The Donald didn’t pull any punches amidst his oratorical flight at Sunrise Florida last night when he proclaimed,

“….the stock market just hit another all time in history high. Meaning 401ks and jobs. Everyone’s getting rich…..and I’m working my ass off”

In point of fact, it never, ever gets more delusional than that. The Fed has unleashed the most monstrous financial bubble in recorded history, yet the Donald thinks it’s a resounding affirmation of his policies.

That’s just crazy. Flat-ass nuts!

Here’s the smoking monetary bazooka on top of all that has gone before. To wit at the tippy top of the longest business cycle ever—-with GDP expanding at 2.1% during the last quarter and the lowest U-3 unemployment rate in 50 years—the Fed just turned on the afterburners on its printing presses.

Since the repo ruction in mid-September, the Fed has expanded its balance sheet by nearly $300 billion. That’s a $1.5 trillion annual rate—-or even faster than Bernanke ran the printing press during the dark days of 2008-2010.

Total Assets Of The Federal Reserve

This is pure madness and has had only one predictable effect: It triggered another buying spree and FOMO rally in the casino for no other reason than that the Fed has again indulged the crybabies and bullies of Wall Street.

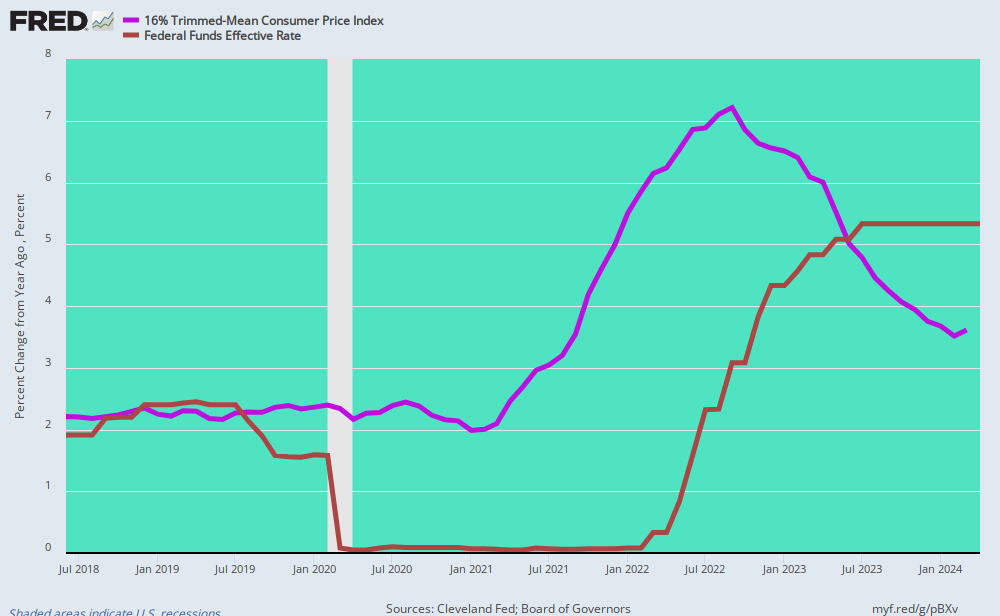

As of this morning, the LTM inflation rate (16% trimmed mean CPI) stood at 2.36% compared to a Fed ordained money market rate (Fed funds) of 1.55%. That means the cost of carry trade funding or for want of a better term, gambling stakes, is now -81 basis points in real terms.

That’s as low as its been for most of the past 10 years, meaning that the Wall Street gamblers once again think they have died and gone to free money heaven, and are acting accordingly. In fact, as shown in the chart below, the Fed’s short-lived effort at “normalization “—when the brown line (Fed funds rate) actually exceeded the inflation rate (purple line)—lasted only eight months.

But the Fed punted in July with the first of three rate cuts and we are now back in negative territory—-the destructive range where the Fed has pegged the money market rate for 132 months out of the last 140.

In vernacular terms, that amounts to running a devils workshop on Wall Street but the longer this goes on, the more toxic the incentives for reckless speculation become.

But, pssst, don’t tell the Donald he had anything to do with it because these fools would have pumped their balance sheet and lowered rates to placate Wall Street anyway—-even had Trump not been hounding them almost daily with his Easy Money tweetstorms.

The estimable Gary Kaltbaum said it about was well as such madness can be described:

Powell leaked his change of stance on Christmas eve from “raising rates” in 2019 to “patience!”. Markets bottomed immediately. Powell confirmed the leak a few days later. Markets rallied into the end of April before a whopping 6-10% correction into the end of May.

Powell again leaked another change of stance from “patience” to “lowering of rates!” Markets immediately bottomed again. Powell confirmed the leak a few days later. Powell then lowered rates…and lowered rates…and lowered rates. But markets just moved back and forth. What to do? Even with the rate cuts, markets were not cooperating. Markets fell into the beginning of October. What to do?

Word leaked out around October 3rd that there was consideration for some sort of QE. What? QE with 3.6% unemployment and with markets up 15-20% on the year?

Just on a “leak”, markets bottomed that day. AND on October 8th, not with an announcement but in an interview at some sort of economic’s club, Powell confirmed “QE BUT DON’T CALL IT QE.

It wasn’t any ordinary QE but as of this writing, Powell is on a run rate of over $1.5 trillion of printed money for the next year. This is more than Bernanke’s ($1 trillion) QE at its most. Just keep in mind, Bernanke printed money when unemployment was in the high single digits and when we still did not know if our financial system was stable. What is Powell’s excuse doing this at 3.6% unemployment and with markets near highs?

What’s worse, these madmen (and women) have the gall to insist that this burst of money printing is just technical—-that they are merely smoothing and enhancing the availability of bank reserves, which now stand at about $1.5 trillion.

Not in the slightest! That is, unless you want to disbelieve your lying eyes.

Here’s the history back to 1950, and it’s damn obvious that until Bernanke panicked at the time of the Lehman melt-down in September 2008 that commercial bank reserves on deposit with the Fed were negligible. Even in the aftermath of the October 1987 23% stock market meltdown, reserves never exceeded $40 billion or 3% of the current level as depicted by the red line in the chart.

What we are saying is that the US banking system operated just fine for decades with 1-3% of the current reserve figure. So this isn’t about the banking system “plumbing” at all. What they are actually doing, instead, is just fanatically forcing the entire financial system to obey their command that short term rates should not exceed their 1.50%-1.75% target.

So again this week they flooded the system with overnight and 14-day term repo. But obviously when you roll repo loans over again and again—week after week— it’s the same thing as permanent bond purchases. Ever Rolling Repo and QE are a distinction without a difference.

The reason for this madness is self-evident: The end of year repo rate in the market traded at 3.40% Monday, according to Curvature Securities versus the Fed’s previously enforced overnight rate for general collateral repo at about 1.59%. So it just turned on the printing presses full blast to ensure that no short-term rate in any market including the multi-trillion overnight and term repo markets would not disobey it commands.

Accordingly, during Monday’s term operation, the Fed accepted $19.25 billion of Treasuries at a stopout rate of 1.60% and took took $5.75 billion of mortgage-backed debt with a weighted average rate of 1.63%.

In other words, even the short-term money markets are desperately trying to bring rationality into the pricing equation, yet the fools in the Eccles Building will have none of it, thereby inducing the casino into paroxysms of feverish speculation as it mechanically floods the market with massive new flows of liquidity snatched from thin air.

At the end of the day, there is but one conclusion. While it is bad enough that the financial system nerve center of American capitalism is being bespoiled by the Keynesian academics and apparatchiks domiciled in the Eccles Building, it is even worse when they take on the mantle of late night TV pitchmen.

These fools have complete license to tell the public the truth about America’s failing debt and speculation-ridden economy, but they prefer to posture like circus barkers every time they speak publicly about the economy.

The Empty Suit who now sits in the Fed Chair’s chair is undoubtedly the most pathetic yet. For example, there has been an eruption of business indebtedness since the 2008 crisis like never before, and it has been overwhelmingly cycled into non-productive financial engineering. But this dissembling liar and PR flack actually had this to say recently:

“Business debt does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm to households and businesses should conditions deteriorate. Moreover, banks and other financial institutions have sizable loss-absorbing buffers,” he said. “The growth in business debt does not rely on short-term funding, and overall funding risk in the financial system is moderate.”

Really?

How did this escape his attention? Since the pre-crisis peak in the fall of 2007, total business indebtedness has risen by $6 trillion or 60%, while shipments of CapEx have expanded by just 6%.

No risks?

The Fed deserves the beating it is getting from the Donald—-even if he doesn’t have a clue that the nose-bleed levels of the current stock market are actually what will be his underdoing in the next election and beyond.

Perhaps like never before in history, the phrase “you boast it, you own it” is about to have a thundering real world demonstration.