There is only one word for this morning’s financial charts: REALLY?!

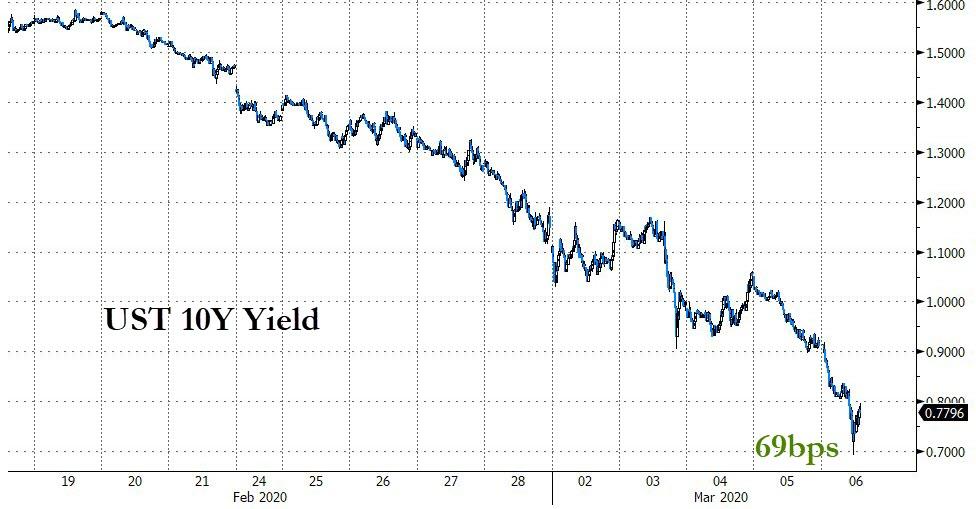

The benchmark security (10-year UST) of the entire global financial system, especially including the $90 trillion bond market, is rapidly making its way to ZERO. Yet the very prospect of it should send grand palpitations through every beating heart on Wall Street—and the silicon-based ones, too.

At the green bolded 69 bps on the bottom of the chart, the message is presumably that the safest security on the planet will now pleasure its holder with a -1.55% annual return after inflation (core CPI at 2.26% Y/Y).

The term “madness” is hardly adequate to the situation. Perhaps not even the “Mother of All Bond Bubbles” would suffice.

But whatever it is, the chart below tells you that the worst crack-up boom in history is now literally frothing at the mouth in the bond pits. When it finally finds its pin, Covid-19 or otherwise, the ensuing implosion will rattle the foundations of the financial system like never before.

That’s because UST bonds are supposed to be the “safe” portion of portfolios, where yields are modest but price risk is virtually non-existent. But today the securities in trillions of bonds funds, pension funds, insurance assets and the bank trust accounts of gray-haired ladies have been levitated to not merely the nosebleed section of history, but, literally, to financial terra incognita—a place noted as “dragons be here” on the world maps of the early explorers.

Moreover, the absurd pricing embedded in the chart below is not a consequence of anything rational, stable or sustainable—such a the bond bulls’ specious claim that the bond market is merely discounting low future growth and the next recession.

Not at all!

This is a speculative mania, and like all manias it will finally stop when the last mullet is relieved of its money. Then, it will go vertically southward with malice aforethought.

Moreover, in the case of the present bond bubble, the vector of violence will be far worse than stock market crashes because there is no prospect of future upside in bonds that are crashing from an absurd premium back towards par—-which is all they will ever pay at maturity, anyway.

The chart below helps to explain the coming mayhem in the bond market. It is the total return index for US Treasury bond futures, which essentially captures price change plus yield on a basket of longer-term treasury bonds.

For want of doubt, in a world of honest money and no inflation, the index would go up 2-3% per year, reflecting the value of the coupon and zero change in the par value of the bond.

Actually, during the 12 months ending today, the total return index has gone up a hideous 28%!

The virtually vertical ascent since early 2019 tracks almost precisely Pusillanimous Powell’s pathetic pivot toward “ease”, which so far has resulted in 125 basis points of Fed funds reduction and $400 billion of balance sheet expansion, and at a time very, very late in the cycle when the opposite should have been happening.

To wit, interest rates should have been normalizing back toward something with a spread above the running inflation level, and the Fed’s elephantine balance sheet should have remained in a full shrinkage or QT mode.

By contrast, between March 6, 2012 and March 6, 2019, the total return index went up at just 2.81% per annum. So you better believe that when annual bond returns accelerate by 10X as they have since last March, you have a runaway financial hot rod heading straight toward the proverbial cliff.

^SPUSTBFTR data by YCharts

In short, since the Christmas Eve crash of December 2018, the geniuses in the Eccles Building have ignited the most frenzied bond market mania in recorded history, which is now fixing to burst on top of the equally manic stock market bubble that inflated by 43% during the last 14-months.

To wit, at the Christmas Eve bottom in December 2018, the S&P 500 posted at 2,380 and topped the scales just 10 trading days ago at 3,394. Back then, the casino was beginning to recognize that the longest business expansion in history was running out of steam—-and that there was nothing left powering the US economy except consumers buried under $16 trillion of debt and a tepid wage gains which were barely keeping up with inflation.

So there was no earthly reason for the subsequent massive stock and bond rallies other than the inflammatory actions of the Mad Men (and Women) in the Eccles Building, whose hammers have been pounding every nail in the money market hard upon the zero bound.

These veritable fools, however, don’t get the excruciatingly fundamental truth that they do not own the money market and the yield curve.

The latter were put there by the financial gods in order to provide a return to savers, calibrated by duration of the holding period and the amount of embedded credit risk; interest rates were not invented so that an all powerful monetary politburo of 12 apparatchiks sitting around a big table in the Eccles Building would have a handy-dandy control dial to micro-manage the GDP.

Accordingly, the Fed is playing with fire, and is literally clueless about the mischief, mayhem and greed-riven speculations that its constant repression of interest rates and falsification of financial assets prices unleashes into the financial system.

One example of the speculative booby-traps which have been fostered by the Fed is the so-called negative convexity matter. As the 10-year bond yield has ripped through the 1.00% level like a knife through hot butter in the last 24 hours, the WSJ was quick to trot out a story averring it wasn’t just irrational fear at work, but also the technical need of big banks and other money dealers to hedge their balance sheets:

A major driver of the roaring 2020 bond-market rally is the insatiable demand of major U.S. banks whose hedging needs have risen with each fresh decline in rates.

Thanks to this year’s bond rally, banks need to buy around $1.2 trillion of 10-year Treasury bonds to offset risks on mortgages and bank deposits, according to J.P. Morgan research estimates.

This practice, known in industry parlance as convexity hedging, has been a significant factor in the bond market for years but has become even more acute in the postcrisis era as a result of tighter rules adopted after the 2008 crisis.

Well, there is nothing mysterious about “convexity hedging” and the new rules to restrain the most egregious forms of financial speculation by Federally insured banks don’t amount to a hill of beans in explaining what is actually happening.

Here is the truth of the matter. There are now $10.5 trillion of home mortgages outstanding, and virtually all of them have been and remain subject to refi as the Fed has driven interest rates relentlessly lower. In a world of sound money, of course, there would be virtually no net refi over time because interest rates would oscillate both down and up to clear markets and balance supply (savings) and demand (mortgage borrowings).

But under a regime of unending financial repression and Fed controlled interest rates, home mortgage refinance has become a giant business accounting for well over half of the current $1.4 trillion per year of mortgage originations, and that’s where the skunk in the woodpile comes in.

As a result of massive financialization of the US economy, the so-called “mortgage servicing rights” (MSR) embedded in home mortgages—that is, the annual flow of fees for collecting interest payments, managing delinquencies and collecting defaults—have been stripped out of the underlying mortgages and sold as an “asset” to banks and non-bank financial institutions alike.

In recent years, the value of servicing rights has been trading at about 1% of the principle mortgage value, meaning that the MSR for a $1 billion pool of mortgages would be valued at about $10 million.

In ordinary times that penciled out as a exceedingly profitable investment because on a standard $200,000 mortgage the annual MSR fees would be about $500 compared to costs of about $60, generating a very healthy profit to the MSR investor who did a decent job of assessing the credit risk in the underlying mortgage pool (collection and loss costs soar when they’re above normal default rates).

But when mortgage rates fall sharply, refi rates tend to accelerate and that causes losses on the capitalized value of the MSR. That is, the acceleration of mortgage pre-payments cause the projected $440 per year profit in the example above to disappear before the scheduled maturity of the mortgage, meaning MSR investors have to book a loss.

In today’s hyper-financialized world, of course, there is always a financial engineering solution for any problem—even if it merely kicks the can down the road. In the present instance, it involves hedging the risk of loss on the MSR asset owing to early refis by buying US treasuries with similar duration.

What that means is that in a period of sharply falling interest rates as the value of MSR assets fall, the value of the UST rises. Presto, the bond gains washout the MSR losses and the bank lives on for another day. Well, at least until these “hedges” explode at such time as the Mother of All Bond Bubbles finally bursts.

In the interim, however, the whole contraption functions mainly to tighten the coil of speculation in the mortgage and treasury markets. To wit, as the Fed presses overnight money market rates toward zero and promises more “not QE” just around the bend, the fast money speculators get busy buying what the Fed is and will be buying on 95% repo at virtually no carry cost on their overnight funding.

This drives bond prices higher and yields lower, of course, which, in turn, causes the linked yields on mortgages to fall and refi/repayments to accelerate. So banks then have to buy more USTs to hedge their MSRs, thereby driving Treasury bonds still higher and eliciting still another round of mortgage refis and still more treasury bond hedging.

You could call it a doomsday machine and be done with it. As the chart of the 30-year mortgage rates shows, this long-downward slope of refi action has been going on for decades, but, alas, at today’s 30-year rate of less than 3.4% there is not much runway left on the charts.

But in the interim, the big banks and other MSR speculators keep driving the coiled spring tighter and tighter, and we are not here talking about trivial sums.

The top eight MSR investors now hold the servicing rights on about $5.0 trillion of underlying home mortgages. And first and second in line are Wells Fargo with $1.48 trillion of that total and JPMorgan with $790 billion.

Accordingly, the big boys have been buying UST convexity hedges hand-over-fist in recent days, driven the world’s benchmark security into a veritable black-hole of irrationality.

Nor is it just the big banks who play in the devil’s workshop of speculation fostered by the Fed’s manic hammering of interest rates to the zero bound. The operators of the world’s largest hedge funds are in neck deep too,, and undoubtedly believe they have died and gone to heaven as the fools in the Eccles Building keep hammering away at what remains of interest rates.

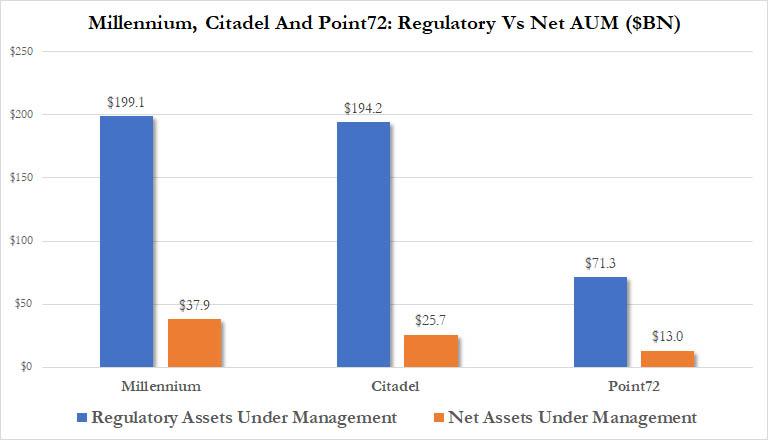

As of a recent filling, for example, the three of the giant hedge funds shown below had asset footings of $464 billion on a combined basis, but that was against just $77 billion of combined investor capital. Thus, Citadel was geared 7.5X and Millennium at 5.2X.

Needless to say, much of this massive leverage was funded in the repo markets and other short-term money market venues and was used to financed arcane arbitrage trades, which can be immensely profitable, until they aren’t—when the tend to get unwound rapidly and violently.

For instance, one increasingly popular hedge fund strategy involves buying US Treasuries while selling equivalent derivatives contracts, such as interest rate futures, and pocketing the arb, or difference in price between the two, and at the same time funding the long position in US Treasuries with cheap overnight repo, thank you, Federal Reserve!

So as the mania moves toward a climax, hedge fund bond buying to execute arb strategies drives UST prices ever higher. In an even quasi-honest market, of course, that would also mean more demand for repo funding and higher market clearing interest rates, thereby at least somewhat tempering the speculative greed.

Alas, not in the present Fed marinated and metastasized gambling arenas!

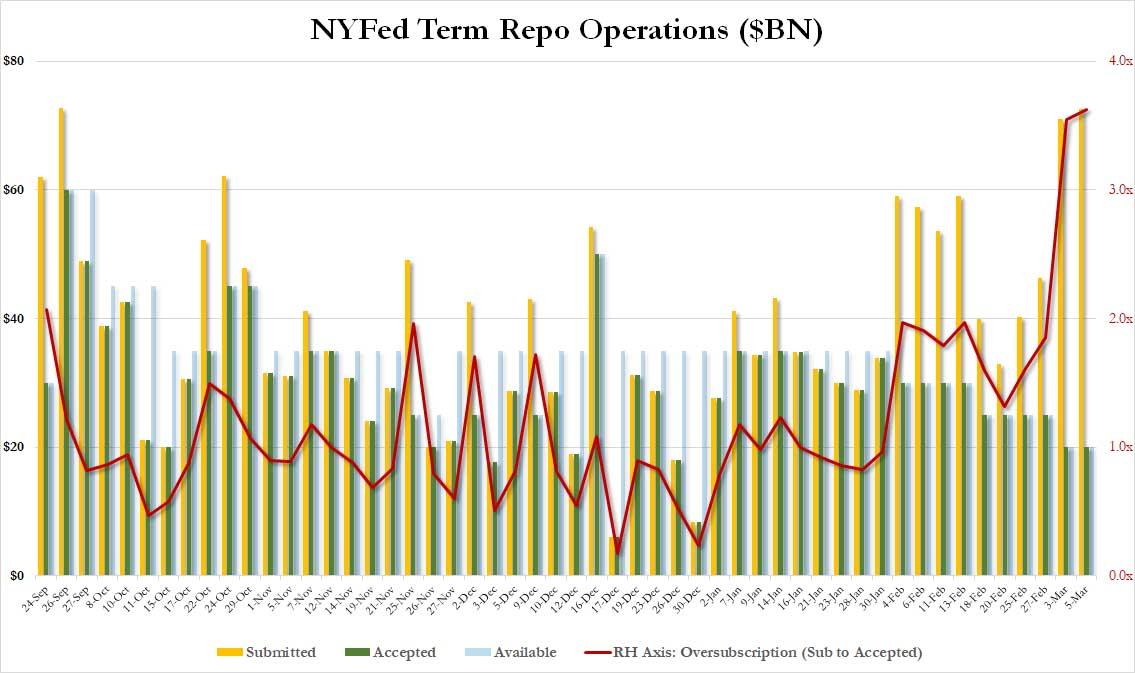

The fools in the Eccles Building have been shoveling liquidity into the bond markets hand over fist since late September trying to keep the repo and other short-term rates pinned to their exact command for the Fed funds rate or policy rate, currently at 1.05%; and after Tuesday’s capitulation, and according to the futures market betting sheets, heading for another 75 basis cuts by Easter to, well, 30 basis points.

On a clear day in the canyons of Wall Street, therefore, you can literally hear the shrieks of delight as the hedge fund speculators put on more bubble fueling arb trades, funded by cheap repo borrowings being underwritten by the knuckleheads in the Eccles Building.

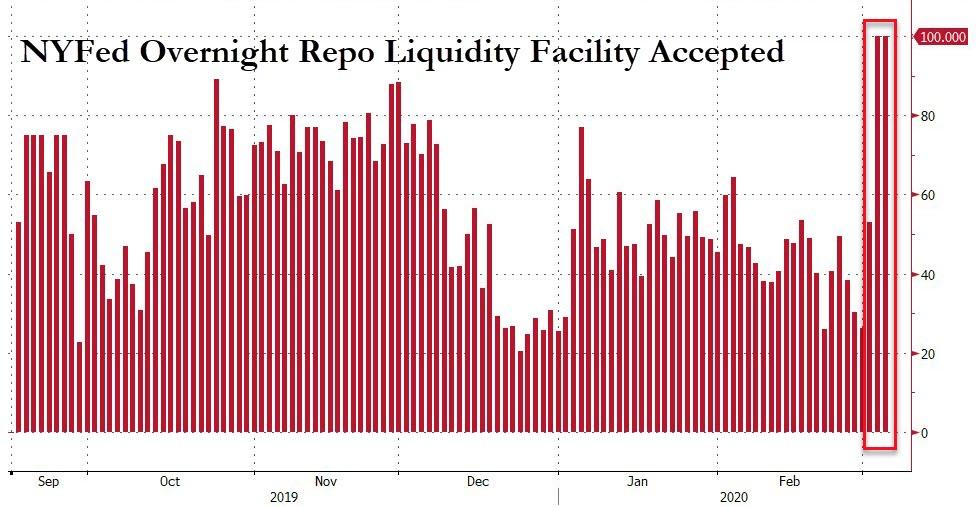

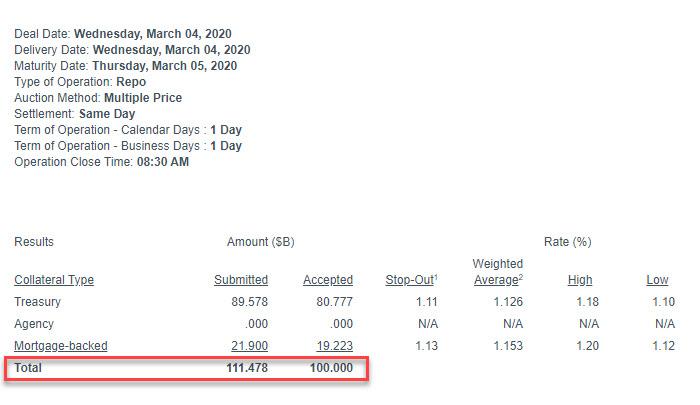

For want of doubt, here is the data for two of this week’s repo facility offers by the Fed. On Wednesday, the Fed provided $100 billion in overnight repo facility funding at around 1.05%. In the interim, Treasury securities have soared by upwards of 5%, meaning the hedge fund speculators are truly laughing all the way to the bank.

Wednesday overnight repo.

Likewise, it offered $20 billion of 14-day repo money at about 1.1% on Thursday, and had $72.6 billion of bids.

And why not? These absurd repo funding facilities do nothing whatsoever for main street and certainly have no efficacy in fighting the Covid-19.

But down on Wall Street, they are the closest thing to a legal printing press that you could have during the final blow-off stages of a bond bubble. That’s because they permit speculators to literally load up the trucks with rapidly appreciating bonds at virtually no cost of carry.

Alas, the end result is the aforementioned Mother of all Bond Bubbles. The Fed fueled it with repo kerosene, but when it craters the Fed heads will attempt to finger some little green Martians who supposedly will have arrived on a comet from outer space.

Once again, of course, these Keynesian money-printers have no clue about what they are doing, and continue to slide by the seat of their pants, making it up as they go along.

Perhaps this time, however, the absurdity of what they are doing will finally catch up. As Jeff Snider relates in a recent post, back in January 2011 Janet Yellen mapped out the “game plan” on how the one-time emergency rate reductions and balance sheet expansions of 2008-2009 would be unwound now that the recession had passed and the financial markets were stabilizing:

It was originally believed, at its outset, that QE2 wouldn’t last more than a year and then once completed the higher level of assets would be maintained for two years afterward. They would then be unwound, securities allowed to mature, maybe even some sold, for an additional five years thereafter. By the middle of 2018, the Fed’s balance sheet was back, or back close to, the pre-crisis baseline.

No lingering trillions in bank reserves. As it was intended: the financial system goes back to normal, the economy then gets back to normal, and finally the Fed can safely return also to normal.

This raises immediate questions about…bank reserves. If the US central bank only ever intended them to be a temporary addition or backdrop to a system that had gone for decades without them, what must we conclude today in light of the inability of the Fed to figure the “right” amount of bank reserves that they now believe must total into the trillions forever?

As it happened, not a single element of Yellen’s game plan came to pass. Not one.

These people did not know what they were doing then, and are even more clueless now.

In truth, they are the greatest financial arsonists in recorded history, as today’s bond market mania attests and as the entire world will soon painfully discover.