At 7:46 AM today, Zero Hedge posted exactly the right headline:

“Powell Throws In The Towel”: Gold, Global Stocks Soar, S&P At All Time High As Yields Tumble

Risk assets, safe havens? it doesn’t matter: just buy it all as central banks enter the last stretch of the race to the (credibility) bottom.

The global dovish tsunami – still in its jawboning phase – which was started by Mario Draghi on Tuesday and escalated on Wednesday when Fed chair Powell finally threw in the towel and effectively said he would cut rates in July, has resulted in a global scramble for both risk assets and safe havens, with global equity markets a sea of green…

They got the alleged safe havens part of it right. As of the wee hours today, the 10-year UST yield plunged to 1.97% and the global bond market went truly berserk.

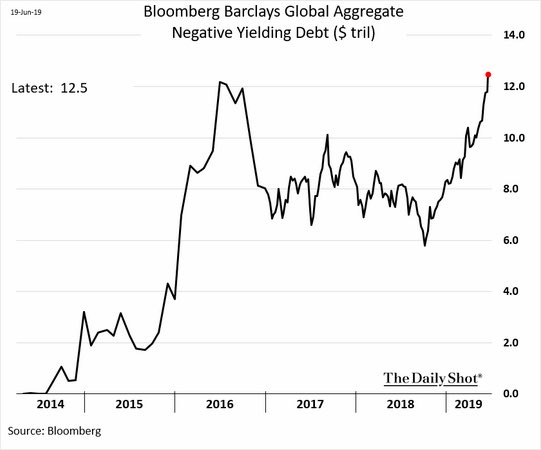

There are now a record $12.5 trillion of government and corporate bonds trading at negative yields—the absurd fruits of the Fed and its convoy of money printing global central banks calling in the sheep.

Indeed, half of all European government bonds–totaling more than $5 trillion— have a negative yield. This includes an incredible 96% of all Swiss bonds, 91% in Sweden, 88% in Germany, 84% in Finland and Netherlands and 76-78% in France, Austria and Denmark.

Obviously, this has absolutely nothing to do with real world conditions or fiscal prospects. Otherwise there would be a difference between fiscally sober Germany and Switzerland and the socialist paradises of Sweden and Denmark.

But there isn’t. The speculators and machines are buying indiscriminately because they are front-running what Draghi told them hardly 50 hours ago and Powell reinforced yesterday afternoon: Namely, the Fed will soon be easing and the ECB will start QE buying again, meaning bond prices are going up owing to the big fat thumb of the central banks on the supply/demand scales in the bond pits.

Moreover, in the case of Japan, the combination of towering debt at 250% of GDP and an aging population which can’t possibly bear this crushing financial burden is juxta-posed with the fact that 74% of this massive Debtberg is now trading at negative yields.

As the man says, you really cannot make this stuff up. As the fabulous Jim Grant soberly averred on bubblevision this AM (before they quickly cut to a commercial break), the central banks have now flat-out “destroyed the global bond markets”.

They value nothing in the real world and discount no discernible future. The trading herd is simply buying what the current reining troika of fools—Powell, Draghi and Kuroda—are buying or will be buying and are laughing all the way to the bank.

After all, not only is the price of so-called safe haven assets (government and corporate bonds) soaring, but none of these speculator cats are buying them with cash reserves tucked away in their desk drawers.

Nope. They are buying on repo and other forms of short-term credit—the very thing that Powell and Draghi promised to make even cheaper.

Indeed, this AM the bond speculators surely believe they have been shot dead and arrived in carry trade heaven. Without even losing a wink of sleep overnight, they have awakened to find that the central banks have unleashed a financial nirvana in which the value of their assets is rising—even as the cost of their liabilities continues to plummet.

Never in all of financial history has a small posse of fools injected such colossal stupidity into the economic life of the entire planet.

Japanese Government Debt As A % Of GDP, 1980-2019

So we now advert to the empty suit part of Powell’s capitulation, or to put it bluntly the raging stupidity of it all. To wit, you only have to examine the last two recessions once over lightly to understand that both were triggered by collapsing Wall Street bubbles that had been previously fostered by the Fed.

For instance, the Great Recession actually incepted in December 2007, but it was essentially a garden variety downturn with the rate of real GDP shrinkage averaging just -0.8% annualized during 2008 Q1-Q3.

Then came the Wall Street bubble collapse led by the Lehman bankruptcy filing in September 2008, however, and the bottom literally fell out. During Q4 2008 real GDP shrunk at a staggering 8.7% annualized rate.

And for purposes of perspective, that was far worse than the -6.3% rate recorded during Q1 1982 when Volcker was administering the bleeding cure to crush double digit inflation or the -3.7% annualized drop during Q4 1990 recession trough.

What matters at present is that the crisis of September 2008 never really went away. It merely represented the first down-leg of financialization coming undone.

Yet owing to 10-years of egregious money-pumping by all the central banks of the world, capped off by this week’s Draghi/Powell capitulation, the Wall Street bubbles are re-emerging in even more virulent and dangerous form.

So it is crucial to understand what actually happened last time, and how Powell’s astounding stupidity in pumping high octane fuel into the current bubble’s blow-off stage is sure to make the coming collapse even more traumatic than last time.

When the 2008 financial crisis was interrupted and deferred by the massive liquidity injections of the Fed and other central banks in the fall and winter of 2008-09, the turmoil had barely grazed main street; the crisis was essentially concentrated in the canyons of Wall Street owing to the blow-up of the mortgage securitization meth labs.

In turn, these mishaps set off a contagion of falling prices for the dregs of the sliced and diced subprime mortgage pools and other dodgy assets held in investment bank inventories, of which Lehman held the most fetid collection.

These dubious assets had been accumulated on Wall Street during the housing and credit booms that the Fed had ignited after the dotcom crash. Dealer balance sheets were bulging with them—led by the massive pile of toxic assets sitting on Lehman’s $600 billion of footings, a large share of which was funded with short-term borrowings.

So when rising defaults on the underlying mortgages caused a sell-off of the securitized derivatives, the liquidation accelerated rapidly; and it was compounded by the Fed’s folly of mechanically pegging and transparently telegraphing its money market interest rate targets.

This kind of absolute money market certainty (stupidly pitched as “transparency” by the clueless central bankers) had encouraged Wall Street to recklessly fund these risky, sticky, longer-term mortgage, real estate and junk bond assets with hideously mismatched liabilities. The latter consisted heavily of hot, short-term money market instruments (unsecured commercial paper and repo) that suddenly dried up in the summer of 2008, forcing dealers to dump even more toxic junk into the market.

Still, the fallout of the Wall Street crisis had initially penetrated Flyover America only obliquely—owing to the fact that the mortgage refi machine, which had been generating hundreds of billions of MEW-based middle class spending, suddenly shutdown.

Likewise, the predatory income production and housing activity generated in the mortgage broker boiler rooms, which peddled low-rate ARMS (adjustable rate mortgages) to economically marginal households, was also stopped cold. That was going to happen anyway, of course, because these marginal borrowers could not remotely hope to afford their subprime mortgages—once the ultra-low “teaser” rates reset and escalated sharply higher.

Both avenues of the housing boom came to a screeching halt when Wall Street melted-down, triggering what would otherwise have been a mild housing-focused downturn.

But what transformed the so-called Great Recession into a rout on main street was the corporate C-suite response to plunging stock prices in the fall and winter of 2008-2009.

To wit, by then the Fed’s cancerous regime of Bubble Finance had turned the C-suites of corporate America into options-obsessed stock trading rooms and financial engineering joints. Almost instantly, a recession that was barely visible in the summer of 2008 to the Goldilocks worshipping economists of both Wall and Washington alike turned virulently south in Q4 2008, as depicted above.

But the crash of business inventories and employment shown in the chart below happened not for the classic reason that main street interest rates were soaring and household and business credit got crunched, but because the C-suites were desperately attempting to propitiate the new trading gods of Wall Street.

The sacrifices they offered consisted of sweeping so-called “restructuring” plans that amounted to shit-canning payrolls, inventories, facilities and balance sheet assets with nearly reckless and frenzied abandon.

During the brief 11-month period after August 2008, more than 6 million workers were tossed overboard and $150 billion of inventories or 10% of outstandings were hastily liquidated.

Even a superficial post-mortem of the data shows that the Great Recession was a drastic over-reaction based on the underlying economics. Demand did not fall by anything close to what was implied by the C-suite initiated strum und drang.

As shown in the chart below, in fact, cumulative real final sales dropped by just 2.5% from the pre-recession peak to the June 2009 bottom, while real GDP plunged by more than 4.0%. The difference represented the drastic inventory liquidation that had been unleashed by panic-stricken C-suites as they watched their stock options vaporize.

So you would think that the knuckleheads in the Eccles Building would appreciate that the very recession they claim to be preventing via ultra-low interest rates and a new, absurd round of “easing” is latent in the C-suites, which have seen their stock prices soar by 300% since the March 2009 bottom.

That is to say, the C-suites learned exactly the wrong lesson and are more invested in the stock market bubble than ever before. Fed policy has only encouraged them to double down by borrowing hand-over-fist to fund financial engineering maneuvers, thereby ruining their balance sheets on the presumption that the bubble will never burst.

What that means, of course, is that when the stock market bubble finally reaches its asymptotic high and the last mullet has bought the last egregiously over-priced share, the C-suite response to plunging stock prices and option’s values will be even more irrational and violent than last time around.

That is, the C-suites will deliver the very recession which Powell was yesterday pledging to forestall—even has he triggered a final speculative burst in the casino.

This is all by way of underscoring how dangerous the stampede into bond market has become. It has made the apparent cost of debt so low that both politicians in the fiscal sphere and corporate executives in the business sector have been incentivized to borrow like there is no tomorrow and let the devil take the hindmost.

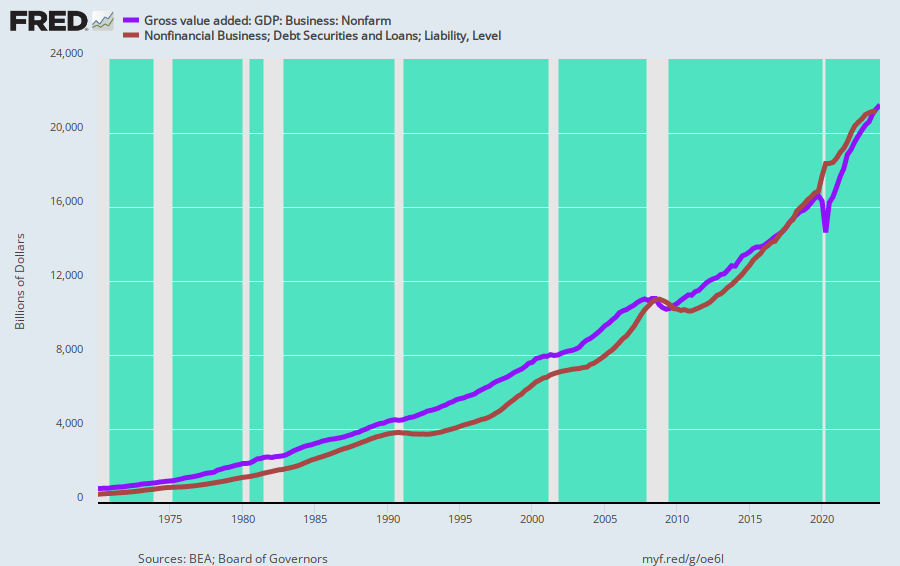

To wit, total business debt (corporate and noncorporate) outstanding (brown line) has now risen by 54% from the already towering level at the pre-crisis peak in Q4 2007. At the latter point it stood at $10.1 trillion and had already risen by 53% from the $6.6 trillion outstanding in Q4 2000.

So in light of this pre-2008 business debt explosion, excessive business debt was almost universally held during the heat of the financial crisis to be a danger that needed to be fixed forthwith.

But never mind. During the last 12 years business debt has soared by $5.5 trillion, or by more than the total level outstanding as recently as Q4 1998, to a current level (Q1 2019) of $15.6 trillion.

And this is no harmless matter of big numbers—because what it really represents is big leverage. That is, total business debt now amounts to 96.8% of the gross value added of the entire non-farm business sector of the US economy.

Needless to say, we have never been there before. On the eve of the 2008 financial crisis, the business leverage ratio stood at 91.8% of gross value added, which, in turn, had soared upward from the 83.1% ratio posted on the eve of the 2001 recession.

And, of course, when you go back in time before the Greenspan Era of bubble finance and Tricky Dick’s destruction of sound money at Camp David in August 1971, the business leverage ratio was a whole lot lower. In 1970 it stood at just 61%.

Yes, the argument is always made that debt is not inherently evil and even rising leverage ratios are not fatal if you are “investing” in productive assets for the future.

Fine. But that is precisely what has not happened during the last several decades and especially since 2007.

At the same time that business debt was rising by $5.5 trillion and to nearly a 100% leverage ratio to gross valued added, the S&P 500 companies alone recycled $7 trillion into stock buybacks; and even more than that went into mainly leveraged M&A deals, whose primary virtue was not business economics, but the fact that they were accretive to per share earnings because the carry cost of the debt which financed them was so aberrantly low.

In short, the $15.6 trillion of business debt depicted below did not go into “investment” on main street; it went into financial engineering and fueling the Wall Street Bubble to its current parlous heights.

Yet having been present and accounted for on the FOMC ever since 2012, Jay Powell noticed nothing with respect to the time bombs which were being implanted into the business sector by the Fed’s egregious money-pumping and interest rate falsification spree. Instead, he showed up at the Bubble’s midnight hour yesterday, kerosene can in hand.

When the Bubble eventually bursts, of course, tens of thousands of blatantly overleveraged business hiding in that $15.6 trillion of collective business debt will hit the wall.

And then the restructuring and bankruptcy advisory business will boom like never before. The sweeping and brutal “restructuring” plans of 2008-2009 will end up looking like a sunday school picnic as million of workers are shit-canned and hundreds of billions of inventories and allegedly impaired business fixed assets and intangible are heaved overboard.

So if the Fed were a fire department, it could be well and truly said that Powell and his posse are now functioning as arsonists, fueling the very financial infernos that they claim to be forestalling.

Of course, if yesterdays Kerosene Can Caper represented some kind of excruciating trade-off, it would be one thing. But anyone who is paying even half attention recognizes that another 25 or even 75 basis points of lower money market rates will do absolutely nothing for the main street economy or forestall the inevitable impending recession.

That’s because America is at Peak Debt. Full stop.

Lower interest rates will not cause more consumer spending or more business investment; they will only encourage the day-traders and robo-machines on Wall Street to bid the bubble higher and the C-suites to continue their suicidal assault on their own balance sheets via rampant financial engineering.

Since 2007, in fact, the C-suites have cycled upwards of $15 trillion into the stock market to buy back their own shares or take out the stock of M&A acquisition targets. So doing, they have become the overwhelming stock buyer of first resort—meaning they have turned the world of corporate finance upside down.

To wit, the functional reason for tradable equity markets under honest capitalism is to provide a venue for businesses to raise risk capital, not liquidate it!

Yet Wall Street today functions essentially as an equity capital liquidation machine. After the early days of Morning In America in 1982-83, in fact, there has been a continuous net liquidation of equity capital in the corporate sector, which totaled $506 billion last year, and more than $3.8 trillion since the current so-called “recovery” incepted in 2010.

How in the world, therefore, can Powell and his Fed heads not recognize that cheap debt is the means for corporate equity liquidation and soaring stock bubbles are the incentive that cause C-suites to indulge in feckless financial engineering games, which end up eating their own seed corn?

Likewise, it doesn’t take much investigation to realize that the household sector is tapped out, and that marginally lower interest rates will not do a thing to goose spending and growth. To that end, we examined the figures for total household debt, which has now reached $15.6 trillion, but stripped out the $1.6 trillion of student loans now outstanding.

After all, student loans are a government entitlement—-the demand for which has nothing to do with interest rates, since student don’t have to pay a dime anyway so long as they stayed enrolled in something—even basket weaving classes.

What we found is that during the 1990:2 to 2000:4 business cycle, household debt ex-student loans rose by 7.5% per annum in response to the Fed’s easy money stimulus. Similarly, during the 2000:4 to 2007:4 housing and credit boom cycle, household debt ex-student loans soared by 9.5% per annum.

At that point, however, the household sector came hard upon Peak Debt with non-student debt hitting $13.7 trillion. Yet here we are 135 months later and the figure has crept up by only $400 billion to $14.1 trillion.

That is to say, the Fed has been pushing on some kind of wet noddle!

Household debt ex-student loans has grown at only 0.25% per annum—notwithstanding massive interest rate suppression during the interest 11 years.

So anyone thinking at all—rather than just intoning the Keynesian catechisms……would say don’t fuel the bubble even more because still lower rates will only make it more unstable and dangerous.

For crying out loud, it truly does take some kind of colossal empty suit not to see that.

“