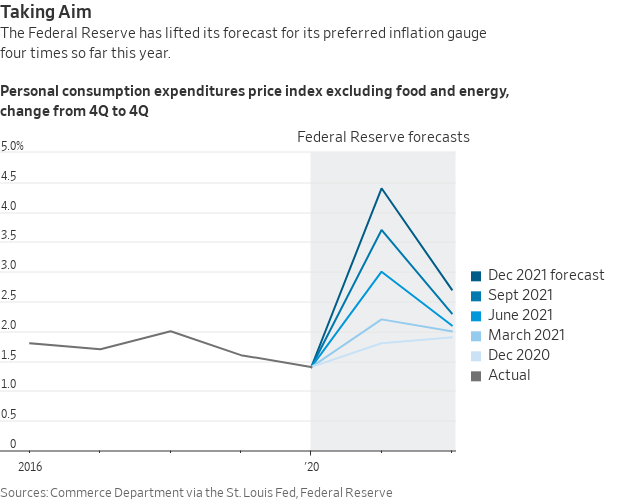

We start with a “geniuses at work” report in honor of the Fed’s latest punt. We are referring to the inflation forecasts the Fed has issued since December 2020, when it originally guesstimated a Q4/Q4 PCE deflator (ex food and energy) gain of 1.75% for 2021. That is to say, still another year of that “lowflation” bother.

Alas, the past 12 months have brought a bother, but not of the lowflation kind. Accordingly, the Fed has been crab-walking its forecasts backwards ever since, with yesterday’s guess coming in at 4.45%!

And, remember, their latest policy tool is “forward guidance”, which implies they know where the US economy is heading and are guiding it along its optimum path.

What unadulterated tommy rot!

As the astute Gary Kaltbaum remarked in response to yesterday’s Fed meeting:

And lastly, before anyone believes Mr. Powell just turned into Paul Volcker. Rates are still at 0% with the man still printing at a run rate of $100 billion/month. That number is still higher than Mr. Bernanke’s money printing when the financial system was in the depths of h—!

Let us also not forget, since Mr. Bernanke started his grand experiment of money printing, our debt has gone up about $19 trillion. Think about that. It took this country’s politicians since day one of the this great U.S. to get to $10 trillion of debt but only another 13 years to add another $19 trillion. Easy money anyone?

Not surprisingly, they were at it again today. With the Fed still printing at a $1.2 trillion annualized rate, neither side of the bipartisan duopoly objected much to another steep increase in the public debt ceiling.

The GOP Senators pretended to complain heatedly, of course, but 14 of them bent over so that the Dems could have their way with the 60-vote filibuster rule.

And in a flash Sleepy Joe had signed a bill authorizing another $2.5 trillion of borrowing. So by the time the next phony “default” crisis comes along shortly after the mid-term elections, the public debt will be in excess of $31.5 trillion.

In a word, the public debt is going parabolic. Compared to the newly approved $31.5 trillion limit, as recently as Q1 2012 the public debt was only half that ($15.6 trillion); and only one-quarter of that in Q1 2005 ($7.8 trillion).

Alas, it was just 3% ($930 billion) of the newly inked limit when Ronald Reagan came to town in January 1981 to slay the monster of the public debt—a figure which amounted to just 31% of GDP (brown line) compared to today’s 123%.

Public Debt And Debt As % of GDP, 1975-2021

It is no exaggeration, therefore, to say that during the last four decades the nation’s public finances have been turned upside down, and at the worst possible time in terms of America’s demographic cycle. Back then, 78 million strong backs of the Baby Boom were just entering the work force.

And while the deserved a better fate than to function as tax serfs, they at least had the capacity to carry a higher burden of taxation had it been thrust upon them.

As it happened, however, the Baby Boom’s politicians have chosen a different route these past forty years: Namely, to spend for a vast expansion of both the Warfare State and the Welfare State, albeit with a lower burden of Federal taxation than existed in January 1981.

As shown below, Federal taxes amounted to 19.4% of GDP in 1981. That figure has trended irregularly lower ever since, posting at just 17.6% of GDP in 2020.

Obviously, what happened is that the Baby Boomers collectively decided to tax the next generation rather than themselves—and now the debt route to public finance is accelerating at a frightful pace.

Federal Tax Receipts As A % Of GDP

Indeed, the debt route has now become the easy peasy choice of first resort. Today’s elected politicians just don’t give a flying f*ck because the Fed has so drastically suppressed interest rates that they do not feel the cost of borrowing: Not in the net interest line of the Federal budget or out on the hustings where their business, homeowner and consumer constituencies can borrow at will for comparatively meager rates and with no crowding out pressures from Uncle Sam’s once and former sharp elbows whatsoever.

Still, we have surely reached the point of near criminal negligence at the Eccles Building. Even as Powell was jawing-on about how the Fed would not raise interest rates by even a single basis point until the taper was complete, this is what he was sweeping under the rug.

That’s right. Soaring double-digit price increases from coffee to copper, but JayPo still has the Fed funds rate pegged at 8 basis points. And that’s just plain insane!12-Month Change In Major Commodity Prices:

Coffee:+87%Lumber:+57%Gasoline:+57%Heating Oil:+50%WTI Crude:+48%Brent Crude:+46%Natural Gas:+42%Cotton:+40%Corn:+37%Sugar:+33%Aluminum:+32%Wheat:+26%Copper:+18%Soybeans:+7%CPI:+6.8%

For want of doubt, consider what pegging rates on the zero bound has meant for the real cost of overnight money in the Wall Street casino. As of November, the latter stands at a record -680 basis points, meaning that the carry trade gamblers think they have died and gone to easy money heaven.

Needless to say, the current madness is the culmination of an interest rate repression spree that has been going on virtually continuously since the financial crisis in late 2008. As shown in the chart below, during the 167 months since then, the real funds rate has been negative in 143 months or 86% of the time.

Is it any wonder, then, that Powell’s double-talk during his presser yesterday ignited a 101 point rally in the S&P 500?

Literally, that was an unbelievable response to the first quasi-rational policy intent Powell has uttered during his misbegotten tenure. What yesterday’s “look ma, no hands” ramp meant was that the Fed generally, and Powell especially, have shown themselves to be such a pusillanimous mark for Wall Street pressure that the gamblers no longer believe a word they say.

Indeed, notwithstanding our minimum low regard for the intelligence of the average member of the US Congress, it appears that the time has come to slightly amend the Mark Twain aphorism that has echoed across the ages. As the Sage of Hannibal would have said,

“Reader, suppose you were an idiot. And suppose you were a governor of the Federal Reserve. But I repeat myself.”

Real Federal Funds Rate, December 2008-November 2021

Of course, all of this furious money-printing has been done in the name of goosing the growth rate of GDP, jobs and consumer spending. But even the fiscal bacchanalia of the past 18 months is apparently reaching its end-point.

That much was evident in this week’s retail spending report for November. As shown in the chart below, inflation-adjusted spending soared by 19% between February 2020 and the final March 2021 Biden blow-out of stimmies. That number was off-the-charts of history and a measure of the reckless “borrow and spend” that was generated by the Covid Hysteria and Lockdowns.

But since March 2021, the story has shifted dramatically. The stimmies and temporary build-up of household cash have rapidly played out, on the one hand; and, on the other, household closets, dresser draws, garages and rented storage spaces are stuffed to the gills with Amazon delivered merchandise purchased during the Covid spend-a-thon.

Accordingly, in inflation-adjusted dollars, retail spending in November was actually 4% below the March 2021 peak, and the roll-off is just getting started.

So what comes next is a faltering GDP and a broadening and soaring tsunami of inflation.

Inflation-Adjusted Retail Sales, October 2019-November 2021

And that means the Fed will have no choice but to unexpectedly permit interest rates to rise considerably, meaning, in turn, big time trouble for the unhinged stock market. As the always cogent Bill Blain observed in his morning missive:

Stock markets are not at record levels because of productivity gains or soaring earnings, but because money has been overly cheap and central banks accommodative – fueling the rally. Mean reversion is not a risk – it’s a rule.

- Credit spreads don’t reflect current real risks, which will magnify as rates rise – Credit Markets are my number one pick for a chronic liquidity crisis.

- Too much easy money and minimal returns have fueled massive speculation, financial asset inflation, crushed returns and is generating a pensions crisis.

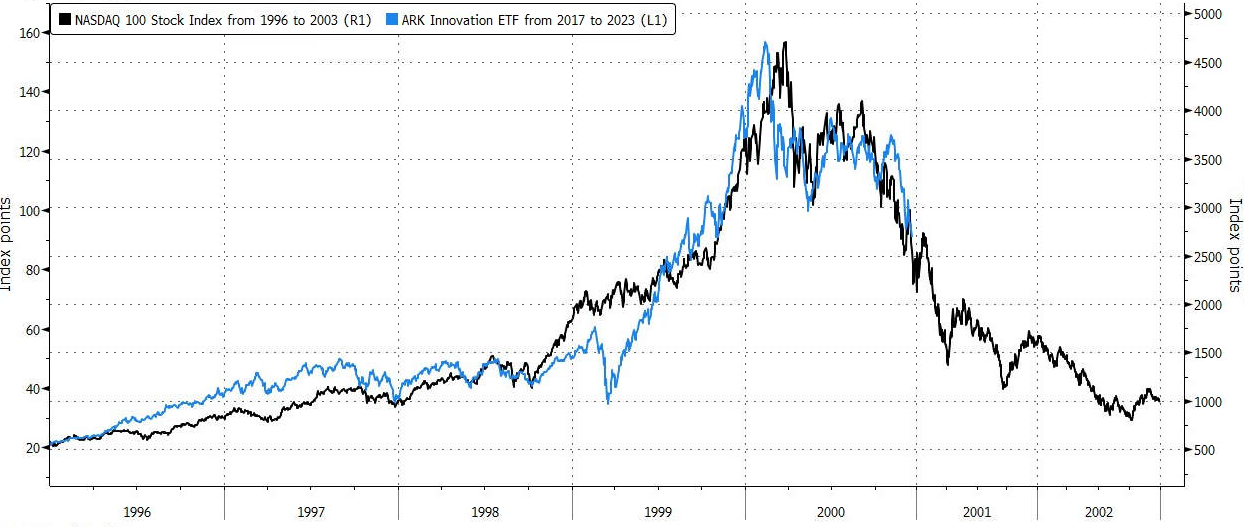

The chart below compares today’s poster-person of unhinged speculation, Cathie Wood, with the path of the dotcom rockets between 1996 and 2003.

Needless to say, Wall Street has been warned. And, again, to doubtful avail.