You do not need to tip-toe through the tulips to espy the irrational exuberance that Keynesian central banking has implanted in the global financial system. It is blatant, omnipresent and gets more hideous by the day.

Today’s flavor is that the dubious sovereign bonds of Argentina are crashing again. As Bloomberg noted, yields have crossed the 20% barrier and the implied probability of default now stands at 60% compared to 23% a year ago— and that’s notwithstanding the massive IMF bailout package in the interim:

This week’s declines mark a setback for a country that weathered a market rout last year when it scored a $56 billion lifeline from the International Monetary Fund. Now the economy is back in recession, inflation is above 50 percent and investors are concerned Macri will lose October’s presidential election, with former president and populist Cristina Fernandez de Kirchner rising in the polls. The crisis prompted Macri to announce price controls on food products last week that some analysts said smacked of panic.

Then again, why in the world are there any Argentine dollar bonds available to crash (again) in the first place? The country has been a serial defaulter (8 times) for upwards of two centuries including the largest sovereign default in history in 2001; and during the last 50 years has been an ungovernable fiscal and monetary basket case presided over by an alternating cast of populists, authoritarians and crooks.

So how in the name of the economic gods did Argentina sell $2.75 billion of 100-year bonds on the international dollar market two years ago at a 7.13% yield, which bonds are now trading at 68 cents and circling the drain with renewed energy?

On an honest free market, in fact, these 100-year bonds would have been unsalable, period. They got placed solely because the central banks have seeded the financial system with marauding bands of desperate, yield-hungry asset managers who will apparently buy anything that promises to help beat their benchmarks.

To be sure, they undoubtedly assume that they will be the first to ascertain any untoward news and to unload their toxic cargo to the next greater fool before their enhanced coupon is completely consumed in principal losses.

But even that rationale is evidence of the sweeping financial deformations that have been wrought by the central banks: That is, fund managers essentially bought the ludicrous 100-year Argentine bond on the theory that they can out-trade the market on a week-to-week basis, the long-run fundamentals be damned.

Of course, that’s not investing; it’s gambling. It is why the money and capital markets have been reduced to wagering casinos, and it’s also why global growth is being slowly suffocated everywhere on the planet.

To wit, if you do not have an efficient, disciplined, free markets for money, debt and risk assets—you will end up massively wasting real economic resources in unproductive investments and rent-seeking speculations.

Since these bonds were issued at a discount in June 2017 at 90% of par, the loss to date is 24% and there is still 98 years to go!

But never mind—because that is exactly the point. Whether they intended it or not, central bank interest-rate pegging and yield-suppression (through QE) has turned the bond pits from places where investors and savers meet to discover economic prices into venues where traders and speculators try to kill each other until either the bonds are redeemed or they are ridden all the way down the rabbit-hole to default.

That much is evident in the street chatter about the latest plunge in the Argentine bonds. As mentioned above, it appears that Argentina’s latest and greatest economy-wrecker, former president Cristina Kirchner, is leading over the incumbent market-oriented reformer Mauricio Macri in the polls for the next election, and that almost everything economic is going south at an accelerating basis.

As Bloomberg noted this AM, even after Macri’s so-called reforms and the $55 billion loan,

The IMF bailout has done little to stabilize Argentina. Inflation, the top issue on voters’ minds, hit nearly 55 percent in March, the highest level of Macri’s presidency, and the peso is down 16 percent this year, by far the worst in emerging markets.

Central bank officials have pulled out all the stops to reel in inflation, to no avail. Interest rates have risen to 68 percent, the highest in the world, as policy makers freeze the amount of money in circulation

But those warnings to get out of dodge and stay out of the bonds get short-shrift in the so-called EM bond markets. Instead, the speculators who dominate these venues simply wheel to-and-fro looking for the next lower entry point from which to scalp short-term gains.

“Valuations are very attractive, but this volatility is hard to stomach,” said Graham Stock, a senior strategist at BlueBay Asset Management in London.

Strategist? Attractive valuations?

Here’s the thing. After-markets are supposed to continuously update the value of securities once issued and provide liquidity for investors needing to adjust or liquidate their portfolios.

But when secondary markets get turned into yield-chasing gambling joints, it is impossible to correctly price new issues. It opens the way to the sale of new bonds like the 100-year Argentines that should never have been issued in the first place, and which have only subsidized Argentina’s broken political system and insistence on living high on the hog with borrowed money.

Needless to say, we think no one should cry for the bond fund PMs who have been losing their lunch in the last few days after apparently finding themselves to be the Greater Fool upon whom they had planned to fob off their holdings. Undoubtedly, they have lost their 7.13% coupon and then some and maybe their investors and possibly their jobs—-yet Los Vegas beckons if worse comes to worst.

Indeed, the asset managers in the great global $180 trillion “market” in bonds and equities owe both their random triumphs and tribulations to the ultimate Great Fools: That is, the several hundred PhDs, ex-bankers and government apparatchiks that run the major central banks, and, thereby, the entire global financial system.

When you cut to the chase, the vast deformations which they are inflicting upon financial markets stem from taking the wholly erroneous and inherently destructive idea of interest rate pegging to its illogical extreme. That is, driving rates and yield curves ever closer to their zero bound on the misbegotten theory that there is insufficient inflation being reported in the random goods and services price indices they have chosen to target.

In the first place, there actually isn’t any inflation deficiency—even if the vaunted 2.00% level where an appropriate policy target, which it isn’t.

Thus, since 2012 when the Fed formally adopted the 2.00% target, the 16% trimmed-mean CPI (which eliminates the most volatile high and low change items each month) has hugged almost on top of the 2.00% line, while in all years except 2015 the PCE deflator ex-food and energy hovered between 1.5% and 2.0%.

During 2018, in fact, the trimmed-mean CPI posted at 2.132% versus prior year and the PCE deflator less food and energy came in at 1.895% over prior year. If you are keeping score at three decimal places (absurd) and average the two, the number comes in about as close as you please to target at 2.014% versus 2017.

Now, either the monetary monks at in the Eccles Tower aver that the PCE-deflator is the one and only index that can be used—among the dozens of arbitrarily measured and weighted general inflation indices that are available from the government statistical mills—or they are just forum shopping looking for an excuse to keep interest rates pressed to the floorboards.

Likewise, they already admit that monetary policy works with a 6-12 month lag (we doubt it “works” at all). So surely the annual rates of change shown below give no indication whatever that the slight, statistical misses from the 2.00% target have had any systematic trend toward the down side.

Actually, when it comes to the numerate mumbo-jumbo the Eccles Building seems to favor, the annual PCE deflator (ex-food and energy) in 2012 was 1.8966% higher than prior year and in 2018 it was 1.8945% higher. That’s four decimal places of the same thing, meaning that you really do need a magnifying glass to see any trend at all.

Finally, when you don’t have an inflation trend to the downside—even using the Fed’s preferred measures as below—the issue is reduced to the proposition that the difference between 1.5% and 2.0% of annual goods and services inflation matters, and that the central bankers are justified in leaning hard on pricing in the money and capital markets to remedy fractional shortfalls.

Except, of course, there is not a shred of proof anywhere that the tiny so-called inflation “shortfalls” shown below make any difference whatsoever when it comes to GDP growth, jobs, real incomes and wealth creation. It’s all academic gibberish and make-believe—-the modern equivalent of medieval scholars debating the number of angels that can fit on the head of a pin.

Still, that is exactly what the monetary priesthood at the Fed is doing. As we have frequently pointed out, during the entire 123 month stretch between April 2008 and November 2018, the inflation-adjusted Federal funds rate was zero or negative.

Anyone who has even a passing acquaintance with financial markets and the art of the carry trades recognizes intuitively that negative real interest rates are the mother’s milk of speculation; and that the longer they persist, the more extensive is the subsidy for carry-trade gambling.

But not the Fed heads. Here is one of the leading Keynesian nincompoops, Charles Evans of the Chicago Fed, arguing that after a few months of marginally positive money market rates (25 basis points at present) 11-years on from when they first went negative, it’s now time to cut the federal funds target again:

“I think the answer has to be yes,” Evans said, when asked if low inflation could be grounds for a cut. “If core inflation were to move down to, let’s just say, 1.5 percent,” that would indicate the current level of rates “is actually restrictive in holding back inflation, and so that would naturally call for a lower funds rate, at least so that it was accommodative.”

It truly doesn’t get more idiotic than that. Whatever the Fed has been doing or not doing in the last few months has had virtually zero impact on short-run inflation run rates. Inflation is globally transmitted and the various inflation indices are crude approximations riddled with short-term bumps, grinds and idiosyncrasies.

When push comes to shove, of course, even the Fed heads struggle to keep a straight face when it is pointed out that the two indices above—both of which effectively remove the volatile commodity elements of food and energy—have a blended average increase of 1.8% over the seven years since inflation targeting has become a formal regime.

Since the Great Recession and financial crisis was already well in the rear-view mirror during this entire period, and since the stock indices had already recovered to their October 2007 peaks at its on-set, only one thing that can possibly explain why the Fed delayed, dithered and defaulted on the business of normalizing rates and balance sheets for more than seven years.

Namely, like the medieval monks, they were chasing meaningless 0.2% inflation shortfalls—and essentially theoretical shortfalls at that. After all, the BLS inflation indices are essentially academic constructs bedecked with hedonic adjustments and geometric mean correction factors which at the end of the day are completely arbitrary.

Needless to say, that’s why the Fed heads have brought a second cover story front and center in recent years.

We are referring to the dodgy notion of “r-star” or the purported god-given neutral rate of interest that is the alleged north star for the Fed’s endless tinkering with and pegging of the Federal funds rate.

In the great scheme of bathtub economics in one country, our Keynesian central planners claim to drive the entire $21 trillion GDP toward the nirvana of Full-Employment and full realization of “potential” GDP. This is accomplished through policy “accommodation” (95% of the time) that takes it just to the brim, or policy “restraint” when it overflows the tub of potential GDP (occasionally in the distant past and almost never anymore).

And guess what? The degree of accommodation or restraint is allegedly measured by the degree to watch the federal funds target for any given month is above or below r-star.

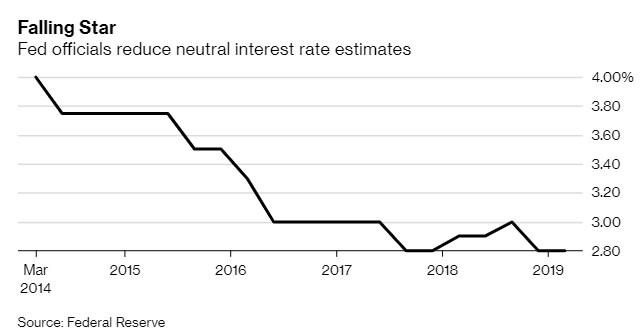

Now if r-star were something fixed like the north star, or the speed of light or even the qualitatively enduring injunctions like the 10 commandments, it would be one thing. But as shown below, r-star is a wholly invisible, arbitrary and ever changing constant (!) that essentially can only be known by the high priests in the Eccles Building and their retainers and acolytes in academia.

That right. Just in the last five years, the consensus of opinion(sic) on the Fed as to the quantitative value of r-star has plunged by 30%.

Some north star!

Then again, we know the reason why r-star is actually the policy constant which isn’t. By the lights of the 2014 consensus value of 4.00%, monetary policy has been wildly “accommodating” and “stimulative”.

But the Fed wanted to pretend that is was deftly withdrawing the accommodation after a 10 year recovery without roiling the boys and girls and robo-machines in the casino—of which they have a deathly fear.

So instead of raising the water level (interest rates), they lowered the bridge (r-star). And like so many angels on the head of a pin, the “accommodation” was allegedly gone.

No it wasn’t. Just like it 2.00% inflation obsession, the Fed’s r-star mumbo jumbo amounts to blithering idiocy, and it all leads to the rollicking asset inflations and speculative deformations that have engulfed the global financial system.

In a word, they have no idea what they are doing and are making-up academic gibberish as they go—always and everywhere trying to keep the obvious bubbles from blowing and the casino’s next hissy fit at bay.

They won’t succeed, of course, no more than they did in 200o-2001 and 2008-2009. And in that context, the Argentine 100-year bonds are only today’s symptom of a financial system gone off the rails.

As earnings season reaches it peak, the rails are getting shakier by the day—meaning there is a lot more madness fixing to blow.