This morning’s incorrigible dip buyers were a wonder to behold. Exactly how did they think this Ukrainian fiasco is going to end without a severe global recession that will leave the central banks paralyzed: Hanging by their own petard, as it were, from the rafters of double-digit inflation?

In all the years since 1945 there has truly never been as bad a macroeconomic scenario as currently looms over the global economy. That’s because the central banks and the Warfare State are now finally on a devastating collusion course.

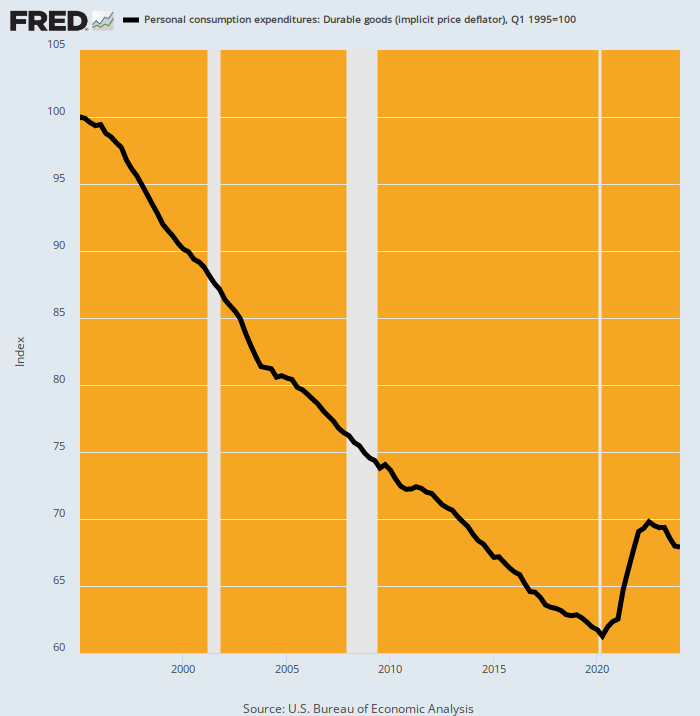

On the one hand, central banks have fueled a massive inflationary bubble that was temporarily kept out of the goods and services sector. That was owing to a one-time global deflation on the labor markets as supply chains were sent racing lickety-spit into the cheapest nooks and crannies of the global economy over 1995-2019.

The 40% collapse of durable goods prices during that period tells you all you need to know. It was both unsustainable and a statistical ruse that gave the false appearance of “lowflation” overall.

PCE Deflator For Durable Goods, 1995-2021

At the same time, the Washington war-mongers have now gone absolutely ape-sh*t with their anti-Putin Sanctions War on the global trading and payments system. The effect will be an end to the dollar-based supply chain expansion and deflation of the past two decades and its replacement by worldwide supply chain contraction and the inherent inflationary pressures of autarkic economics.

Yet the apparent assumption on Wall Street is the the Ukraine imbroglio is just a temporary distraction, which will soon be over when the heroic resistance of the Ukrainian people forces Putin to give up the ghost and head back to Moscow, tail between his legs. With Washington having prevailed, in turn, the sanctions regime will be lifted and global trade, including the Russian commodity trades, will resume as normal, with Moscow toeing the line under a chastened Vlad or his successor.

Fat change of that, however. Indeed, if you don’t think a hair-curling, market-bashing recession is on the way you actually have to be delusional enough to believe that something like the November 1918 armistice is coming down the pike. That is, an end to the Ukraine war via a final western imposed settlement on Russia, including reparations to Ukraine for the massive damage now being visited upon the country by Putin’s invasion.

Of course, that’s completely bonkers—at least outside the confines of the disinformation cocoon inhabited by CNN, NBC and the rest of the MSM. The truth is, Russia is going to prevail in a matter of weeks and impose its terms. These include retention of Crimea, separate states in the Donbas or even the full extent of Ukraine east of the Dnieper River (i.e. “New Russia”) and a demilitarized rump state to the west which forswears by its amended constitution any future alliance with NATO or the west.

And the evidence for that outcome is plain as day via what might be termed the Ukrainian dog that isn’t barking. That is to say, where is its air force?

Gone.

Where is its Navy?

Gone.

What has happened to its Army, especially the Nazi militias such as the Azov Battalion which were incorporated into it main units?

They have been drawn and quartered into isolated segments, with each segment encircled in classic cauldron formations by the Russian army, waiting for their death sentences to be administered.

So how in the world can Russia not win, when it is now damn clear (fortunately) that Washington/NATO will not intervene militarily, thereby provoking a hot war with the world’s other principal nuclear power?

The fact is, there will be no “no fly zone”; no fleet of 50-year old Polish MIG-29s; and no further major surge of western tactical weaponry after Saturday’s demonstration near Lviv that Russia now means to destroy from the air new NATO supplied anti-tank and anti-air weapons as soon as they cross the border.

Needless to say, this means Russia will prevail militarily. But once Kiev succumbs to the above described settlement, Washington will lapse into a whirlwind of furious denial and escalating sanctions rage.

Foremost among these further strikes at the global economy that will be “secondary sanctions” against any nation perceived to have undermined the primary sanctions against Putin and to thereby have enabled him to escape Washington’s condign punishment for daring to safeguard his borders and national security from the relentless encroachments of NATO.

As shown below, Washington has declared a Sanctions War Party and most of the world outside of Europe (gray areas) has refused to RSVP. So even before Ukraine’s looming military defeat becomes a reality, Washington is already threatening “secondary” sanction, as it did over the weekend against China:

“If China does choose to materially support Russia in this war, there will likely be consequences for China,” the defense official said. The White House says there will be “consequences” for China if this occurs and the State Department that “we will ensure that no country is able to get away with trying to bail out Russia”.

It doesn’t take much imagination to recognize where secondary sanctions would lead: Namely, to a cataclysmic breakdown of global trade and finance that is scarcely imaginable.

Washington’s Anti-Russian Sanctions Party Got Few RSVPs

Moreover, it is becoming more obvious by the day that sanctions are a two-way street. With global grain prices already at record levels owing to the 25% market share bottled up in the Black Sea, Russia’s Minister of Industry and Trade announced his nation is suspending fertilizer exports.

The market is already in short supply, prices have surged. Russia is the world’s largest fertilizer exporter, accounting for 18% of the potash market in 2017, 20% of ammonia exports and 15% of Urea.

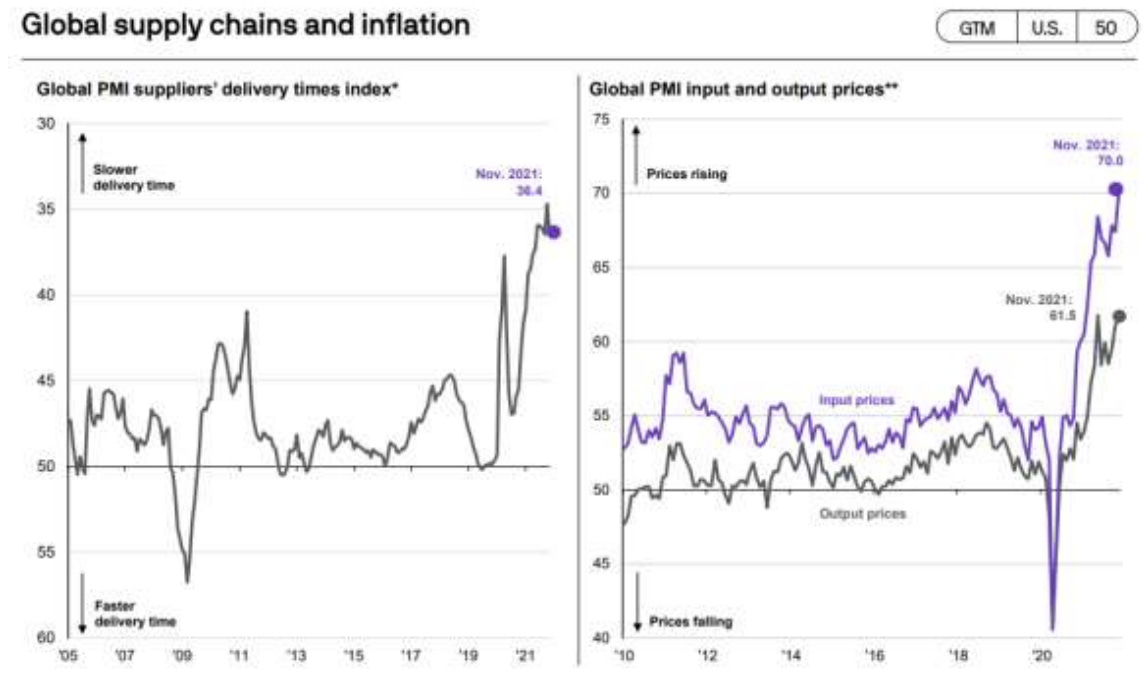

To appreciate the distinct impact of the Russia-Ukraine conflict, it’s important to recognize that these unfolding autarkic trends long predate the war, and indeed even the pandemic. An analysis published by the WTO, for example, shows that at the time of the 2008 financial crisis, fewer than one per cent of merchandise imports were impeded by mechanisms introduced by governments of the world’s top 20 economies. In 2019, on the eve of the pandemic, this figure had expanded more than tenfold to hit over 10 per cent of trade.

In any event, global supply chain disruption is already well underway: Delivery lead times are already back to record levels, while input and output prices tracked by global PMI surveys are now up by 63% and 70%, respectively, on a Y/Y basis. And this is just the warm-up compared to what is likely to follow when Washington seeks to avenge its impending humiliating defeat on the battlefield in Ukraine.

One of the next shoes to fall on the domestic inflation front is in the cost of shelter, which accounts for 31% of the weight in the CPI. In a paper issued last month, researchers from the International Monetary Fund and Harvard Kennedy School of Government used market housing and rent data from Zillow and CoreLogic to project housing inflation into the future — and it wasn’t a good look!

All told, inflation from owners’ equivalent rent can be expected to climb from 3.8% in 2021 to 6.3% in 2022, and it will stay elevated at around 5% in 2023, according to the IMF’s Marijn Bolhuis, independent researcher Judd Cramer and Harvard’s Lawrence Summers.

Accordingly, the 14-year high in primary rents (which pass thru to the OER calculation as well) reported in the February CPI is just hitting lift-off. It alone will keep the CPI above 6%—to say nothing of the pass through of raging commodity and global supply chain inflation.

Meanwhile, the Fed is stuck pathetically behind the inflation curve. This excellent chart from Wolf Richter tells you all you need to know. That is to say, when the Fed is finally forced to catch-up with multi-hundred basis point increases in interest rates, it will be all over for the dip-buyers except the shouting.

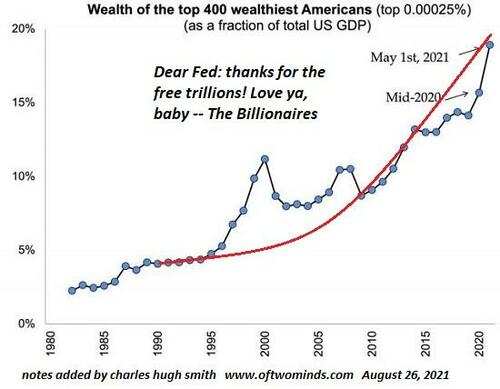

It will also usher in a day of reckoning for the 1% and the 0.1%. Indeed, during the Fed’s three decade long print-a-thon the net worth of the wealthiest 400 Americans has exploded from 3% of GDP to nearly 20%.

Needless to say, that wasn’t the free market at work meeting out rewards to the “makers”. It was simply the consequence of a massive inflation of financial assets that has brought the US economy to its present precarious estate.