The starting point for understanding the delusional fantasy of the present moment is this: The mainstream narrative is so corrupted by greed, sloth, group think and will to power that it has become a risible caricature of itself. In plain english, what is held to be true by the powers-that-be is flat-out unreliable, unhinged and unsustainable.

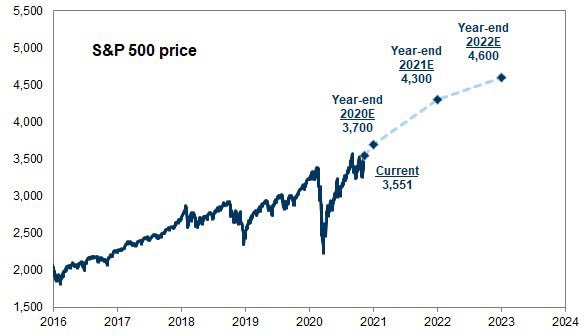

For instance, bubble vision is jawing giddily this morning about the new stock market forecast from Goldman’s chief equity strategist, David Kostin. According to this overpaid genius, the silver bullet of a Covid vaccine is now assured owing to the Pfizer announcement (but see the debunking below), so we will soon be back to normal and the stock market will soar to 4,300 on the S&P by the end of next year (2021).

So back up the trucks!

That’s a 25% gain (with dividends) from here if you are an old-fashioned troglodyte who buys stock with cash. But for an eazy peazy fortune, just call your Goldman broker and order some December 2021 calls. For instance, 3900 strike calls expiring on that date can be had for $115 per share, meaning that you stand to make 3.5X your money just by closing your eyes, hitting the buy key and waiting for Goldman to send you the check for the $400 gain when its forecast comes true.

Then again, it needs be recalled that in their wisdom, sell side analysts now see December 2020 LTM earnings on the S&P 500 coming in at $91.80 per share, and then leaping upwards by 47% to $135.13 per share by December 2021. Yet even if the latter hockey stick should come true, the implied PE multiple at Goldman’s swell new December 2021 price target is 31.8X!

That’s right. If you shell out the $115 per share options premium you’ve got to believe that neither Sleepy Joe, nor Kamala Harris and her progressive-left comrades, nor the Covid, nor a gridlocked Washington, nor a confused or faltering Fed, nor any other untoward development will stand in the way over the next 14 months of a booming return to economic normalcy, a 47% gain in profits and a PE multiple more than double the historic average!

Or, in the alternative, even at a frisky December 2021 PE multiple of 18X on that year’s reported earnings, the latter would have to post at $240 per share on an LTM basis to hit the Goldman target. Now, that would be up by 73% from the pre-Covid all-time peak of $139 per share in December 2019 and 164% compared to the (optimistic) Wall Street consensus for December 2020.

But, hey, don’t snicker. That’s the mighty Goldman Sachs reinforcing the mainstream narrative.

Just the same, and to paraphrase Abe Lincoln’s famous story about the man who was tarred, feathered and run out of town on a rail: If it weren’t for the honor of doing business with Goldman, we’d just as soon keep the $115.

Of course, Goldman doesn’t base its stock price forecast on the kind of earnings that CEOs and CFOs must report honestly to the SEC on penalty of jail time: Namely, GAAP net income.