The third great certainty in life these days besides the old standbys of death and taxes is that POTUS 45 does not have a single consistent bone in his body. Not one.

The plunging red line on the right margin of the chart below has surely not yet finished its southward excursion, but it tells you all you need to know about the volcanic eruption of the blame game that is about to issue from the Donald’s twitter keys.

After all, when the markets closed several hours before the polls did on November 8, 2016, the S&P 500 stood at 2140, and during the last months of the campaign Trump had properly called it evidence of “one big, fat ugly bubble”.

Three years and change latter and after the Donald’s Trade Wars, Fiscal Debauch and idiotic calls for negative interest rates had made the mess he inherited far worse, the S&P 500 top-ticked at 3386 on February 19th.

That is, the big, fat ugly bubble had gotten 58% bigger, but the Donald was now suffering two dislocated shoulders from incessant and frenzied patting himself on the back.

We are now down 14.5% in just seven trading days since then, but the eventual plunge has just begun. So as the red line in the chart makes it way back to where it started and even lower, the Donald’s wrath against the Democrats, the Fed, the mainstream media, Deep State saboteurs in his administration and countless more will likely know no bounds.

Indeed, the one apparent talent the man has displayed over a lifetime in the public eye has been the capacity to bitterly blame one and all for whatever goes wrong, and to do so with copious amounts of bile, bellicosity and bombast. And it will be made all the worse by the soon to be appearing Dem campaign ads wrapping the collapsing stock averages right around the Donald’s political neck.

So there are a lot more shoes to fall from the Covid-19 outbreak than the fracturing global supply chains that are now pulling the global economy hard upon recession’s front door. The arrival of the latter will, in turn, evacuate the bottled air holding the stock market aloft, which development will send the Donald’s entire MAGA meme crashing hard upon the rocks of reality.

After all, there has been absolutely no acceleration of the economy during the Donald’s first 12 quarters in office compared to Obama’s last 12 quarters. In fact, after yesterday’s Q4 GDP revisions, the numbers speak for themselves: Real final sales to private domestic purchasers rose at a 3.24% annualized rate during Obama’s final 12 quarters compared to a 2.77% annualized rate during Trump’s 12 quarters ending in Q4 2019,

The only thing that has changed is that the cycle has gotten longer in the tooth and more debt ridden, while the Donald’s misbegotten Trade Wars, Border Wars, Fiscal Debauch and Fed-bashing in behalf of negative interest rates have caused the underlying rot he inherited to become just that much more fetid.

Year-Over-Year Change In Real Final Sales To Private Domestic Purchasers

So as crashing stock prices strip away the veneer of phony MAGA, the already bitter partisanship of the 2020 presidential campaign will turn flat-out butt-ugly.

It will be the most fraught US election ever because the partisan hotheads on both sides of the aisle have taught their respective bases an exceedingly incendiary proposition: Namely, that the election process is corrupted and rigged and that the election night results are not to be trusted or even accepted.

The establishment Imperial City Dems are the worst on that score. After serial hook-ups with Deep State operatives on the Russia Collusion Hoax, the Ukrainian Hoax and the Impeachment Farce, they are again laying the planking for an absurd “Putin did it” reprise, even dragging poor old Bernie into the narrative.

At the same time, the GOP is not remotely innocent, either. The entire noisy and frequently vicious campaign against illegal immigrants and sanctuary cities has an ill-disguised sub-text: Namely, that these immigrant folk are not likely to vote Republican, so we don’t want them; and if we don’t crackdown hard, the Dems will pack them in buses and steal the next election.

In fact, illegal aliens will have had no more impact on US elections than Vlad Putin himself, which is to say, none at all.

Yet as the election year calendar advances and it become clear that the mother of all hanging-chad elections is likely to be the outcome next November, it will be all over except the shouting.

That is to say, even as the Fed will soon be proven impotent to stop the economic damage from Covid-19, it will be even less able to ameliorate the effects of a potential constitutional crisis.

In any event, the Donald is about to get Hoovered. Having foolishly embraced the big, fat ugly bubble he inherited, he’s about to find out that the down side of bursting bubbles is not nearly so tweetable.

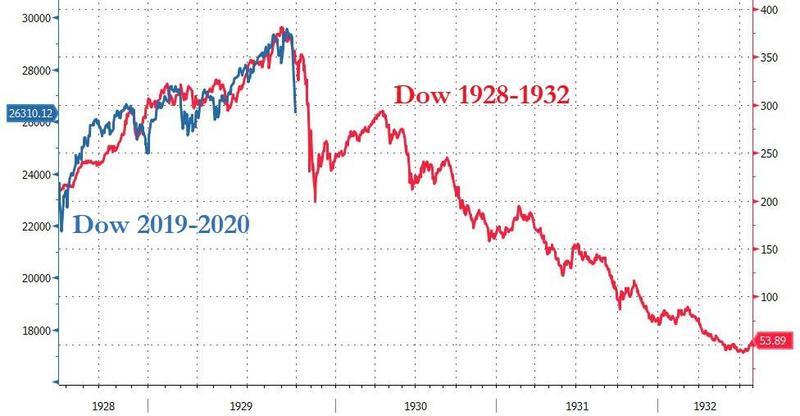

Indeed, in the last five days the Dow Jones has experienced the fastest collapse from an all-time peak since, well, 1929.

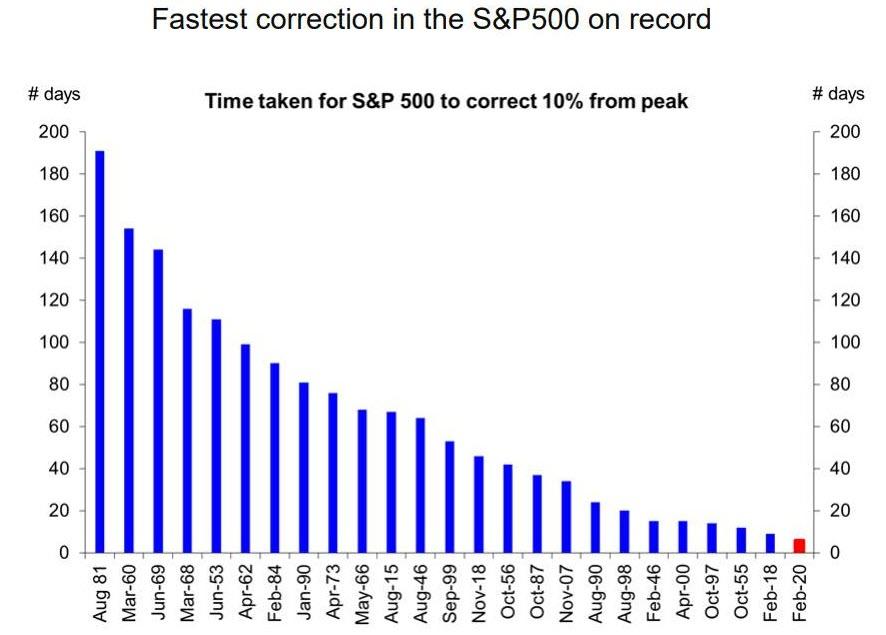

Viewed from the perspective of the S&P 500, the story is the same. Never before has a 10% correction occurred with such lightening speed ( the red bar is now).

Then again, what did the Donald expect? As indicated in the chart below, Trump was getting scammed like Jose, who famously climbed to the top of the flagpole at Yankee Stadium before each game because the crowds always sang “Jose can you see?” right before the umpire yelled, “play ball!”

Yes, the clueless Donald was setting up there atop an all-time stock market capitalization record at 157% of GDP, and just couldn’t stop boasting about his own brilliance in causing it to happen.

Needless to say, you don’t want to be atop the financial flagpole when violent storms like those of the last six days hit the casino. As the stock averages and the Orange Combover clinging to them descend back to earth, the crowd down below will be singing not the Star Spangled Banner, but the refrains of “You boast it, you own it”.

Still, the Donald can perhaps be given a partial hall pass for not understanding the full extent of the financial malignancies which he inherited and which represent the cumulative deposit of three decades of Keynesian central banking at the Fed.

To that end, we heard live time proof of the corrupt Wall Street/Fed symbiosis on CNBC this morning. Former Fed governor Kevin Walsh was hosting the show and beating the tom-toms for a Fed coordinated global rate cut over the weekend. Said Walsh:

The Fed gets paid to make the tough decisions…..it needs to act now—even with imperfect information—-to prevent the economy from suffering. So we all need to rally around the chairman“.

Oh, puleese!

What he was really saying is that the job of the Fed is to prevent “suffering” among the gamblers and big swinging dicks on Wall Street because there is no other possible purpose to the 75 basis points of rate cuts now priced into the futures market than to juice the day traders and robo-machines so that the hedgies, insiders and wise guys have some mullets to drop their longs upon.

After all, three rates cuts would take the Fed funds rate from an already idiotic 1.55% to just 0.80% basis points, but the very proposition that this could do anything to stimulate an already debt-saturated main street economy is just risible nonsense.

For example, take the case of mortgage rates and housing construction. After 30-years of Keynesian central banking there is literally nothing left in mortgage rates to cut or that could possibly make a difference on housing demand.

At the present moment, the 30-year fixed rate mortgage yield is just 3.45%, which means after the LTM inflation rate of 2.27%, the real yield has been reduced to just 118 basis points.

Yet, presumably, mortgages still carry the risk of loss and investors are still entitled to some return on 30-year money after compensation for inflationary erosion of principal. The startling fact is that at today’s narrow spread over inflation, most of the nominal mortgage yield at the current CPI rate is needed to compensate for erosion of purchasing power, which would amount to a 50% loss after 30 years.

Indeed, the margins on mortgage money are now so razor thin as to sharply illuminate the dead-end into which our Keynesian central bankers have marched, and why they now have virtually no ability to “stimulate” the main street economy.

Here is a chart of the 30-year fixed rate mortgage yield (brown line) versus trend inflation since the eve of Alan Greenspan’s arrival at the Fed in August 1987.

We use the year-over-year change in the CPI less food and energy (purple line) as a proxy for the trend level of inflation. The drastically shrinking gap between the two lines makes it abundantly clear that the historic mortgage rate spread over inflation has been almost completely extinguished:

- In June 1987 the mortgage rate of 10.27% represented a 632 basis point spread over the CPI rate of 3.95%;

- At the pre-recession peak in June 1990, the mortgage rate was still 10.15%, representing a 526 basis point spread over the CPI rate of 4.89%;

- By the December 2000 cycle peak the mortgage rate was 7.13% or 456 basis points above the CPI rate of 2.57%;

- At the November 2007 cycle peak, the mortgage rate stood at 6.10% or 370 basis points above the CPI at 2.34%;

- On February 27, 2020, the mortgage rate stood at the aforementioned 3.45% representing a mere 118 basis points over the 2.27% CPI rate.

It needs especially to be noted that the claim that today’s super-low mortgage rates are due to the disappearance of inflation is completely debunked by the data in the chart below. Outside of modest oscillations, the trend inflation rate around 2.25% on a year-over-year basis has not changed since the year 2000, even as the mortgage rate has been cut nearly in half.

Needless to say, if reducing the mortgage spread to barely one-fifth of its pre-2000 levels has not caused a housing boom, its pretty damn evident that a further reduction in the mortgage rate from today’s rock bottom levels and spreads over inflation won’t make any difference at all.

Of course, what a reduction in the Fed administered money market rates would actually do under present conditions is cause carry-trade speculators to think they have died and gone to heaven.

That is, if the Fed drives the repo rate down to 80 basis points per its command that any and all short-term money market rates must march in lock-step with its “policy target” for Fed funds, the carry cost of holding appreciating mortgage paper on 95% repo will essentially evaporate.

It would be as if Pivoting Powell had taken a page from Bernie’s playbook: Free stuff for the hedge fund speculators, too!

So thanks, Kevin Walsh, for letting the cat-out-of-the-bag. The purpose of the Wall Street/Fed cheap money alliance is to generate ill-gotten economic rents and trading arbitrage windfalls down in the canyons of Wall Street. By contrast, owing to the drastic repression of interest rates and the burying of households and businesses in Peak Debt, the time has long passed when the Fed’s machinations had any impact on main street production, jobs and income.

Just consider what has happened since the Greenspan housing boom peaked in January 2006. At that time, single family housing starts posted at a 1.823 million annual rate, the 30-year mortgage rate was 6.12% and the spread over inflation was 400 basis points. In the chart below, the former two variables are indexed to 100.0

Now, notwithstanding all of the Fed’s rate repression and ferocious bond-buying (QE) since then, single family starts in January 2020 where 45% lower at 1.01 million units per annum.

So the question recurs. What good did it do to crash the mortgage rate to 3.45% and a 118 basis point spread over inflation?

Indeed, the indexed chart below debunks of all the Fed’s gumming about how it is “stimulating” main street activity and growth. To wit, 43% lower mortgage rates (purple line) resulted in 45% fewer housing starts (brown line).

Needless to say, that’s upside-down. It implies that the elasticity of mortgage rate cuts is negative -1.00!

Even if the chart slightly exaggerates the matter owing to the starting point at the early 2006 housing boom peak, the point remains: Namely, the Fed’s decade long attempt to stimulate the main street economy by drastic interest rate repression has benefited primary traders and speculators in mortgage paper on Wall Street.

After all, the reciprocal of the plunging purple line for the 30-year mortgage yield is soaring prices of the same paper. Yet during almost the entire period, the Fed pegged money market rates on Fed funds, repo and other short-term credit at a level which was tantamount to zero.

That’s free stuff for traders that would make even Bernie blush.

As it happened, bubble vision this AM wasn’t done showing some thigh on exactly who will benefit from the now clamored for rate cuts.

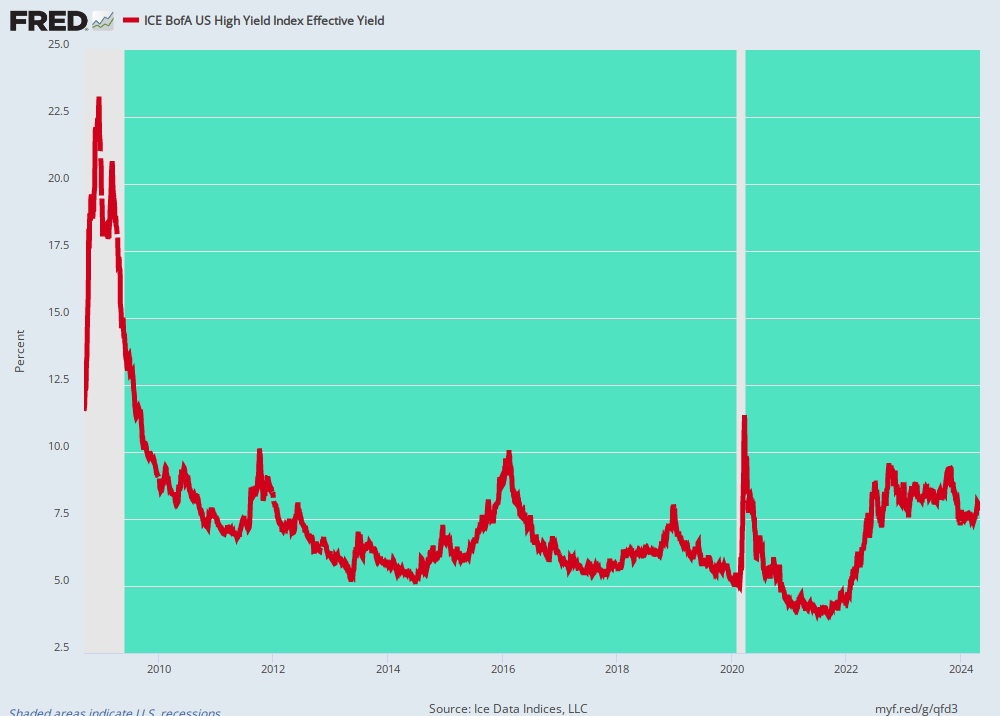

In this instance, CNBC had one of its slickest Wall Street shills, Michael Santoli, doing a chart talk on why a rate cut right now will help because during the last few days the high yield spread over treasuries has widened sharply. That is, treasury yields have plunged, causing the spread to the Merrill Lynch high yield index to “blow-out” from 356 basis points on February 14 to 462 basis points yesterday.

Down in the canyons of Wall Street that sharp, sudden spread widening is viewed as a very bad thing because it implies trouble in “credit”, meaning weaker performance by corporate issuers and rising defaults.

Indeed, up until a week ago, the go-to mantra of the bulls was that the coast is clear to push stocks even higher into the nosebleed section of history because “credit” was strong and spreads were tight. This purportedly meant that there were no signs of earnings weakness or recession on the horizon.

So Santoli’s point was that the sudden arrival of “credit” trouble was unnerving stock speculators and would likely discourage the C-suites from borrowing cheap money to buyback their own stock.

And yet that symbiosis between Wall Street speculators and debt-and-buyback-binging corporate America has been the primary force levitating the stock market to ever higher levels. In fact, share buybacks account for 100% of net new stock purchases since 2010.

Accordingly, Santoli averred, its time for the Fed to rejuvenate the confidence in the high yield markets and bring the spreads back in. That would, in turn, amount to issuing an all-clear signal from on the high yield pits, thereby encouraging stock speculators to get back into the game and the C-suites to get back to their job of issuing more debt and buying back more stock.

We’d say that’s a pretty damn sick justification for another round of Fed rate cutting, but that’s exactly how the insidious alliance of the Keynesian central bankers and the Wall Street high rollers, rolls.

Of course, what Santoli didn’t explain is why the rock bottom high yield credit spread of two weeks ago was the “right price” for high yield risk (surely 356 basis points isn’t) and why the Fed’s awesome powers to falsify asset prices should be deployed to restore it.

Even a brief glance at history tells you how delirious Wall Street has become. On the Friday before the Lehman bankruptcy filing in September 2008, the high yield spread was 862 basis points, which then violently blew-out to 2106 basis points during the meltdown carnage thru December 17, 2008.

By that point, Bernanke had also blown-out something—the Fed’s balance sheet, which had exploded from $930 billion to $2.3 trillion during the same 13 week period. Thereafter, the Fed did not let up, flooding Wall Street with endless liquidity until its balance sheet hit $4.5 trillion by 2016.

Not surprisingly, the impact on the high yield market was staggering, as shown in the chart below. Within two years, the spread over the US treasury benchmark had come in to less than 800 basis points, or below its pre-Lehman level, and kept on shrinking irregularly from there until it touched the aforementioned 356 basis points on the Valentine’s Day just passed.

Yet these cats down on Wall Street say the nation can’t stand a 462 basis point spread when history overwhelmingly shows that it can; and they also insist on rate cuts now like a bunch of spoiled crybabies because they are needed to “ease financial conditions” and get stock speculators and the trend-following funds and robo-traders back into a stock buying frame of mind.

The purple line in the above chart, of course, tracks the spread against the UST benchmark yield, which also has been shrinking at a fearsome pace since the crisis. But at the end of the day, what really counts is the absolute level of corporate rates and by the sheer math of “benchmark plus spread”, they have been relentlessly dropping even more precipitously.

To wit, on the eve of the Lehman filing the Merrill Lynch high yield index stood at 11.62%, and, in fact, double digit nominal yields had been the norm for most of the time since the high yield market became significant in the late 1980s. Then, after soaring to 22.4% in the heat of the later 2008 meltdown, a long march down began that would have done even Mao’s journey to Shaanxi proud.

Yet why in the world would anyone think that the 5.03% nominal junk bond yield posted on February 14th was a good thing that needs to be preserved at all hazards? After all, subtract the 2.25% of current LTM inflation and you have a real yield of just 275 basis points to cover default losses which historically have averaged more than 5%.

That’s just plain insane, of course, and leads to levels of malinvestment that would probably be unimaginable even to the Austrian economists who coined the term a century ago. But that’s exactly where the Fed’s reckless policies have taken things.

As Gary Kaltbaum noted this AM, the Eccles Building is now populated by a posse of groupthink fools and sniveling cowards who function at the beck and call of the Wall Street traders, speculators and high-rollers. As he succinctly documented, the reaction function of the Fed is to go into a panicked rate cutting/easing/money printing modality whenever stock prices drop by more than 10%.

Needless to say, that means that the bubbles are becoming ever larger and that the eventual day of reckoning will be that much more traumatic.

But, no, Wall Street wants another hit of monetary heroin, and it is likely to materialize by Monday morning.

The irony, of course, is that the Donald keeps on attacking Powell and the Fed, and his twitter onslaught is certain to get more vehement and over the top if the 4,000 Dow point meltdown does not stop right soon.

Yet that 58% gain from November 8, 2016 was the hoary step-child of the Fed’s supine submission to Wall Street’s demands that the Eccles Building keep the bubbles afloat.

That meant destroying every vestige of honest money and, more importantly, eviscerating the financial stability which is impossible without it.

4140 Dow points to the downside since February 12 are a harbinger of the proof soon to come.

We told you early in the week that the Fed would lower rates at the next meeting. Everyone as well as the futures are now putting the number at 100% but think if this continues lower, something coordinated would come out sooner. Fedhead Evans leaked some of this noise yesterday.

Speaking of the Fed, The Fed response to corrections since 09:2010: -17%. Took rates to 0% and QE22011: -21%. Rates still 0% and Operation Twist2012: -11%. Rates still 0% and QE32016: -15%. Rates at 0.25%, stopped hiking plan.2018: -20%. Change from raising rates to patience leading to 3 rate cuts.Current: – 14%. 3 rate cuts now priced in with 1st one in March at 100%.Of course, the maniac running the Fed is still performing his NOT QE.