Our unhinged Keynesian central bankers are now literally strangling the last remnants of honest price discovery in the financial system owing to their moronic belief that ever lower interest rates are the magical key to economic advancement.

That’s why they have trotted out a rapidly mushrooming pile of TOMOs (temporary open market operations) and POMOs (permanent open market operations). Before the clock struck one today, in fact, these geniuses pumped $107.4 billion of TOMO/POMO cash into the bond pits in response to Wall Street’s actual bid for even more—$158.6 billion to be exact.

We will provide more detail about these operations tomorrow, but there should be little doubt that the Fed has now opened Pandora’s Box.

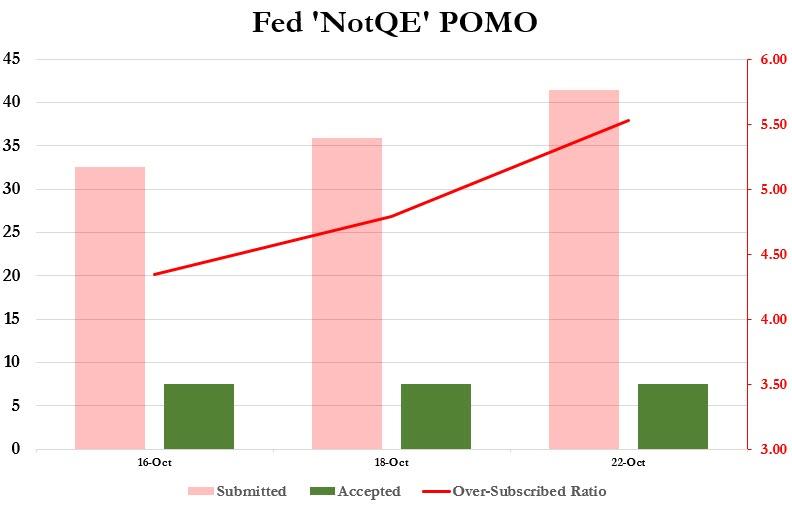

Just in the case of the $60 billion per month POMO involving the purchase of $7.5 billion of US Treasury bills at a crack, Wall Street demand (pink bars) for cheap new cash has already become nearly unquenchable, as shown by the chart below. Today’s dealer bids came in at 5.5X the amount of T-bill purchases (green bars) on offer at the NY Fed—reflecting an over-subscribe ratio that has steadily risen during the first three offers under “Not-QE”.

Of course, the Fed and its Wall Street handmaids want you to believe that there is nothing to see here in today’s $158.6 billion scramble for cheap cash; it supposedly just reflects some hic-ups down in the financial market plumbing owing to regulatory requirements for increased cash reserves, seasonality and other technical quirks.

Baloney!

For one thing, the geniuses in the Eccles Building have again been taken for fools down in the bond pits—meaning that part of the demand for repo funding comes from speculators playing the Fed. For instance, JPMorgan analysts recommend investors use futures markets to position for the spread between the Fed’s directly pegged funds rate and the open market repo rates it is indirectly attempting to suppress through its TOMO/POMO operations.

More importantly, there should be no doubt about why the Fed is literally inundating Wall Street with cash and the absolute speculative insanity that it is generating.

As to the reason, the Eccles Building will stop at nothing to enforce its 1.75% interest rate target in every nook and cranny of the financial market. So all that massive cash throw-weight is designed to insure that nothing which moves and nothing which stands still in the multi-trillion money market and repo sector dares to deviate by more than a handful of basis points from its sacred targets—even to the 1.92%/1.93%general collateral repo rates which prevailed early Monday morning.

With respect to the consequence, it’s plain as day that we have now reached truly insane levels of financial speculation.

For instance, today’s money flood was close coupled with a veritable poster boy for the over-the-top mania down on the Unicorn Farms. We are referring, of course, to the $9.5 bailout of WeWork by Softbank, which stick-save included a $1.7 billion payday for the very fool who single-handedly created this gonzo house of cards.

But as the never nonsense real estate kingpin, Sam Zell, told his agog hosts on CNBC a few weeks back, WeWork was never more than a glorified S&L heading for a wall that would make the 1991 crash of the same look like a sunday school picnic by comparison.

After all, what would you otherwise call an outfit with $47 billion of 10-20 years lease obligations on 425 different facilities, which actually rents out its “desks” (i.e. not floors, not rooms,) by the month to 400,000 exceedingly sketchy customers?

Upwards of 70% of these, in fact, are evidently cash-burn start-ups or other shoe-string operations that the company’s lawyers would not let it even describe as “enterprise customers”.

Still, you don’t need to overthink it—just behold the numbers. To wit, between 2017 and 2018 WeWork’s sales rose from $886 million to $1.820 billion or by $934 million. At the same time, its total expenses soared from $1.88 billion to $3.70 billion.

There is no doubt that Adam Neumann with his super-charged voting shares was completely in control of the company while that happened, meaning that he was OK with spending $1.82 billion more last year to generate $934 million of higher sales.

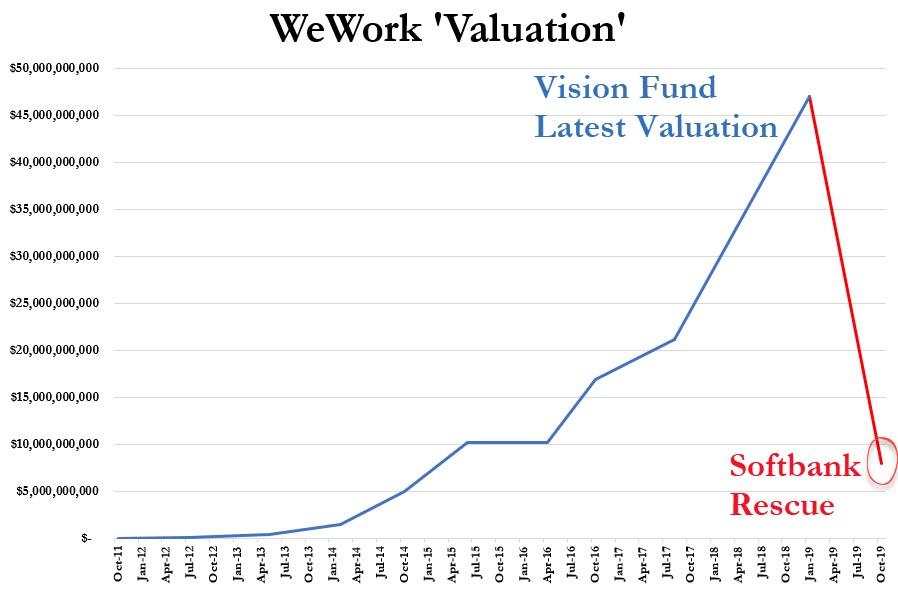

Perhaps raising spending at twice the rate of sales growth was too much for even the hit-and-run punters in the IPO market, but the 11th hour withdrawal of this thundering trainwreck from the IPO cue only begs the real question. To wit, what exactly were they smoking down in VC land when the company’s valuation did a Jack-in-the-Beanstalk, rising from $5 billion in October 2014 to $10 billion in May 2015 to $22 billion in September 2017 to $47 billion in January 2019?

As it happens, the bubble-riders/blowers at Softbank will apparently end up with upwards of 80% of the company at a pro forma value of less than $8 billion, but even that reminds that there are no adults in the room.

For crying out loud, these fools had already put $9 billion of Saudi et. al. money into WeWork and apparently did not even noticed that Neuman had outfitted them with their very own IEDs (improvised explosive devices) in the form of his 40X voting stock.

So when the brown stuff hit the fan, he apparently stuck them up at gunpoint. And it servers them more than right that they will now pay this con man $1.7 billion to get lost—-even as the company sinks rapidly toward its true equity value of far less than zero.

Stated differently, paying a grifter $1.7 billion to get off his own trainwreck is not some kind of one-off anomaly, but is actually rooted in the global chain of reckless speculation that the Fed and its fellow-traveling central banks have seeded all across the planet.

After all, without Softbank’s multi-billion investments in in successive VC rounds, the company’s purported private market cap could not have been kited as per the parabolic rise in the chart above. In essence, Softbank and its lesser investors just kept funding the company’s exploding losses, while rewarding themselves with a sequence of 2x mark-ups of the last valuation for their troubles.

No sweat!