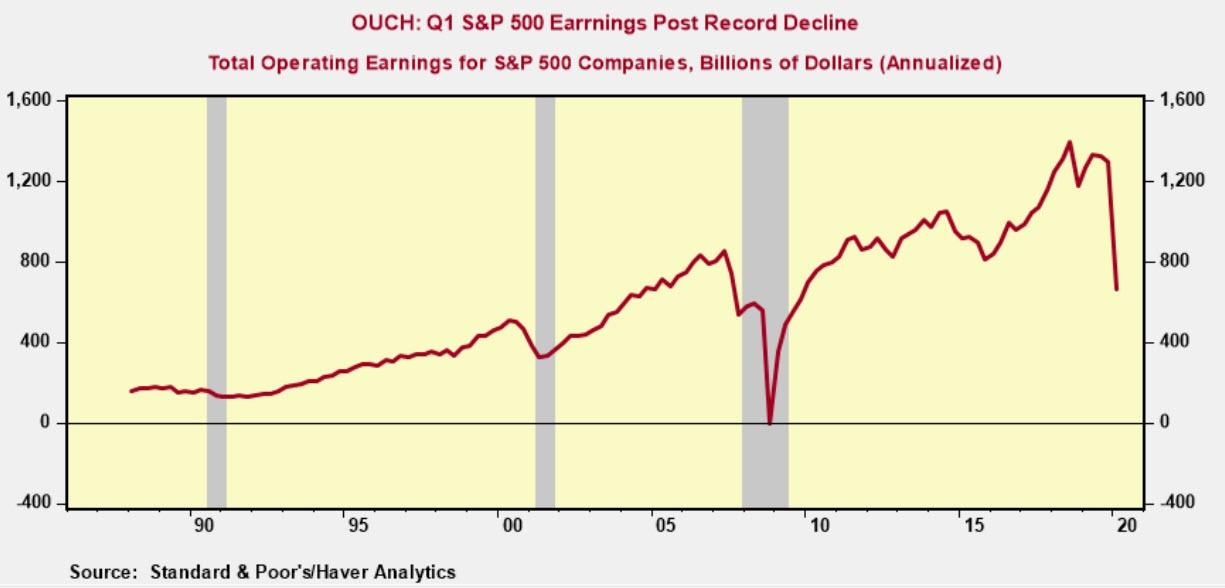

With 97% of companies reporting, it appears that aggregate S&P 500 net income posted at a paltry $661 billion annualized rate in Q1. That’s down 50% from the Q4 2019 level of $1.289 trillion, and marks the lowest posting since since Q4 2009 when the US economy was deep in the Great Recession swamp.

But never mind. Today was just the day for a stock market rip on the strength of, well, the fact that it was open. Accordingly, the S&P 500’s market cap weighed in at $24.12 trillion, meaning that the implied PE multiple on annualized aggregate first quarter profits was 36.5X.

Then again, the first quarter was just a warm-up for the GDP and earnings carnage that is already baked into the cake for Q2. On a per share basis, even the hockey stick wielding Wall Street consensus expects an LTM figure for the June quarter down by 10% from Q1.

So that means the robo-machines and day traders (increasingly more of the latter, who are throwing their $1,200 helicopter check into their trading accounts) in their wisdom are pricing current earnings north of 40X.

The reason for this insanity, of course, is that there is a double-V purportedly coming just around the bend–that is, vaccines for all and a V-shaped income rebound on both main street and Wall Street. So the LTM low point of $113 per share on the S&P 500 projected for Q4 2020 will leap by 45% to $164 per share by Q4 2021.

On an aggregate annualized basis, the expected rebound is even more spectacular.The $661 billion run rate for S&P 500 profits posted in Q1 2020 will reach, according to the Wall Street consensus, an all-time high of $1.475 trillion by Q4 2021.

Up nearly 125% in eight quarters. No sweat!

These future period hockey sticks should be taken with a grain of salt, and not just because they never materialize. The fact is, the don’t matter because the stock market has morphed into a pure gambling casino which chases the Fed’s liquidity pumping and nothing more.

As the estimable David Rosenberg, who has been following the markets for more than three decades, noted in his morning post,

The consensus for Q2 has downshifted to -30%. And the market has soared more than 30% in the past two months —when it’s not even clear looking at valuations that the magnitude of this current recession was ever even fully discounted at the March 23rd lows.

Then again, the Fed has effectively taken the two-way trade out of the market, has removed true price discovery in credit and turned the investment landscape into a casino where nobody is allowed to lose…a new brand of capitalism.

For want of doubt, here is the run since the market bottomed on March 23. The NASDAQ Composite (brown line) is up 32% and sits just 3.7% from it all-time high of February 19.

During the interim, of course, Lockdown Nation broke out and the number of continuing unemployment claims soared more than 8-fold from 3 million to an off-the-charts 25 million; and even that is a lagging indicator compared to the 43 million initial claims that have been filed under the traditional state programs and the new CARES Act expanded Federal coverage.

So there is a fanciful “V” all right—namely the one that has already materialized in the stock market indices. But what it is discounting is the madness in the Eccles Building and the absolute financial incontinence it has fostered in the public and private sectors alike.

Indeed, the entire notion that the Lockdown Nation collapse didn’t happen and that by 2021 the US economy and corporate profits will be back on their pre-Covid path rests on two utterly fallacious assumptions that we will be dissecting in the day ahead: