Baghdad Bob Pisani finally got it right today when he noted that during the previous 10 hours the Dow futures had been on a vertigo-inducing roller-coaster.

The index had first dropped by 400 points in the wee hours last night; it then exploded upward by 800 points into the market open thru midday; and at the time of his report (2PM), it had plunged back down by 600 points after the headline on the Nassau County 83 (of self-quarantines, not infected cases) hit the tape.

As to the reason for this violent oscillation, the Baghdad Bob of Bubble Finance cleared his throat purposefully and then succinctly remarked:

“The markets are clueless“.

He got that right—even if 2035 Dow points of Covid-19 trigged decline in just three days has awaked some of the dream walkers.

Of course, honest price discovery with respect to investment fundamentals was destroyed years ago in favor of one-decision speculation: To wit, buy the dip always and everywhere because the Fed and its fellow-traveling central banks around the world will never again allow markets to correct or run native after the trauma of 2008-2009.

Needless to say, that has been a winning “strategy” whether you bought at the March 9, 2009 bottom or the October 2007 top. The compound annualized return was 14.5% in the former case and 7.0% in the latter.

After upwards of 50 buyable dips in the broad market averages since 2009, therefore, investment strategy got boiled down to “respect the price action”. Or, more crudely, buy what’s going up.

As a practical matter, our Keynesian central bankers have relentlessly and massively inflated financial asset prices on the mistaken presumption that QE and NIRP/ZIRP actually stimulate the main street economy. But they don’t under present conditions of Peak Debt—if they ever did on a sustainable basis.

Nothing better illustrates this main street “stimulus” illusion than the explanation offered by the empty suit who currently sits in the Fed Chairman’s seat. Addressing why inflation shortfalls from the 2.00% target are bad during his January 29 post-meeting presser, Powell emitted the following drivel:

“…inflation that runs persistently below our objective can lead longer-term inflation expectations to drift down, pulling actual inflation even lower. In turn, interest rates would be lower, as well, closer to their effective lower bound.

As a result, we would have less room to reduce interest rates to support the economy in a future downturn to the detriment of American families and businesses.

We have a newsflash for Jerome. The Fed’s drastic post-crisis rate-cutting and balance sheet pumping amounted to a live fire test. But if you look at the data honestly and without the presumption that if the economy grew the Fed must have caused it, the Eccles Building’s impotence is self-evident.

So the FOMC doesn’t need to foolishly struggle to create more inflation because they don’t need more room to cut rates. At current rock-bottom, sub-inflation levels—further rate cuts don’t “support the economy”; the only thing they boost is more financial speculation on Wall Street.

The fact is, back in 2010-2011 the main street economy recovered on its own after the violent labor and inventory liquidations ordered by the corporate C-suites (to support their share prices and stock options) during the year after the Lehman event had run their course. In turn, labor and inventory restocking got the wheels of capitalist growth rolling again.

From there, the inherent tendency for capitalism to generate ever higher levels of production and investment—because workers, entrepreneurs, businessman and investors want to improve their lot—took over. It fueled a long-running, tepid expansion, albeit against the headwinds of excessive household debt and growth-stunting corporate financial engineering engendered by the Fed’s own financial repression policies.

The proof that the Fed had virtually nothing to do with the main street recovery is five-fold as we amplify in Part 2. Relative to a textbook-style springing rebound from a deep recession, there has been,

- virtually no industrial production growth,

- flat utility consumption,

- tepid labor hours growth,

- punk productivity gains, and

- stagnant real net business investment.

The truth is, the Fed’s massive attempt at economic “stimulus” never really left the canyons of Wall Street: It reflated financial assets to a farethewell, but did so at a terrible price.

That is, the already heavy public and private debt burden at $53 trillion on the eve of the crisis (Q4 2007) was quickly given a hall pass in the form of drastically lower (and falsified) interest rates. This sharply reduced the carry-cost of the US economy’s swollen debts, even as total outstandings soared to $74.6 trillion by Q4 2019.

Consequently, the aggregate leverage ratio against national income (GDP), which had hit a historic peak at 3.5X in late 2007, was not reduced at all during the last 10 years of so-called recovery. Accordingly, the two turns of extra debt relative to the historically proven 1.5X aggregate leverage ratio remained as it stood when the crisis was triggered in 2008.

By “proven” we mean the latter ratio had prevailed during the century of industrialization, robust growth, rising living standards and burgeoning wealth gains that had been extant prior to 1971. The financial discipline imposed by one form of the gold standard or another had proved itself via the undeniable capitalist prosperity on main street that materialized after 1870.

But by Q4 2019 those two extra turns of debt amounted to $40 trillion. That was the headwind to recovery.

And it’s also why the Covid-19 event is not just another public health emergency—incipient pandemic even—that is causing temporary economic havoc by disrupting the global supply chains, but which will eventually fade into the rearview mirror.

The talking heads are pushing exactly that meme, of course. That is, they argue that Covid-19’s economic impact should be given a hall pass because even though the supply chains are more brittle than they realized, government authorities will at some point contain the virus, thereby permitting workers, truckers, airline pilots, longshoremen etc. to go back to their jobs, supply chains to restart, inventories to be replenished and supply chain deliveries to return to normal.

Indeed, today we heard a permabull on CNBC taking it even one step further. Purportedly, the geniuses who run the corporate world have gotten a wake-up call and will now take steps via technology and entrepreneurial innovation to make global supply chains far more robust and shock resistant, and therefore their stocks even more valuable in the future.

Said she,

Five years from now we won’t even remember the coronavirus and the global supply chains will be more efficient and productive than ever.

Not so fast. Today’s fracturing supply chains did not materialize on Adam Smith’s free market, nor are they a testament to the wonders of comparative advantage.

To the contrary, they are the dark underbelly of the world’s $255 trillion of debt, and the massively falsified global financial markets which have been fostered by the central banks.

The problem is not the debt per se or that it bears some kind of existentially evil characteristic. The skunk in the woodpile is actually the reason why it is there in the first place and what it funded as it metastasized into today’s brobdingnagian accumulations .

In a word, the entire chain of malignancy was driven from the Eccles Building after 1987. The US economy needed to deflate from they rampant inflation of the 1970s in order to remain competitive with the mercantilist Asian economies rising from the rice paddies—most especially China after Mr. Deng choose the export route in the early 1990s and proclaimed it was glorious to be rich.

But the double-talking, adulation-craving Greenspan claimed that mere “disinflation” was enough, and eventually this got canonized by Bernanke as inflation targeting—with its sacred 2.00% increase objective. In turn, accommodation of 2% inflation blocked the natural process of wage/price/cost deflation that the US economy would have otherwise undertaken in response to what can be called the China Price challenge.

We will leave for another day the debunking of the self-serving central banker axiom that any deflation—whether competitively produced or not—is bad, and will cause economy’s to circle inexorably downward into the drain. That’s unadulterated tommyrot which the towering prosperity of Silicon Valley alone dramatically refutes.

But deliberately inflating an uncompetitive cost structure was a calamitous error that caused corporate America to spend the last three decades relentlessly out-sourcing and off-shoring production and investment to venues with lower dollar costs. Obviously, that search was especially focused on the ultra-low cost labor that was available among the hundreds of millions of incipient industrial workers previously engaged in subsistence agriculture in Asia and elsewhere in the DM world.

In fact, the Fed’s pro-inflation policy actually amounted to a double whammy. It obviously did not help the workers who got off-shored, but it also didn’t help those who managed to hang on to jobs in America.

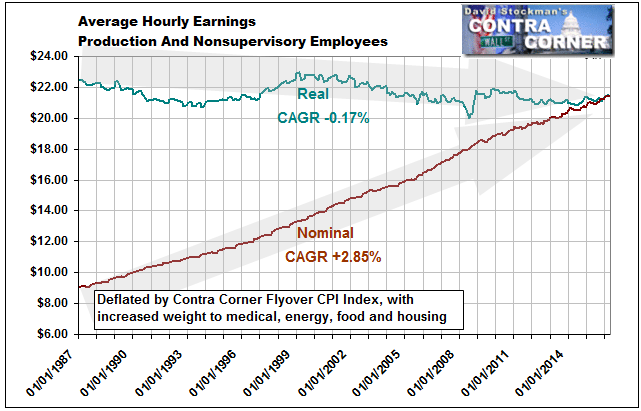

To wit, nominal wages (brown line) got inflated at an average of 2.85% per annum during the 30 years after 1987, but in real terms (green line) they actually declined slightly.

So production and jobs got off-shored hand-over-fist owing to relentlessly inflating dollar costs when there should have been dollar cost deflation, but self-evidently—as Bernie keeps reminding us—the living standards of workers went nowhere.

Moreover, there are three more twists that complete the circle of central banker folly now being uncovered by the Covid-19 fractured supply chains.

First, rice paddies do not turn into gleaming export factories overnight in a world of honest money. It takes decades and decades for developing economies to accumulate the capital needed to build a modern industrial economy.

And in a world of honest money—say the pre-1914 gold standard—developing economies could not print their way to capital accumulation on the cheap via artificial suppression of interest rate, either.

That’s because specie outflow (gold or silver) would have stopped them cold; and if they attempted to float their currencies, their FX rates would have quickly crashed into soaring, debilitating domestic inflation.

But Greenspan and his heirs and assigns broke the rules of sound money and finance. By flooding the global financial system with massive dollar liabilities owing to their pro-inflation policies, they made it possible for China, South Korea and the rest of the Asian supply chain to run ultra-easy monetary policies without crashing their own currencies.

That is, the flood of dollars should have caused China’s currency to appreciate sharply, thereby reducing its dollar cost advantage. But the People’s Bank of China and the other DN central banks soon learned to simply take a page from the Fed’s play book.

When the Fed pumped dollar liabilities into the global financial system, the DM mercantilist just pumped out their own currency liabilities. That is, they printed yuan, won, Taiwan dollars etc. in order to buy-up the excess dollars being earned by their exporters and sequestered them on central bank balance sheets, where they were dutifully disguised as FX reserves.

No, they weren’t honest FX reserves. They were just the asset side of wildly inflated central bank balance sheets. China’s, for example, has risen by more than 9X just since the turn of the century, and 40X since the early 1990s.

Balance Sheet Footings Of The People’s Bank of China

So the rice paddies got mobilized by factories built with cheap, central bank fostered debt rather than old-fashioned capital accumulation from current savings.

What this means, of course, is that much of the outsourcing to China and elsewhere which has occurred during the last three decades—-what is pejoratively called “globalization”—wouldn’t have happened in a world of honest money.

The true cost of 12,000 mile-long, inventory light, air freight-driven, JIT supply chains—even in today’s world of high speed communications and flat earth technology platforms—-was not reflected in the drive for dollar cost arbitrage and off-shoring.

Now, finally, in blunderbuss fashion, Covid-19 is already making that abundantly evident.

Even then, two countervailing forces should have at least slowed the headlong stampede into off-shoring and the fragile China-anchored supply chains upon which it was built. The dogs that didn’t bark, so to speak, were:

- Main street America, where working and middle class political revolt against the stagnation of real living standards was barely evident until Trump and Sanders finally mobilized it in behalf of ersatz populism and socialism;

- Wall Street investor discounting of labor-based earnings arbitrage (we are talking to you, Apple Inc.) owing to the hidden and latent costs of globalized supply chains.

We will address these factors at greater length in Part 2, but suffice it here to note that essentially the Fed’s Keynesian central bankers hoovered up Bread & Circuses to euthanize the natural opposition to bad money-corrupted globalization.

The Bread part is embodied in the $16 trillion of debt that households accumulated to supplant incomes based living standards, and which was facilitated by the Fed cheap interest policy.

The Circus part needs little elaboration. When you transform discriminating capital markets into gambling casinos supported by central bank liquidity floods, price-keeping policies (wealth effects) and support for decades of reflexive dip-buying, who is going to bother assessing supply chain fragility, to say nothing of pricing it into PE multiples?

At long-last, of course, Covid-19 should at least be providing a wake-up call regarding the enormous downside of today’s artificially born, bred and fueled global supply chains.

But we rather suspect that Pivoting Powell will again be making like a whirling dervish right soon.

Finding that Covid-2035 is raising doubt about the “good place” where the US economy was ostensibly resting even as late as his January 29 presser, Powell and his merry band of delirious money printers will undoubtedly try still another stick save of a rotten system.

This time, however, cauterizing and stabilizing the rotten foundation they have fostered in both the financial markets and global supply chains may well be above the pay grade of even the masters of malignant money.