg

Oil prices ended the day lower, but like everything else bounced hard (off $82.00)…

Which means higher prices for gas at the pump are imminent…

Source: Bloomberg

Gold followed the same pattern of early liquidation followed by panic-biddery…

Finally, we note that while today was the official start of the “buy back bid” as corporates exit the black out window, buyback-related stocks did not seem to be the drivers of the rebound…

Source: Bloomberg

Did Mr.Powell get back to work?

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

OK NASDAQ, we get the point