It doesn’t get more lunatic than this. The domestic and global Virus Patrol has monkey-hammered the world economy like never before.

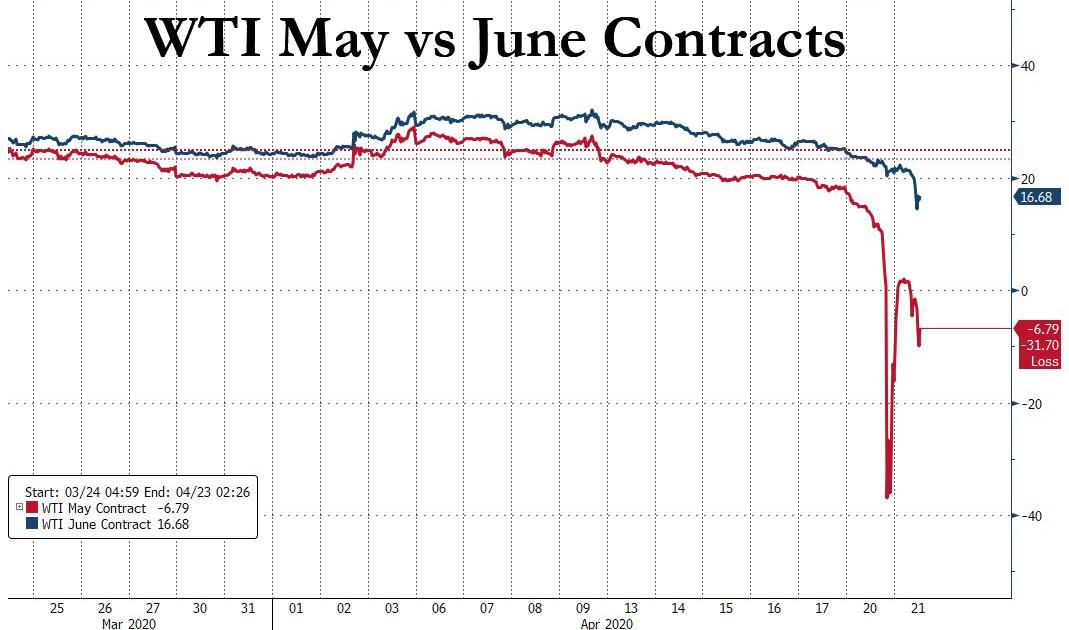

So yesterday, the front month futures price of oil went deeply negative!

To be sure, some of that was technical and flowed from today’s 2:30 PM settlement time for the May contract. Wrong-footed traders have to take physical delivery upon expiration, but there is no place to put it—with every storage facility and floating oil tanker already filled to the brim. So they are desperately willing to pay someone to keep it from being dumped on their own front lawn, so to speak.

But still, the incredible -$37 per barrel closing price of the May contract yesterday is as good a proxy as you can find for the speed and depth of the unfolding economic collapse resulting from Lockdown Nation.

These fools have unleashed torrents of cascading knock-on effects and secondary and tertiary dislocations that are nearly unfathomable, and which will be especially virulent as they come crashing into America’s hand-to-mouth economy and debt-entombed business and household balance sheets.

And the oil carnage is just getting started. As Zero Hedge noted with respect to the stunning collapse of the May WTI futures contract:

The physical reality of a still massively oversupplied oil market will likely exert downward pressure on the June WTI contract (currently still trading at +$21/bbl).”

….. Tuesday morning, the panic selling that originated in the May contract, which expires today at 230pm and which settled at just shy of -$38 yesterday, has spread to the June contract – just as we warned would happen yesterday – which briefly dropped as much as 42% to $11.79 a barrel, and was last trading just above $16 even as the May contract remains deep in negative territory.

Needless to say, the plunging red line in the above chart is slicing through the US shale patch like a super-cyclone. As one knowledgeable student of the shale patch put it a few weeks ago,

“The shale players were already stretched to their limits, and the virus has just broken every thread they were holding on by,” said Ed Hirs, an energy economics lecturer at the University of Houston.

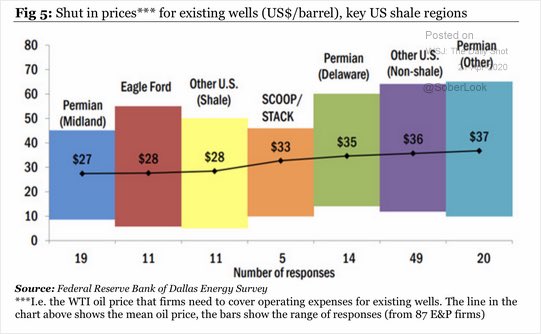

In fact, according to the Federal Reserve of Dallas, most of the major shale basins need WTI prices ranging between $27 and $37 per barrel just to cover variable operating costs. That means at the current future market strip out through mid-summer, producers will be literally burning gobs of cash with every barrel that comes to the surface.

And this is where the hand-to-mouth economy comes into play. If there was ever an industry that should not be leveraged—let alone actually fund its operating costs with junk bonds—it is oil production companies, owing to the massive swings in commodity prices and revenues which have been a recurring feature of the petroleum landscape for the past 50 years.

Yet since shortly after the turn of the century, energy companies have been among the largest issuers of junk bonds on Wall Street, according to an analysis from JPMorgan. In 10 of the last 11 years, energy companies were the single largest junk bond borrowers.

Overall, shale producers and their service companies have borrowed in excess of $300 billion since 2006, and now America’s house of shale cards is crashing in a way that is far more consequential for jobs and GDP than simply the standard balance sheet wring-out that causes imprudent investors to take a loss and producer expansion plans to be put on the shelf.

In the case of the shale patch, the crash of energy debt will cause the industry to literally suffer a hard stop—the economic equivalent of cardiac arrest. That’s because shale production companies have levered up not just to fund capital equipment or other long-term assets; they must also actually borrow the cash they inject into the well-bore.

That is, they must also borrow money in order to cover what is effectively OpEx, not just traditional CapEx. These operating expenses include employee salaries, fraking sand and chemical purchases, drilling service contractor invoices, pipeline company charges and the rest of the production infrastructure.

Of course, in a honest bond market nobody would have loaned money for operating expenses to radically cyclical shale companies, even at usurious double-digit rates. The self-evident risks of the commodity cycle scream out for deep equity-based balance sheets and plenty of accessible cash reserves.

So what is embodied in the chart below is not the Donald’s ballyhooed energy sector boom, but malinvestment of biblical proportions. Easily half of the recent 13 million barrels per day production peak represented a call on labor, materials and capital that would never have occurred on an honest free market.

Now, Lockdown Nation is ironically revealing the folly of debt-financed speculation in money loosing shale production for all to see. It’s a case of Warren Buffett’s naked swimmers exposed by the retreating tide, if there ever was one.

And we do mean money losing. Here is the quarter by quarter comparison of operating cash flow with CapEx for the 40 leading shale companies since the 2014 commodity cycle peak when oil briefly soared above $100 per barrel.

Save for Q3 2016, there is not a single quarter in which the green bars (cash flow from production) exceeded the brown bars (CapEx to keep the ultra-shorted lived shall wells flowing). Now, of course, the green bars themselves are turning negative, which means that with the junk bond market shut down, CapEx will coming to a traumatic, screeching half.

Indeed, the chart below from Wolf Richter tells you all you need to know about the fragility of America’s debt-fueled hand-to-mouth economy and the idiocy of the Fed’s ultra low interest rate policies which made it so.

To wit, after the last oil cycle peak and crash, when prices soared to $115 per barrel in mid-2014 and then crashed to the $25 per barrel 20 months later, the US shale industry nearly lost its lunch. A wave of bankruptcies and defaults temporarily dried up Wall Street’s burbling flows of malinvestment to the shale patch, resulting in a staggering $208 billion worth of bonds making a round trip through the bankruptcy courts.

But thanks to the foolish free money policies of the Fed and its fellow-traveling central banks around the world, the 2014-2016 scare turned out to be merely a case of rinse and repeat. That is, when upwards of $17 trillion of lower-risk sovereign and investment grade corporate debt was driven to sub-zero yields by the central banks, yield-starved money managers and home gamers alike plowed back into energy junk bonds like there was no tomorrow.

Accordingly, instead of the drastic throttling back of investment and drilling in the US shale patch that the risks and the economics warranted, the US shale industry went into a final blow-off top that pushed debt-fueled US production to 13.3 million barrels per day. That was absolute economic lunacy, of course, when the marginal barrel (Saudi and other Persian Gulf producers) in the 100 million barrel per day world market costs less than $10 to lift.

This time, however, there will be no artificial re-flow of capital to the hot-house US shale patch. That’s because they central banks can’t make the cost of capital go any lower, and the world is now so soaked in excess oil supply that even the desperate money managers who survived the 2014-2016 cycle plunge will now be losing their own lunch, or their jobs.

In fact, the coming dislocation in the energy debt market will surely be one for the record books. Foolishly believing that risk had been purged from the world and that there was no economic hiccups the central banks could not print away, bond managers bought $240 billion of energy industry debt during the last six years—debts which will now be coming due during 2020-2024.

That includes $86 billion issued by E&P companies, $32 billion by oilfield service companies and $123 billion by pipelines, much of which went into the vast new gathering systems that have been put in place in the shale patch to carry uneconomic shale oil to market.

This time. of course, the can-kicking refi machine on Wall Street will be closed for business.

Needless to say, the coming shale patch carnage is only the poster boy for the catastrophic failure of Keynesian central banking that is coming hard and fast down the pike. The entire US economy is riddled with fragility and hand-to-mouth economics because that’s the inherent consequence of systematically falsifying the price of money, debt and other financial assets.

In essence, debt and capital users become euthanized when financial prices are falsified for decades running. They lose all memory muscle with respect to risk and the downside—electing, instead, to swap the carry cost of liquid and shock-resistant balance sheets for the joy of higher profits and returns today.

This structural impairment of the US economy was well stated Tad Reville, CIO of the TCW Group, and even better captured by the cartoon he appended to his investor note:

Shield a business from its “natural” ups and downs, provide it with cheap and ready credit, and you can be pretty sure that, over time, such a business will “learn” to be under-equitized and hence ill-prepared for a downturn from which it cannot be so shielded. Ditto for the private citizen who is “taught” that a world without recessions is a world that needs no rainy day fund nor indeed any cushion between expenses and earnings. In short, the central bankers’ “best intentions” set up the private economy like so many bowling pins.

That they surely did.

But that’s not the end of the story. It is now blatantly apparent that the households and businesses house-trained on the Fed’s falsified financial asset prices are not about to eat their broccoli unaided. One and all are lining up in a coast-to-coast soup line fixing to feast on the Everything Bailouts, which today got refreshed with another another $500 billion, thereby bringing the total since March to nearly $3 trillion and counting.

And we do mean counting. It seems that the Donald is not about to let the long-overdue massacre in the shale patch run its course:

We will never let the great U.S. Oil & Gas Industry down. I have instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!”

What he was referring to, of course, is an absolutely bonkers plan to pretend that unproduced oil which has been embedded in shale formations for the past 300 million years or so is the same thing as crude oil injected into the nation’s Strategic Petroleum Reserve (SPR). That is to say, the Donald is planning to pay shale patch speculators to keep in the ground oil that the world does not need and which would generate billions in losses if actually produced.

You heard that right. Whereas FDR paid farmers to shoot their little piggies, the Donald is fixing to pay the shale speculators to shoot their drilling rigs.

But that’s a road too far even in this world of Covid Hysteria induced fiscal incontinence.

For one thing, the purpose of the SPR is to protect that national economy against a drastic shortage of global crude oil resulting from a major war or sudden drastic disruption of supply. It was never, ever intended to be a bailout mechanism to reward oil speculators for reckless and wasteful investments in uneconomic oil reserves in the face of the opposite condition—a drastic surplus of crude oil which could take years to liquidate.

In fact, you editor has some hands-on knowledge and experience on this matter because we were the primary architect of the SPR strategy back in 1981.

That happened on the heels of the severe supply squeeze and price explosion in 1979-1980 when we convinced the Gipper that rather than have Washington massively subsidize high cost domestic energy producers and attempt to pick winners in the name of supply security, the far more efficient and pro-free market approach would be to build-up a SPR shock-absorber that would be released only under the most dire and extenuating supply disruption.

Now, of course, the only silver lining in the Lockdown calamity is the fact that energy costs are being driven to rock-bottom levels, thereby providing paycheckless workers and cash flow parched businesses at least a measure of economic relief.

But rather than allow the energy market to work its will, the nation’s bailer-out-in-chief wants to pump billions of debt-financed graft from Uncle Sam into the shale patch.That amounts to keeping economic zombies alive because, well, the Donald has claimed America’s phony energy boom was all his doing and he’s not about to allow his boasts to get in the way of economic and fiscal rationality.

And speaking of shale patch zombies, here is an illustrative case. Whiting Petroleum would be one of the major recipients of the Donald’s planned largesse, but in a sane world it would actually be the target of a mercy killing.

To wit, during the last ten years it has generated just $11.2 billion of operating cash flow, but spent $16.4 billion on CapEx to generate it. That is, over a decade running, Whiting has been a cash burn baby to the tune of $5.2 billion.

It has also been a plaything of the Wall Street speculators and hedge funds. After going public in 2004 at about $375 million of market cap, it value was driven to a peak of $10 billion in September 2014, marking a 27X gain for the punters who went along for the ride.

That’s notwithstanding the fact that Whiting never had any prospect of generating positive cash flow in either this world or the next; and also that it has subsequently been a widow-maker for the home-gamers who were told the Fed would never fail them and that in the bye-and-bye the company’s market cap would fly upward once again into the wild blue yonder.

WLL Market Cap data by YCharts

In a recent post, the ever prescient Tom Luongo was quick to spot the the Donald’s shale patch bailout scam. So we quote at length.

To Trump nothing cannot be fixed without his direct application of the weight and force of the U.S. government.

From sanctions to tariffs, stimulus spending to bailouts, Trump has become the WWE Version of FDR in the past month. The latest bailout to the oil industry Trump is proposing is paying drillers to leave their oil in the ground.

The keep-it-in-the-ground plan, which would require billions of dollars in appropriations from Congress, could be unprecedented and reflects a Trump administration push to help domestic drillers battered by a surge of oil production and a collapse of demand tied to the coronavirus.

Luongo further noted that what we have here and with the rest of the business bailout soup line is a classic case of Bastiat’s seen and unseen. That is, if Trump really wants to help the shale patch he should end the Lockdown ASAP and get the government’s big fat foot off the neck of petroleum demand.

By contrast, bailouts only reinforce the malinvestments and misallocations that have made the US economy so ultra-fragile in the first place:

And the unseen effects of these bailouts and alphabet soup programs of asset purchases will be the final wholesale looting of what once was the engine of the U.S.’s economic greatness, the middle class.

Trump thinks he’s saving middle class jobs here but he’s destroying them. These were jobs that should never have existed in the first place. Extending them into the future only prolongs the agony while the money spent mostly goes to the vultures hanging around D.C. to save themselves.

The fact that every action taken so far by the Trump administration to counter the effects of the deflationary spiral set off last money has been to bail out someone else, tells you no one in D.C. is even paying lip service to the unseen effects of their actions.

Moral Hazard? We don’t have time for that!

Trump’s “Best Economy Ever” was built on a foundation of quicksand and now he’s scrambling to prop it up before it sinks into oblivion.

The U.S. had a grenade dropped on its budget. It looks like a nuclear bomb, but that’s only because of the continued arrogance and necessity of politicians, like Trump, needing to be ‘seen’ doing something caused far more damage than it would have if they hadn’t intervened in the first place.

The adage, “never let a crisis go to waste,” is apropos here. Politicians use the cover of crisis to act. They have to be ‘seen’ acting rather than not. Trump is acutely aware of this because he truly can’t stand criticism.

A man without principles, Trump acts mostly out of his need to deflect criticism and be ‘seen’ by his base as their champion.

From here on out it will be an endless series of Hollywood Red Carpet openings while they further destroy what’s left the discipline of the market and hollow out what’s left of our lives.

The government has always been an economic vandal, obsessed with first-order effects to further is own ends. As the after-effects of this period of history present themselves we’ll come to understand this even more acutely.

By the time Trump and his band of economic ignoramuses are done there won’t be an America worth making great again. That’s the future once seen, you can’t unsee.

Needless to say, the price of crude oil is not the only thing plunging under the body blow of Lockdown Nation. Virtually every sector is or will be soon registering prints so deep into the sub-basement of history that they have never before been seen.

For instance, while total used vehicles sales for the entire month of March plunged 18.4% year-over-year, that was a blend of high and low that obscures what is actually happening. As Wolf Richter noted,

On a daily basis, early March sales of used vehicles also had been strong, running well ahead of prior year. But by March 12, they were below the level a year earlier. Then they plunged, and by the end of March were down 68% from a year ago.

They ticked up a smidgen and on April 5 were down 63.5% year-over-year (chart via Cox Automotive presentation where the blue line represents daily year-over-year change for 2020;, and the green line reflects daily year-over-year change in 2019.

As to the most recent week’s 63.5% Y/Y plunge—-there is absolutely nothing like it on the books.

Nor is there anything like this eruption of initial unemployment claims. The 5.58 million weekly average for the last four weeks, in fact, represents 8.6X the worst four-week rolling average during the Great Recession, when the figure clocked in a 639,000 for the weeks ending in April 18, 2009.

Here’s the thing. A fully hysterical set of governors, mayors, Federal health apparatchiks and the Trump-hating mainstream media have brought the entire US economy to a near standstill in just five weeks based on the fear of a deathly Black Plague like pandemic which is simply not happening.

Buried in the most recent CDC data on the coronavirus case and death count is this smoking howitzer. To wit, across the entire country outside of the five boroughs of New York City there have been no excess deaths relative to seasonal norms, and in fact, the total death rates are actually running well below the 20017-2019 based averaged from which the CDC makes its “expected deaths” estimates.

For the 11-week period from February 4 to April 11, the CDC projected 620,760 deaths from al causes for the entire USA outside of the five boroughs. In fact, the actual numbers has come in at just 561,490 including deaths attributed to Covid-19 and to mixed cases of Covid-19 and seasonal pneumonia.

Stated differently, the rest of the US is running 10% below the expected mortality rate for the two months during which Covid-19 deaths have been reported and ballyhooed nonstop by the mainstream media.

On the other hand, the 12,440 deaths in New York City projected for this same period (based on 2017-2019 seasonal and population-adjusted trends) have actually been superseded by 75%, with the current tally standing at 21,080.

In short, there have been 8,640 so-called “excess deaths” in New York, but that compares to a 59,270 shortfall from the expected seasonal norm in the rest of the USA.

So the question recurs. What is the basis for the unprecedented Economic Lockdown now monkey-hammering the US economy per today’s oil price lunacy?

Call it the greatest Mass Hysteria since the Salem Witch Trials of 1692, and you would not be wrong.