The decade-long, bubble-infested simulacrum of recovery since the financial crisis has come at a considerable cost. Among others, it has reduced both ends of the Acela Corridor to a Fantasyland.

On any given day you only need to contemplate the head line stories and memes to see it in action. In no particular order today’s doozies included,

- the Donald’s hideous boasting about the USMCA nothingburger,

- the robo-machines buying Boeing after a disastrous earnings report,

- the former head of the NY Fed claiming $425 billion of Fed liquidity pumping since September has not impacted stock prices,

- Tesla’s market cap hitting $105 billion despite no hope of ever making a profit,

- the GOP head tax-writer telling CNBC that more tax cuts are coming and that “growth” is the answer to trillion dollar annual deficits as far as the eye can see; and,

- the Dem’s embrace of serial liar and war-mongering neocon Empire Firster, John Bolton, as a defender of the constitution.

This morning’s appearance by Rep. Brady deserves special scorn. He happens to be the author of the $1.7 trillion Christmas Eve tax cut paid for on Uncle Sam’s tapped-out credit card. But on CNBC he had the gall to say that it’s working as planned, has increased Washington’s revenue take and needs to be made permanent after most of the individual cuts expire in 2025.

For crying out loud, just yesterday afternoon CBO published the 10-year fiscal outlook summarized in the table below. It projects $13.2 trillion of new debt over the next decade and a 5% of GDP deficit into the indefinite future, thereby causing the debt-to-GDP ratio to hit a Greece-style 150% within two decades.

Yet even that dire scenario assumes no recession occurs ever again; and also that the Trump-GOP tax cuts are allowed to expire in 2025 as scheduled, along with the positive deficit impact of a myriad of other expiring tax loopholes and outyear spending cuts, which otherwise keep getting deferred as their effective dates draw near.

So Rep. Brady was really advocating a permanent extension of the Trump tax cuts that would increase the flood of red ink depicted below by another $3.8 trillion over a 10-year period. While that would expose the scam perpetrated in 2017 when the cuts were made to abruptly expire in order to stay within the 10-year revenue loss prescribed in the budget deal, it would also bury the nation even deeper in public debt.

As we have frequently pointed out, if you factor in even a mild recession between now and 2030 and the absolute political certainty that scheduled out-year spending cuts get deferred ( they were put there in the first place for budget window dressing purposes) and expiring tax cuts and loopholes get extended (K-street lobbies always see to that), the true baseline deficit over the next decade is closer to $20 trillion. And that, in turn, means that total public debt would hit $43 trillion before the decade’s end.

However, when asked about the endless trillion dollar deficits shown below and whether defense cuts should be part of the solution, Rep. Brady wasted no time spewing forth the GOP’s risible talking points.

To wit, any time the Dems are ready to give them political cover, the GOP is willing to talk entitlement reform. Likewise, since combined defense and non-defense “discretionary spending” is only $1.4 trillion out of a $4.6 trillion outlay budget, it’s not really the problem.

Here’s the thing. If you insist on taking the defense budget from $550 billion, which was already way too high, to $740 billion, as the Trumpite/GOP has done since 2016, and not put a scratch on $2.9 trillion per year of entitlement spending until the Dems embrace it, you flat-out don’t have the right to promise even more trillions of tax cuts—no matter how appealing as a matter of philosophy or taxpayer equity.

Sixty-five year ago, President Eisenhower got it right when he said that the high Roosevelt-Truman tax burden must come down, but the GOP has to earn the right to relieve the taxpayers by first cutting spending and balancing the budget.

By contrast, today’s Brady-style GOP stands for just the opposite. That is, they propose to cut taxes morning, noon and night, goose the defense and discretionary spending budgets year after year and then blame the Dems for the resulting giant deficits because they are not willing to attack the Welfare State.

Stated differently, America is positively heading for fiscal catastrophe because the GOP is the party of the Warfare State, the Dems are the champions of the Welfare state and there is absolutely no one left advocating for fiscal sanity.

Table 1-1.

CBO’s Baseline Budget Projections, by Category

The GOP’s risible hypocrisy on fiscal policy is highlighted by two sets of figures in the above CBO table. The first is that the sum of mandatory spending and interest expense will rise from $3.1 trillion in 2019 to $5.7 trillion by 2030. That’s a gain of 83% but Rep. Brady and his GOP colleagues insist they can’t and won’t do a thing about it until the Democrats sign a blood oath not to campaign against Social Security and Medicare cuts.

Of course, the world will be a chorus of whistling dogs before that happens.

Secondly, the Federal revenue share of GDP is only 16.4% in FY 2020, and would stay at 17% or under indefinitely if the expiring Trumpite/GOP tax cuts are made permanent. But spending is heading for 23.4% of GDP by the end of the decade—even under the CBO baseline without the increased interest expense burden of extending the tax cuts and the likely recession driven downturn in receipts sometime during the coming decade.

And the latter will surely happen. As it is, the current expansion is already the longest in history. Yet by 2030 it would be more than double the 119 month length of the 1990s expansion, which occurred under far more propitious circumstances.

SUBSCRIBE TO CONTINUE READING

Already a subscriber?

Login below!That why the GOP’s tax cut fairy tales are so lame. Surely 2019 was the peak of the current business cycle and as the CBO table indicates Federal tax collections came in at 16.3% of GDP after the Christmas Eve tax cut had become fully effective.

But contrary to the GOP’s silly claim that revenues have gone up—when the always do in an expanding $21 trillion economy—the relevant measure is in comparison to 2016. The latter represented the prior tax policy baseline enacted via the 2012 bipartisan compromise extension of the Bush tax cuts.

That figure was 17.5% of GDP, meaning that without the Christmas Eve tax cut, Federal receipts in 2019 would have been $3.715 trillion or $253 billion more than the $3.462 trillion actually collected.

So the tax cuts are not remotely “paying for themselves” and there is not a snowball’s chance in the hot place that even more tax cuts would relieve the massive structural deficit depicted in the CBO table above.

In fact, what is actually happening is that the spending side of the Federal ledger is being driven to historic highs by the demographic tsunami of Baby Boom retirements hitting the Welfare State budget and the neocon/ War Party domination of the bipartisan duopoly ballooning the Warfare State budget.—even as GOP tax policies are taking receipts to modern historic lows relative to national income or GDP.

For instance, measured at business cycle peaks, the Reagan budget took in receipts of 17.6% of GDP in 1987, the Clinton budget collected 19.7% of GDP in 2000, the Bush revenue take was 17.8% of GDP in 2007 and the Trumpite/GOP take was just the aforementioned 16.3% in 2019.

To be sure, the Federal government could more than do its job with revenues of 15% of GDP or even 10% under the strictures of a thorough-going small state view of its appropriate functions. But Brady and the GOP don’t remotely advocate that—they can’t even get rid of the Bank of Boeing, otherwise known as the Export-Import Bank.

Thus, Washington’s fiscal fantasy is plain as day. The GOP is totally AWOL from its function as tribune of fiscal rectitude in the politics of American democracy.

So there is nothing left except an accelerating drift into eventual fiscal calamity—an eventuality which will become a certainty if the King of Debt is returned to the Oval Office.

Meanwhile, Wall Street one-upped the GOP by bidding up Boeing’s stock by 1.7% to $322 per share today on the heels of a truly disastrous Q4 earnings report. As Yahoo Finance summarized its report:

The aerospace giant swung to a core operating loss of $2.33 per share from a profit of $5.48 a share a year ago, well below estimates for EPS of $1.73. Revenue plunged 37% to $17.91 billion, badly missing views for $21.67 billion. Boeing had negative free cash flow of $2.67 billion vs. positive free cash flow of $2.45 billion a year earlier.

Commercial airplanes Q4 unit revenue sank 67% to $7.5 billion, as Boeing announced earlier this month that deliveries plunged 67% to 79 aircraft. Defense revenue fell 13% to $5.96 billion. Global services revenue fell 5% to $4.65 billion.

The backlog ended Q4 at $463 billion, down from $470 billion in Q3 and $490 billion a year ago. Boeing had negative orders for commercial jets in 2019, losing a net 87 orders vs. a gain of 893 net orders in 2018.

Boeing announced an additional $9.2 billion in charges for potential concessions to 737 Max customers, costs to produce 737 aircraft, and $4 billion in “abnormal production costs,” assuming a gradual resumption of production at low rates……Last year, Boeing booked $9.2 billion in charges related to the 737 Max, including $5.6 billion in compensation for airline customers and $3.6 billion to cover additional production costs.

To remind, prior to these catastrophic figures, Boeing’s $181 billion market cap was already valued at 48X its September LTM net income of $3.8 billion and 225X its September LTM free cash flow of just $806 million.

But after today’s release, its LTM earnings have turned into red ink and its four-quarter trailing free cash flow computes to $-4.3 trillion.

Yet Wall Street assumes that the MAX problem will be all fixed by mid-summer 2020 and all will be forgotten—including the fact that since 2013 Boeing’s foolish management cycled $63.3 billion of stock buybacks and dividends into Wall Street, even as it only earned $43.4 billion during the same 7-year period.

But here’s the thing. Max or no Max, the global market for commercial aircraft is driven by the Red Ponzi. China will make up about 18 percent of the world’s demand for new commercial airplanes over the next two decades.

That translates to about 7,700 airplanes solely for Chinese customers; and when it comes to certain aircraft body types the China ratio is far higher. For example, about one-third of Boeing 737 orders are attributable to China.

So the question recurs. Aside from China’s towering $40 trillion debt, its massive malinvestment in empty apartments, unused public infrastructure, ghost cities, empty shopping centers, endless redundant industrial capacity and now the raging coronavirus and the Donald’s far from ended Trade War against the Red Ponzi, what could possibly go wrong?!

Finally, the Donald joined the Fantasyland party, too, declaiming that the USMCA replacement for NAFTA was more important than the invention of sliced bread:

The USMCA is the largest, fairest, most balanced and modern trade agreement ever achieved. There’s never been anything like it….USMCA is a massive win for American manufacturers and auto workers!…… USMCA is a cutting edge state of the art agreement that protects, defends and serves the great people of our Country. Promises Made, Promises Kept!

Actually, nothing of the kind. The Donald’s ballyhooed deal is just the old NAFTA with a new name, and some marginal adjustments that will be much appreciated by Mexican workers, who will get a big pay raise, but do nothing at all for the US economy.

Specifically, the Mexicans and Canadians agreed that 75% of parts for cars they build for export within North America would be made in North America in order to qualify for duty-free treatment, as opposed to 62.5% under NAFTA.

But US and Canadian made autos already exceed the 75% North American content threshold. So any increased use of North American parts will happen in Mexico and benefit Mexican workers, while raising the Mexican export price on assembled, finished vehicles sent to the US.

In the alternative, Mexican based auto assemblers can pay a 2.5% tariff on passenger cars if they do not meet the 75% standard, which will again raise export prices to the US and be paid for by US consumers.

In fact, the Center for Automotive Research, an industry-funded think tank estimates that the changes to NAFTA’s auto rules would prompt manufacturers to pay the 2.5 percent tariff on anywhere between 46 and 125 different vehicle models.

Likewise, the new USMCA requires that 40%/45% of North American-built cars be produced by workers earning at least $16 per hour by 2023. That too will do nothing for US or Canadian wages which are much higher than $16 per hour, and, of course, that’s, assuming that government decreed wage rates are a good idea, which they are not.

But the fact is, average hourly wages in Mexican vehicle sector were about $3.38 in 2015 and are probably less today because the Mexican peso has completely tanked. So workers toiling in Mexico’s vast auto assembly and parts factories owe the Donald a big thank-you, but that’s about it.

In fact, the only other material provision that can even by firmly estimated—everything else is process-oriented K-street trade palaver—is the slight opening of the Canadian dairy industry to US exports.

But it doesn’t amount to a hill of beans in the scheme of things. In the most recent year, American farmers exported about $233 million worth of dairy products to Canada. The Donald’s deal will require a 3% share of its domestic market., adding up to about a $70 million gain, at best.

Unfortunately, our trusty hand calculator does not have enough decimal places to calculate the impact of $70 million of Wisconsin cheese and dewatered milk on the US $21.5 trillion GDP.

The rest of the deal is essentially special interest nits and nats, such as this boon to South Dakota wheat farmers:

“The agreement provides for a new Canadian grain grading policy that allows U.S.-grown wheat of varieties registered in Canada to receive an official Canadian grain grade so that country of origin statements on quality certificates are no longer required.

Wow!

Finally, we will let B-Dud, former head of the New York Fed and Goldman Sachs’ designated insider, speak for himself:

The notion that the Fed’s actions are fueling a stock market bubble isn’t supported by how the Fed’s T-bill purchases are affecting short-term interest rates or how the Fed’s actions are increasing liquidity in the financial system. Third, there is a more obvious explanation behind the stock market’s rise: the prospect of a sustained economic expansion and a Fed that is likely to stay on the sidelines and not raise its federal funds rate target in 2020.

As the venerable Albert Edwards exclaimed:

“Incredible. What planet do these guys live on? Before each and every bubble bursting policy makers deny 1) there is a bubble and 2) after it bursts that they bear no responsibility for the mess. I thought Bernanke was the worst offender but….

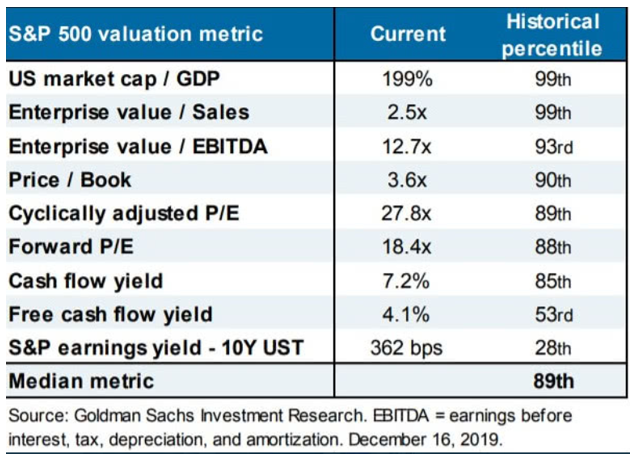

As to the meme repeated endlessly during the attempted rebound of the last two days insisting that markets are not extended, let alone in bubble land, this chart also more than speaks for itself.

As we said, Fantasyland is alive and well at both end of the Acela Corridor.