This is going from the ridiculous to the sublime. After pumping $107.3 billion of freshly manufactured cash into the bond pits yesterday (via two TOMOs and one POMO), the monetary whores of Liberty Street had the red lights on again this AM.

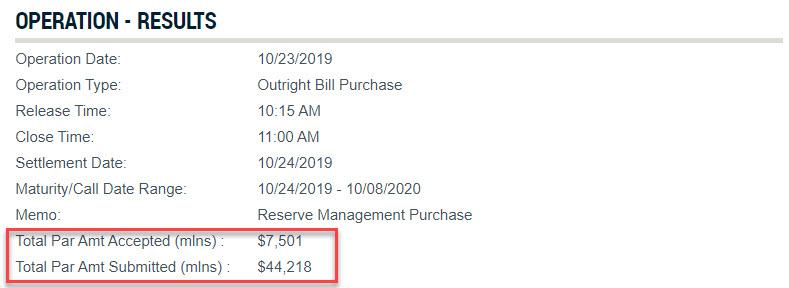

In response to its 4th consecutive $7.5 billion POMO offer, a truly lecherous throng of dealers gathered out front of the New York Fed waving some $44.2 billion of T-bills for the chance to be pleasured with instant gains.

That they were–yet the question recurs. What gives?

To wit, the current 3.4% unemployment rate is at a 50-year low and the trailing 12-month CPI less food and energy posted at 2.13% in September, which is about as close to the Fed’s 2.00% target as you please. Those two stats are supposedly the very marks of Keynesian full-employment nirvana, but the denizens of the Eccles Building are pumping cash as if its September 2008 all over again.

Indeed, right before the market close today the New York Fed posted an intention to raise the daily TOMO from $75 billion to $120 billion as of tomorrow morning and to offer four new term (14 day) TOMOs over the next two weeks with a potential of a further $160 billion of cash injections.

The wise guys on Wall Street aver, of course, that the Fed heads know something, and that something is not good. But we seriously doubt they have any clue at all about what’s coming down the pike on main street or even about what may or may not be happening down in the plumbing of Wall Street.

To the contrary, these fools unlike King Canute actually think they can shout back the economic tides. That is, they can cause interest rates to obey their commands by purchasing as much government paper as it takes to balance supply and demand at the precise money market yield embedded in their current policy target.

Never mind that this flood of cash snatched from thin air amounts to massive monetization of the public debt. And we do think that $114.9 billion of monetization in the last two days qualifies both as “massive” and also likely as permanent.

That’s because today’s TOMO announcements make clear that the Fed attends to do a monetary Proud Mary and keep on rollin’ these TOMOs over and over on a river of permanent liquidity.

In any event, the implied annualized run rates of the currently announced TOMO’s and the $60 billion per month of T-bill POMOs adds up to more than $1 trillion.

Of course, this isn’t QE or even monetary policy according to the Fed. In fact, it claims there is nothing to see here except some monetary technicians at work nudging and smoothing the money markets to keep them on an even keel.

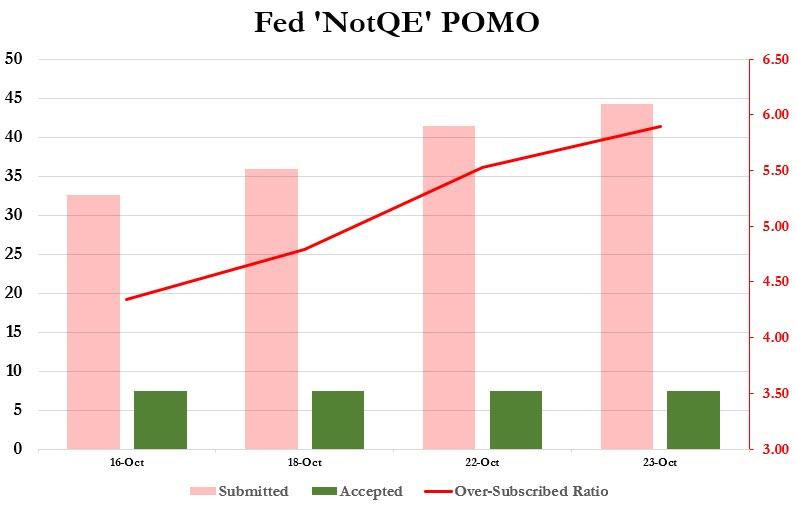

Then again, how do you explain the POMO chart below? Today the amount of T-bills offered by the street (pink bars) reached yet another high at the aforementioned $44.2 trillion or 5.7X the Fed’s actual offer.

Obviously, there is more going on here than technical “smoothing”. Yet these robotic monetary central planners have their heads down and are charging the line– utterly oblivious to a fundamental financial truth that has been known for centuries. Namely, that there is no free lunch and that when you finance the government’s debts at the printing press chronically, massively and insouciantly your are sowing the seeds of ruin.

And not just because it insures that politicians will bury the state under unsustainable debt eventually. In the here and now, massive monetization also unleashes the speculative juices in the trading pits because it invites get-rich-quick front running. That is, the buying early of whatever the lumbering central bankers have announced or telegraphed they will be buying next.

In the case at hand, the clueless Fed heads have effectively told the gamblers they will not brook with any dissenting rates across the entire multi-trillion range of money market and repo sector transactions—even at month-end and quarter-end. That’s when beat-the-regulators window dressing inherently roils the markets and causes repo and other financing rates to rise as regulated institutions and publicly reporting companies look for safe places to temporarily park their financial hot potatoes.

Needless to say, this is October 23—a calendar point at which no windows have historically been dressed.

So what is happening is not at all technical or temporary. With each passing POMO offer of “Not QE4”, the oversubscribed rate has climbed steadily higher, rising from 4.3x to 4.8x to 5.5x and now 5.7X. And what it means is that the gamblers down on Wall Street have found still another way to play the Fed.

There is plenty of evidence for that on the other side of the market and out the maturity curve. Indeed, if you didn’t know any better, you could get whiplash looking at it.

Thus, when the US Treasury came to the sell side of the market yesterday to place 2-year notes it was met with bundles of outstretched arms bearing huge chunks of cash. That is, traders of government paper wishing to buy, not sell.

So when the digital dust had cleared, Uncle Sam walked away with $40 billion of fresh cash from the $107.8 billion offered, and did so at a median yield of just 1.56%.

That’s right. The yield which cleared the two-year market was 29 basis points below the Fed’s pegged overnight funds rate at 1.85%. In turn, that so-called “policy rate” stood well above today’s–

- 10-year UST yield at 1.769%,

- 7-year at 1.679%,

- 5-year at 1.592%, and

- the 2-year UST note which today closed at 1.575%.

At first blush, of course, this seems like a real head-scratcher. Over on the TOMO/POMO side of the market at the Liberty Street brothel, there is an implied dire shortage of cash which is pushing money market rates higher and eliciting the aforementioned flood of newly minted cash from inside the building.

Yet down in the T-bill and bond pits of Wall Street there is so much loose cash looking for a berth that the Treasury has been able to sell more than $700 billion of new paper since June 30 with alacrity and at rates which per today’s close are well below the money markets.

In truth, however, there is no real mystery. The Fed funds market trades by appointment and has been deader than a doornail since Bernanke euthanized it in the fall of 2008 in a flood of printing press cash. In fact, 80% of the trivial daily volume of about $70 billion is accounted for by government agencies—the Federal Home Loan Banks—playing financial games with their excess cash.

Therefore, in order to keep up the pretense that it is actually pegging the Fed funds rate like in the old days, the Fed pays the banking system a hideous amount of interest each year to keep its excess reserve deposited at the Fed, and thereby obeying the rate target it has ordained.

Last year the Fed paid the banks upwards of $40 billion under the so-called IOER (interest on excess reserves) program so that it could pretend to be setting and capping the essentially non-existent Fed funds rate.

The chart below, in fact, is a monument to the institutional hubris of the Fed—a complete waste of money that has no purpose and effect other than to falsely channel $1.4 trillion of current excess bank reserves into a sequestered account at the NY Fed that would not exist for an instant on the free market.

The other make pretend tool the Fed uses to peg the non-existent Fed funds rate is the so-called ON-RRR (overnight reverse repo). Under that bit of just plain idiocy, the Fed essentially brings monetary coals to New Castle.

That is, the joint that can create trillions of new cash at the flick of the digital printing press switch actually borrows cash (i.e. drains cash from the bond pits) least some rogue trader disobey the interest rate writ of the Eccles Building and offer to loan cash at a rate below the Fed’s policy targets.

Then again, in recent months the ON-RRR rate has fallen into relative dis-use and why not: It involves draining cash from the bond pits at the very time that the new TOMO/POMO facilities are flooding it in!

Indeed, the chart below is a tribute to the absolute stupidity that has infected the groupthink at the Fed. In a world of multi-trillion dollar daily money flows and state of the art trading technology, the chart below amounts to attacking M-1 tanks with a tomahawk.

In short, everything the Fed is doing in the money markets is pointless and destructive. It segments and falsifies prices, and as we have shown over and over again does absolutely nothing for the main street economy.

But on the margin all of the above described new cash does go somewhere, and that is mainly into an incremental bid for risk assets in the casino.

And perhaps that’s why the billionaire stock market gamblers have begun to come out breathing fire against the presumptive Dem nominee, Elizabeth Warren.